Supply and Demand Trading in 2026

We have been trading supply and demand strategies for over ten years, and they have stood the test of time remarkably well. Supply and demand is...

The stop loss order is not only completely misunderstood, but also has a much worse reputation than it should have. Here are only 4 of the many reasons why a stop loss should be valued highly by any trader and a trade should not be entered without one:

After you have identified the stop loss price level for your trade, you can measure the distance between your entry and the stop loss to determine the potential loss and then figure out the position size. It sounds more complicated than it is; take a look at our position size calculator to test it out. Without a stop loss, it’s impossible to determine the accurate position size.

The stop loss order makes sure that your trade will be closed when price reaches the level (although events might occur where your stop isn’t filled). Thus, with your stop loss order and the correct position size you can pre-determine how much you are willing to lose on any particular trade. Only risk what you can lose comfortably and there will be no surprises anymore with a stop loss in place.

The reward:risk ratio is the figure that calculates how much you can potentially win on a trade and compare it to the potential loss. But, the risk reward ratio does much more for a trader. As you will learn in the advanced section, the reward:risk ratio helps you understand your performance much better and even allows traders to estimate the expectancy of their methodology before they enter the trade. To sum it up, the reward:risk ratio is among the most powerful trading concepts.

Once a trade has moved in your favor, you can move your stop loss behind current price, to secure unrealized profits. More to that later.

The majority of traders only spends little thoughts about stop loss placement. Usually, traders don’t even have a thought-out plan or concept when it comes to placing stop loss orders, but they just arbitrarily place stop loss orders at random levels. The following 3 concepts help you improve your stop loss approach:

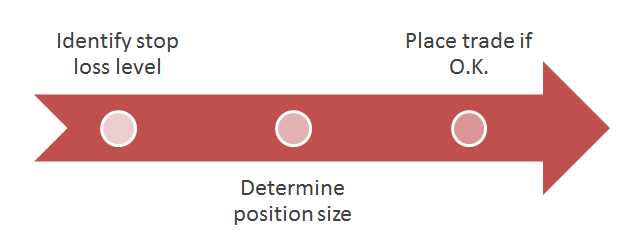

Most traders have good intentions, but often execute it the wrong way. It is important that you identify the price level for your stop loss level first. Most traders just think about how big their position should be and then try to find a stop loss price. Why this is wrong, we will investigate in the next point. It’s essential that you stick to the following process:

Additional tip: After identifying your stop loss level, look for the price to place your take profit order at. After knowing where you place your orders, determine the reward:risk ratio. If the reward:risk ratio does not match your criteria, skip the trade and do not try to modify your orders to achieve a better reward:risk ratio. This is a common beginners mistake.

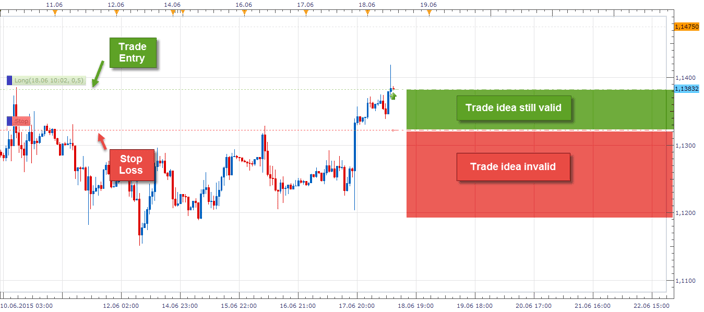

Most traders misunderstand what a stop loss really is. At its core, the price level of your stop loss order is the price where your trade idea is no longer valid. It is O.K and normal if price goes against you on your trade, but at some point, a price movement against your trade makes your trade idea invalid.

Therefore, it is important to use reasonable price levels for your stop loss order. Traders who use random stop loss orders tend to re-enter and revenge trade more often because they still believe that their trade idea is still valid.

Realizing a losing trade is normal in trading and it is unavoidable. Most traders know this concept and understand that you just cannot trade with a 100% winrate. BUT! But, when it comes to dealing with losses, traders are particularly bad. When price hits your stop loss, it is not (necessarily) a sign that you are a bad trader, or that you have done something wrong, but just that your trade idea did not work out.

As a trader you have to make sure that you can come back tomorrow and not lose all your money, or an unnecessarily large amount, on a single trade. For this reason, you have to live by this concept: Don’t personalize losses. If you ever find yourself widening stop loss orders or taking them off completely because you want to give your trade the chance to turn around, think twice and really evaluate your objectives and reasonings.

By following the previously laid out plan, traders can already make their stop loss placement much more professional. But there are a handful of concepts that can help traders even further improve the way of placing and executing their stop loss orders.

Once price hits your stop loss order and moves on, it’s very easy to find reasons if you should have stayed in that trade or whether you should have used a different stop loss approach.

When traders see that their stop was set too far away, they will use a smaller stop on their next trade which will make them more vulnerable to volatility. On the other hand, if traders notice that they should have used wider stop loss order, they will reduce the reward:risk ratio of their system by using larger stop loss orders.

As a trader it is important to think ‘long-term’. Do not make adjustments to your approach on a trade-to-trade basis. Follow your rules, evaluate your data and then try to find ways to improve your trading.

Moving a stop loss to the point of your entry (break even) is a great amateur mistake when done with the wrong intentions. The point of your entry, especially if you trade the obvious moving averages or support & resistance levels, is very evident and the smart traders will know where amateur traders get into their positions and that they move stops to break even. This makes stop hunting very easy. As you can see, brokers do not have to read out their customers’ order information because the average trader makes it too easy and obvious how they execute their trades in the first place.

The myth that not using a stop loss provides you with some kind of flexibility to react to sudden price moves is one of the worst things common trading knowledge suggests to traders. Not using a stop means that you risk being wiped out in one single trade, or at least lose so much money that it cancels out months of good and consistent trading. Furthermore, it is impossible to use a sound money and position sizing strategy if you don’t use a stop loss order.

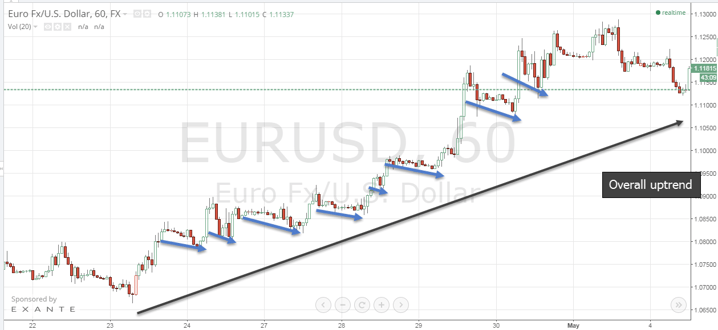

The majority of trades doesn’t just take off and run straight into your take profit, but moves back and forth. Whereas trailing a stop behind the current price to protect your position can be a good thing, the way traders execute this concept will ruin every profitable system.

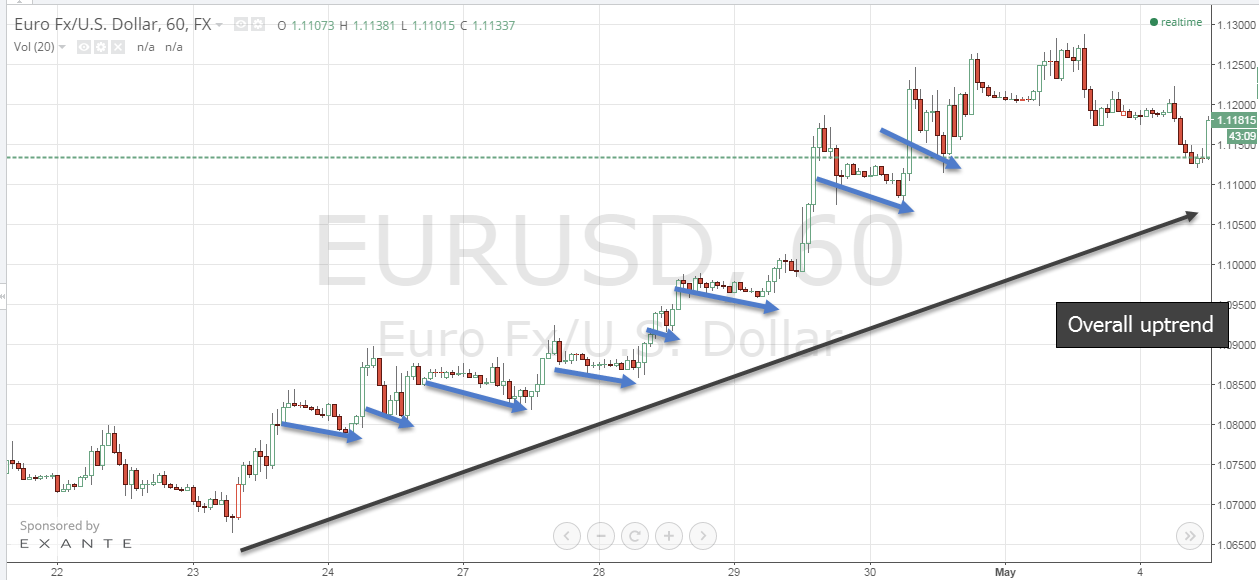

It is therefore important to give your trade room to breathe and not move your stop loss to close to current price. Spend some time observing how price moves back and forth and you will be able to spot the wavelike price behavior. The screenshot below illustrates how in a long-term uptrend, you will get frequent retracements.

Financial markets are constantly changing, the volatility changes and also how price reacts to certain conditions varies a lot. Traders, on the other hand, use a fixed and always constant approach when it comes to placing stop loss orders. Often, traders, even use the same stop loss approach across different financial instruments or timeframes.

Being a trader means adapting to changing market conditions. By tracking volatility and how price behavior changes over time, you can improve your order placement by adjusting your stop loss approach.

In times of higher volatility, use a wider stop loss and take profit method. In times of low volatility, use smaller orders. Tools to measure volatility and changes are the ATR indicator, Bollinger Bands® or the VIX.

We have been trading supply and demand strategies for over ten years, and they have stood the test of time remarkably well. Supply and demand is...

3 min read

Choosing the right trading journal is essential for traders wanting to analyze performance, refine strategies, and improve consistency. In this...

3 min read

“95% of all traders fail” is the most commonly used trading related statistic around the internet. But no research paper exists that proves this...