Supply and Demand Trading in 2026

We have been trading supply and demand strategies for over ten years, and they have stood the test of time remarkably well. Supply and demand is...

We have been trading for over 15 years and during that time, tested hundreds of resources and trading tools. In this article, we have compiled the 9 most helpful trading tools and resources that we use daily.

Let´s start with the most important resource: your trading platform. Without a trading platform, you cannot trade.

Although there are many great trading platforms for Forex traders out there, we still prefer MetaTrader 4. Some traders may argue that MT4 looks outdated, it is the number one Forex platform for a reason. What we particularly like about MT4 is the whole environment that surrounds it. Because it has been around for so long you can find whatever indicator, script, or add-on you are looking for; customizing your MT4 is super easy.

MetaTrader 5 has also come a long way and if your broker only offers MT5, you will also be able to find many custom indicators, scripts, and tools for it. And if something is missing, any good freelancer (check Upwork, or Fiverr) will be able to create what you need.

I keep charting separate from trade execution which is why I use Tradingview (https://www.tradingview.com/) for my daily chart work and I have spent thousands of hours in Tradingview over the last 9 years. Although you can directly trade from Tradingview, I prefer to use Tradingview exclusively for my charting simply because I do not want to see my floating P&L and my open trades all the time. It can easily create emotional pressure.

Tradingview is great for numerous reasons and the customization options are the main benefits for me besides the sheer number of markets that are available within Tradingview. You can create custom templates, set up your personalized watchlists, and pick from hundreds of scripts and indicators. And if you are missing something, you can simply add new scripts and tools to your Tradingview by using their Pine Script editor. Again, if you are not a coder, there are plenty of resources where you can find willing and able programmers who will create whatever you need for your charting.

A trading journal is a must-have and it is probably no surprise that I recommend the Edgewonk (https://edgewonk.com/) trading journal since we developed it.

A trading journal is a tool that analyses your past trades so that you can see what worked best, and what didn´t work so well, and it also shows you how to improve your performance.

The key to a trading journal is that it must be customizable because no two traders are alike. With Edgewonk, we built many customization features into the journal so that every trader will be able to adapt it to their trading. Plus, Edgewonk also allows you to monitor your mental state, keep track of your discipline, and work on your mental edge.

As a Forex trader, you need to be aware of the daily news schedule because news releases will have significant impacts on price development and can cause wild price swings.

Every morning, I check the Forex Factory (https://www.forexfactory.com/calendar) news calendar to see when important news releases are scheduled. Typically, traders avoid trading right at the time of the news release to avoid being caught in the initial volatility spike; during a high-impact news release your broker´s spread also typically widens.

On days without news, the price is typically much calmer and does not show as much momentum. Many traders, therefore, only trade on news days, after the initial volatility has calmed down.

I believe that backtesting plays an important role when it comes to strategy development and improving your confidence in your trading strategy.

Especially when starting with a new strategy, backtesting can be extremely helpful to get going. When backtesting, you go through historic price charts, looking for previous trading opportunities. After your backtest, you can evaluate the effectiveness of your trading approach and find potential weaknesses. It is a great way to get to know your strategy and see what to expect performance-wise.

I have been using the Forex Tester (https://new.forextester.com/) for over a decade and with their constant updates and improvements, it is still a worthy tool today. Although you could use Tradingview´s replay feature for backtesting, Tradingview has a few limitations that make backtesting not as effective which is why I always come back to Forex Tester.

A lot of traders struggle with risk management, especially position sizing. Ideally, all your trades follow the same position sizing strategy, meaning that all your trades should have an equal size.

To achieve a consistent position size, I recommend using a Forex position size calculator. There are dozens of options out there and I like the one from Babypips (Position Size Calculator - BabyPips.com). With just a few clicks, you can calculate how many lots you must buy/sell to achieve the desired risk level based on your trading situation.

Typically, it is recommended to aim for a 1% per trade position size. This is reasonable to keep losses small and consistent. Some traders even go for 0.5% per trade.

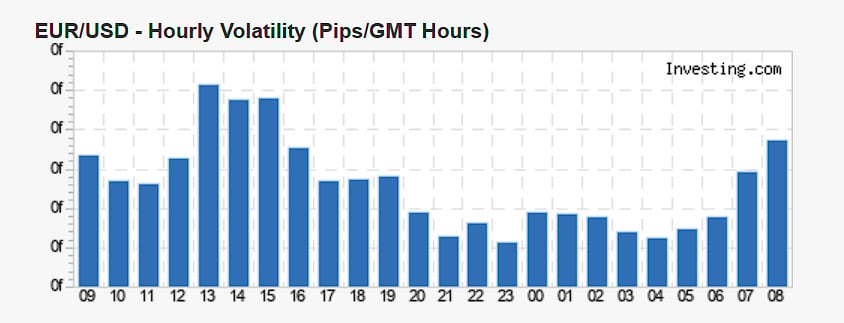

Selecting your Forex pairs based on the volatility can make a huge difference. You typically want to avoid trading Forex pairs that don´t move because finding profitable trading opportunities might be much harder. To realize large enough Reward:Risk Ratio trades, the price of a Forex pair has to move.

And, just as important, the price of your Forex pair must move during your active trading times. It doesn´t help to find a Forex pair with an overall high volatility such as the AUD/USD only to realize that this Forex pair moves the most when you are asleep or at your day job.

For that, the volatility tool from Investing.com (Forex Volatility Calculator - Investing.com) is very helpful because it not only shows you the overall volatility but breaks it down into hourly volatility as well.

In today's times, Forex traders have a huge advantage in that they don´t necessarily have to trade their own money, significantly reducing personal risk factors. With the rise of funding companies, traders can qualify to receive capital allocations from private firms. You then trade the funding company´s money and receive a profit share based on your performance. Except for the initial cost of purchasing the funding challenge, there are no other costs associated with it.

This is an almost risk-free way of increasing your AUM (assets under management) without putting your own money on the line. However, this is only recommended for traders who are already profitable to have a chance of passing the initial evaluation.

Some funding companies offer free trial challenges which can be a great way for newer traders to test their skills. The rules of a funding company then also force a trader to adopt a more careful risk management approach which can greatly benefit the trader's learning progress.

Although it is not necessary to follow macroeconomic events and developments from around the world, I enjoy following up on world events.

When it comes to news sites, there are hundreds of resources out there, but here are my top three picks: Wall Street Journal (https://www.wsj.com/), Seeking Alpha (https://seekingalpha.com/), and the Economist (https://www.economist.com/). I do not read all articles every day, but checking in multiple times a week will give you a good idea of what is going on in the world.

We have been trading supply and demand strategies for over ten years, and they have stood the test of time remarkably well. Supply and demand is...

3 min read

Choosing the right trading journal is essential for traders wanting to analyze performance, refine strategies, and improve consistency. In this...

3 min read

“95% of all traders fail” is the most commonly used trading related statistic around the internet. But no research paper exists that proves this...