Supply and Demand Trading in 2026

We have been trading supply and demand strategies for over ten years, and they have stood the test of time remarkably well. Supply and demand is...

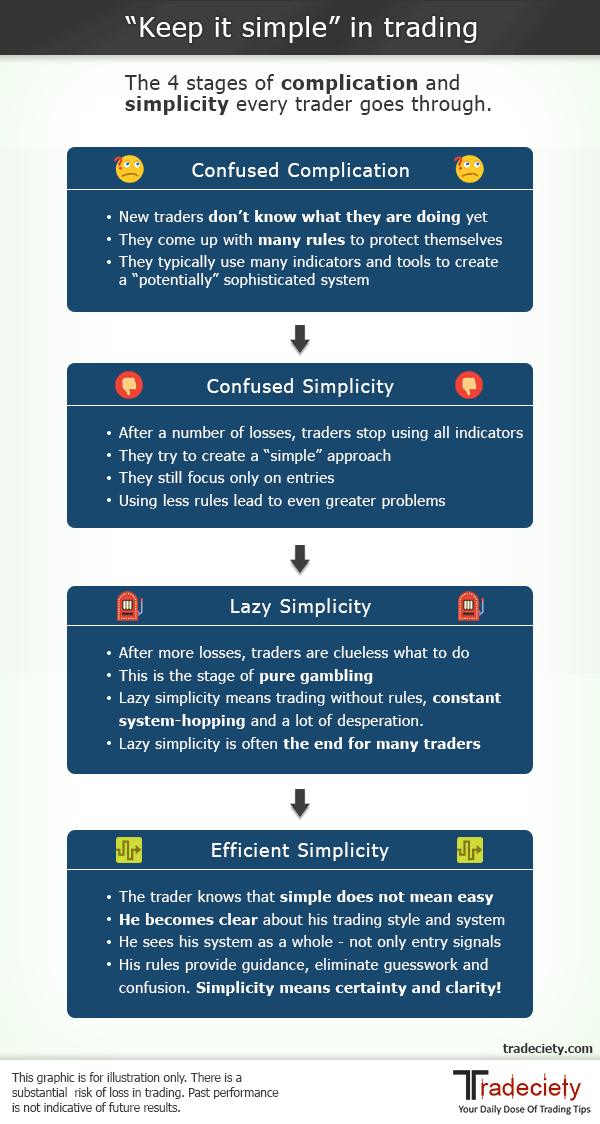

Everywhere on the web you can read that you have to keep it simple if you want to become a professional trader. However, trading isn’t simple and you can’t just eliminate indicators, “clutter” and all the rules from your trading and then suddenly become profitable.

The (mis)belief of keeping it simple can be a very dangerous one if a trader fails to put it into the right context. Using the excuse to “keep it simple” to justify trading without a set of fixed rules can will lead to inconsistent trading results. Keep it simple should not be an excuse for the lazy traders to avoid putting in the work.

The following 4 stages are the typical stages any trader goes through on his journey. Knowing where you are can help you eliminate false thinking and help you get to the next step sooner.

When new traders start out, they really have no idea what they are actually doing. Typically, new traders buy the first best system they stumble upon. Usually, the first systems traders go through are heavily indicator-laden because all the fancy lines give the impression that this is the professional way to go.

New traders often believe that the more tools they use, the better the trading signals they get will be. Then, they try to come up with all the indicator based rules until they are so confused that the decision-making process becomes a real pain.

It is not uncommon to see “paralysis by analysis” at that stage because of all the contradicting signals the different indicators and tools provide.

The next step on a trader’s journey is the “freeing from the indicators”. It is such a common theme to see traders go from complete indicator-madness to pure price action trading. At that stage you can hear traders say “I can finally see what is really important”, “price is king and indicators are lagging”, or “only trade what you see.”

Confused simplicity refers to a state where traders still don’t know what they are doing, but they believe that a complete turnaround will probably be the cure for their problems. Needless to say that trading off of blank charts is not going to suddenly turn a losing into a winning trader.

The system-mindset and the negligence of risk management, money management and position sizing are typical characteristics at those early stages.

After a lot of frustration and a long time of inconsistent trading results, the intentional and lazy simplicity starts to take over. This means that traders are somewhat clueless how to start making money as a trader; indicators didn’t work and price action did not work either – what is left to try?

Lazy simplicity typically leads to pure gambling. At this stage, traders are only hoping to somehow stumble over a trading system that will work right from the start. Traders don’t want to put in the work anymore and are only looking for the easy way out.

Lazy simplicity is often the final stage for most traders before they give up and/or lose their trading account. The traders who do not give up and make it to the next stage are often rewarded for their endurance and their tenacity, and professional trading is within reach.

To avoid the pitfalls of lazy simplicity and to help you overcome this dangerous phase, here are the top 5 tips to make it through:

This is often referred to as the aha-moment when traders finally stop looking at trading entries alone and understand that a trading method is more than just hunting signals.

During the final stage, traders start building their own trading system. They combine what they have learned throughout their trading career and put together the tools in a meaningful way. Traders also start to realize that it does not matter whether they use indicators or price action; both are essentially the same and it comes down to applying what the different tools tell you.

As we have said earlier, simple does not mean easy and it does not mean trading without rules. It is quite the opposite. Professional simplicity can only be reached when a trader is 100% clear about his trading system and approach. In the new context, simplicity then means certainty.

A trader who is clear about his approach and who has a set of fixed rules follows a repetitive trading routine. Certainty and rules eliminate guesswork, confusion and it helps traders make better and faster decisions. The following checklist depicts the different aspects of a trading method and routine; use it to create more certainty and simplicity for your own trading.

| Component of your trading method | What you need to know |

| Entry criteria | How does your perfect trade look like? |

| Stop loss rules | Where do you place it? When is your trade idea invalid? |

| Take profit rules | Do you use a fixed target? Do you trail your stop? What signals an early exit? |

| Position sizing | Do you always use the same amount? Do you vary based on the quality of the setup? Do you add to trades and how do you do it? |

| Trade management | How do you manage the trade? Do you actively move stop and profit orders? |

| Risk management | How do you deal with losing and winning streaks? |

| Pre-market analysis | Do you write a trading plan? When do you do it? |

| Post-trading analysis | How do you review your trading day? Do you update your trading plan? |

| Performance review | When do you review your past trades? How do you keep track of your trades? |

| Improvement process | How do you analyze your trading? How can you find weaknesses and how do you make tweaks and adjustments? |

Only if you are 100% certain about each point, you can reach the state of effective simplicity. Making trading decisions will become much easier and it will eliminate inconsistent trading results. Take the time to define your own system. The reason why most amateur traders fail is because they have no idea what their trading system is all about.

If you are looking for guidance and you are not sure how to take your trading to the next level, we offer a 12 week trader development program together with the most sophisticated trading journal out there on our partner site Edgewonk.

We have been trading supply and demand strategies for over ten years, and they have stood the test of time remarkably well. Supply and demand is...

3 min read

Choosing the right trading journal is essential for traders wanting to analyze performance, refine strategies, and improve consistency. In this...

3 min read

“95% of all traders fail” is the most commonly used trading related statistic around the internet. But no research paper exists that proves this...