Supply and Demand Trading in 2026

We have been trading supply and demand strategies for over ten years, and they have stood the test of time remarkably well. Supply and demand is...

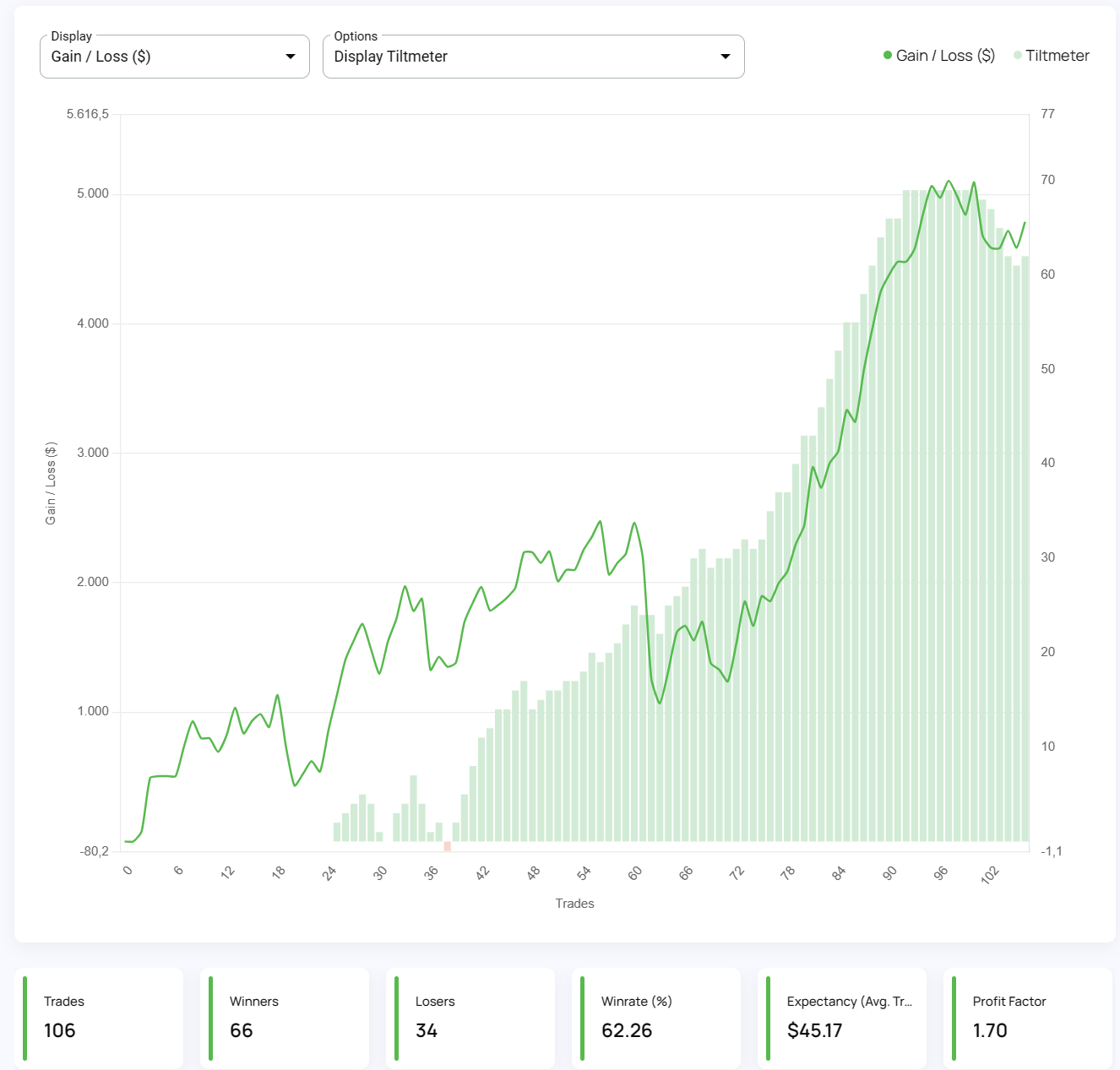

It's easy to get discouraged by losses and question your every move. But what if there was a way to track your progress, learn from mistakes, and build confidence as a trader? A trading journal offers exactly that. By recording your trades, emotions, and results, you can transform yourself from a novice into a self-aware and successful trader. Here are 10 reasons why a trading journal is your secret weapon in the financial markets.

If you want to start tracking your trades, make sure to check out our Edgewonk.com trading journal and use the discount code "tradeciety" during the checkout.

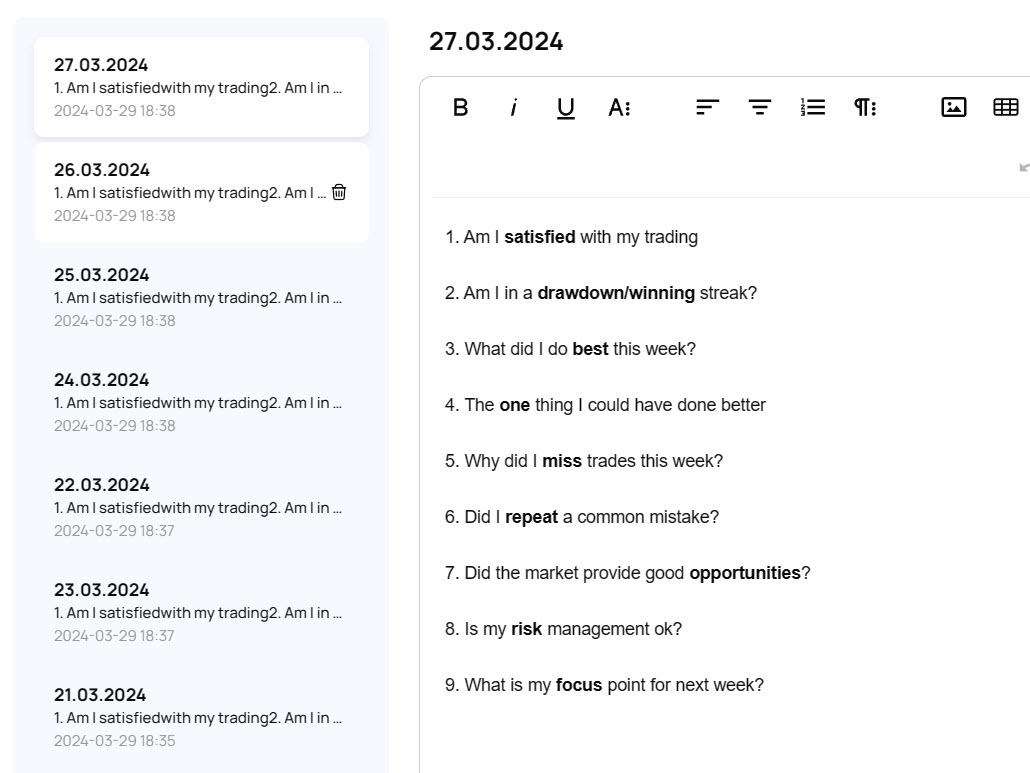

Don't get discouraged by the seemingly endless learning curve in the trading world. A trading journal acts as a personal roadmap, allowing you to track your progress and celebrate milestones along the way. By reviewing your past performance, you can see how far you've come in terms of strategy development, risk management, and emotional control. This not only builds confidence but also helps identify areas that still need work. Journaling your wins, big or small, reinforces positive trading behavior and keeps you motivated on your trading journey.

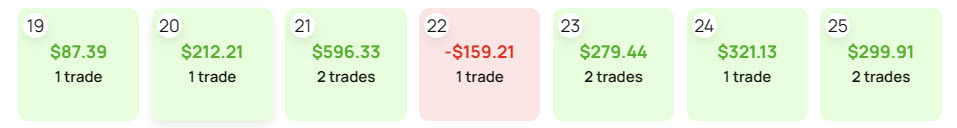

Turn your losses into valuable learning experiences. By reviewing your trades in your journal, you can pinpoint recurring mistakes that are chipping away at your profits. Ask yourself what went wrong on each losing trade. Did you deviate from your trading plan due to emotions? Did you enter or exit a position based on weak evidence? Quantify the cost of these mistakes to solidify their impact. By recognizing these patterns, you can develop strategies to overcome them and become a more disciplined trader. The more you learn from your mistakes, the less likely you are to repeat them in the future.

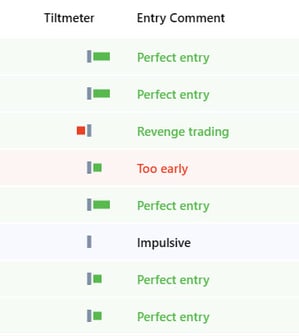

Trading can be a rollercoaster, and emotions can easily cloud your judgment. A trading journal can help you master your emotions. By recording your emotional state – were you feeling anxious, overconfident, or fearful? – alongside each trade, you'll gain valuable self-awareness. This newfound insight will help you identify emotional triggers and detach from impulses. Over time, you'll cultivate a calmer, more rational approach, allowing you to make sound trading decisions based on your strategy, not your mood.

Trading can be a rollercoaster, and emotions can easily cloud your judgment. A trading journal can help you master your emotions. By recording your emotional state – were you feeling anxious, overconfident, or fearful? – alongside each trade, you'll gain valuable self-awareness. This newfound insight will help you identify emotional triggers and detach from impulses. Over time, you'll cultivate a calmer, more rational approach, allowing you to make sound trading decisions based on your strategy, not your mood.

By dissecting both your successful and losing trades, you can uncover recurring patterns that show what works and what doesn't within your approach. This newfound knowledge allows you to fine-tune your trading strategy, making it even more effective.

Furthermore, analyzing past trades helps you optimize your Reward:Risk ratio and your strategy parameters such as the take profit placement and trade exits. By understanding your strategy's profit potential compared to its potential losses, you can adjust your entry and exit points to squeeze out bigger wins while keeping losses in check.

Doubt and fear can creep in during market downturns, leading to impulsive decisions. By reviewing past trades, you'll see documented evidence of successful setups and strategies you've employed. This proof builds trust in your abilities and increases confidence. Imagine flipping through your journal and seeing a recurring pattern where a specific strategy consistently yielded profits. This documented success fuels your motivation and keeps you focused during those inevitable choppy market periods. In essence, your journal transforms from a record of trades into a source of confidence.

By recording your entry and exit points, stop-loss levels, and position sizes, you can analyze your past performance and identify areas where your risk management could be tighter. This self-reflection allows you to assess if your stop-loss levels are appropriate for the market volatility, or if you're risking too much capital on a single trade. By pinpointing these weaknesses, you can refine your trading plan and develop a more disciplined approach to risk management, ultimately protecting your capital and keeping you in the game.

Emotional reactions to market swings can be a trader's worst enemy. A trading journal acts as a shield against impulse by forcing you to confront your plan before every trade. By reviewing your entry criteria and exit points documented in the journal, you can stay disciplined and avoid the temptation of impulsive decisions that contradict your overall strategy. This focus ensures your trades align with your well-considered approach, not fleeting market emotions.

Unconscious biases can cloud judgment and lead to costly mistakes. Here's where your trading journal becomes a powerful introspection tool. By reviewing your trades, you can uncover patterns in your decision-making. Are you entering trades based on gut feelings rather than solid strategy? Do you hold onto losing positions for too long, hoping for a turnaround? The journal exposes these tendencies, allowing you to challenge them and make more objective choices. With self-awareness comes greater control over your emotional responses, ultimately leading to better trading decisions.

The beauty of a trading journal lies in its ability to transform you into a better trader over time. By meticulously recording your actions and decisions, you create a treasure trove of knowledge. Your journal becomes your personal trading coach, highlighting areas for improvement and tracking your progress. Imagine steadily addressing one weakness at a time, like a sculptor refining a masterpiece. Through this continuous learning process, driven by your journal's insights, you'll be well on your way to achieving your trading goals. After all, consistent improvement is the cornerstone of long-term success in the ever-evolving world of trading.

Unlike cramming for an exam, successful trading requires ongoing self-evaluation. A trading journal fosters this crucial process by prompting you to define your goals and risk tolerance. By recording your trades, you gain valuable insights into your strengths and weaknesses. This newfound self-awareness is the bedrock of a well-defined trading plan. Just as you wouldn't navigate a complex journey without a map, a documented and data-driven approach is essential for consistent profitability.

We have been trading supply and demand strategies for over ten years, and they have stood the test of time remarkably well. Supply and demand is...

3 min read

Choosing the right trading journal is essential for traders wanting to analyze performance, refine strategies, and improve consistency. In this...

3 min read

“95% of all traders fail” is the most commonly used trading related statistic around the internet. But no research paper exists that proves this...