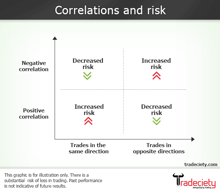

Risk management in trading is the set of rules that controls how much you can lose on any single trade and how you protect your account during losing streaks. It covers the practical decisions that shape real performance: risk per trade, stop-loss placement, position sizing, reward-to-risk planning, and limits that prevent one bad day from turning into a major drawdown. In other words, risk management is what turns a trading idea into a sustainable approach.

Risk management in trading is the set of rules that controls how much you can lose on any single trade and how you protect your account during losing streaks. It covers the practical decisions that shape real performance: risk per trade, stop-loss placement, position sizing, reward-to-risk planning, and limits that prevent one bad day from turning into a major drawdown. In other words, risk management is what turns a trading idea into a sustainable approach.

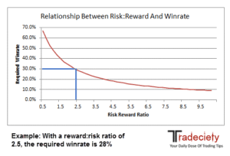

For traders, the biggest benefit is consistency. When risk is defined upfront, you stop making decisions based on fear or hope and start evaluating setups based on whether the payoff justifies the downside. Good risk management doesn’t just reduce losses; it improves execution, keeps your equity curve stable, and allows your strategy to play out over a meaningful sample size.

Most traders don’t fail because their entries are bad. They fail because their losses are unplanned, their position size is inconsistent, and one bad streak does more damage than their winners can repair.

Most traders don’t fail because their entries are bad. They fail because their losses are unplanned, their position size is inconsistent, and one bad streak does more damage than their winners can repair.