Supply and Demand Trading in 2026

We have been trading supply and demand strategies for over ten years, and they have stood the test of time remarkably well. Supply and demand is...

As a Forex trader, you can choose from dozens of currency pairs to trade from, but which is the right choice and what are some common pitfalls when choosing the wrong Forex pairs for your trading? Choosing the wrong Forex pairs can result in suboptimal trading conditions, increased risk, and reduced profitability. The best Forex pairs often depend on market volatility, economic events, liquidity, and your personal risk tolerance.

It's important to consider factors like the pair's average daily range, trading times, and costs. By understanding these elements, you can identify pairs that offer the best opportunities for your trading style. Whether you're a day trader, swing trader, or long-term investor, focusing on the right Forex pairs can enhance your trading success and help you avoid unnecessary risks.

The first step when choosing a Forex pair for your trading is making sure that it shows sufficient volatility. This is important because only when the price of your chosen Forex pair is moving enough, you will be able to realize winning trades with a significant size. When the price is not moving, it might be harder to find profitable opportunities, and large trending moves are less likely. Especially for trend-following traders, or traders who try to catch extended price moves, high levels of volatility are an important factor when it comes to pair selection. On the lower timeframes, this might not play such a large role because traders aim at much smaller price movements.

The graphic below shows that the AUD/USD and the NZD/USD have been the best movers on average over the last 40 weeks when looking at their percentage range. Other AUD and NZD crosses such as the AUD/JPY, NZD/JPY, or the AUD/CHF also show high levels of volatility.

Some commonly traded Forex majors such as the USD/JPY and the GBP/USD also show high levels of volatility but fall behind the AUD and NZD crosses. Other Forex majors such as the most traded Forex pair, the EUR/USD, show much lower levels of volatility. Many new traders are automatically drawn to the EUR/USD, USD/CAD, or EUR/GBP but looking at the percentage moves, they might not be the optimal choice.

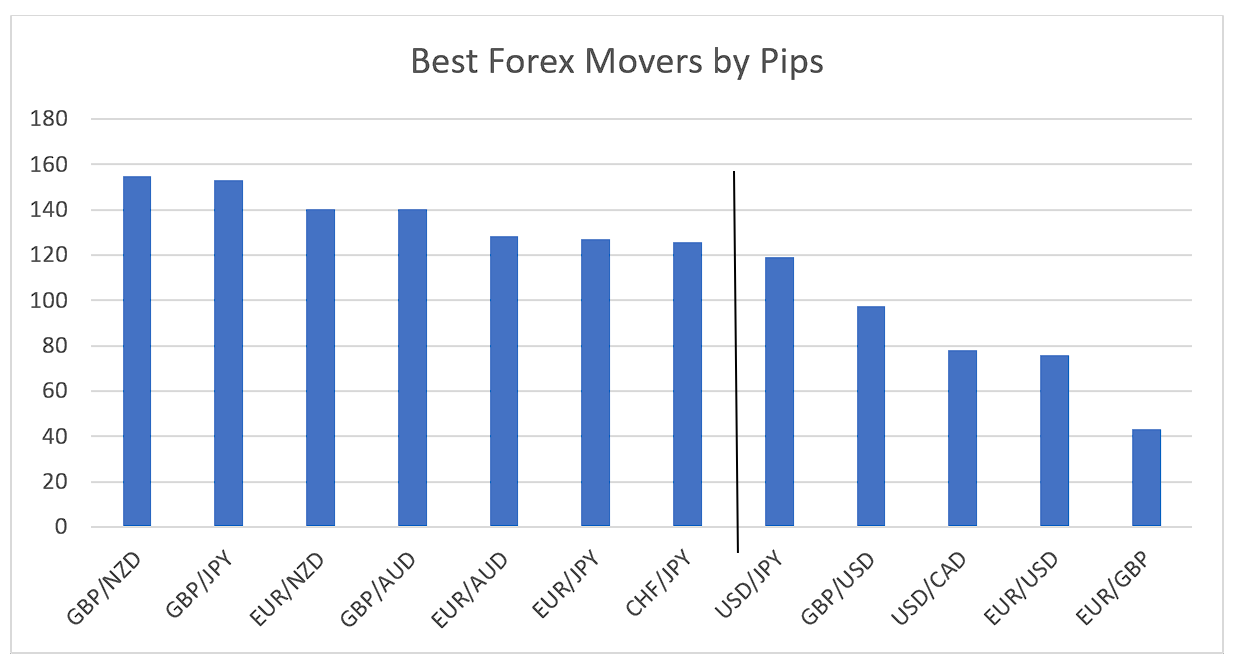

When just looking at the pure pip range, we now also find some GBP pairs besides the previously mentioned AUD and NZD Forex crosses among the best movers. Still, the Forex majors EUR/USD, USD/CAD, and EUR/GBP fall well behind the top movers; EUR/USD and USD/CAD Forex majors are moving, on average, only half of the pip range, compared to GBP/NZD or GBP/JPY.

It is important to note here, that those characteristics can change over time, and you might also find instances during which the usually less volatile EUR/USD or USD/CAD can exhibit high levels of volatility. Especially when geopolitical or macroeconomic (read more: most important Forex news events) situations undergo changes, this can directly impact volatility. Therefore, it is important to pay close attention to volatility and the average price movements so that you can spot trend changes early on and adjust your market selection.

Source: Forex Volatility - Mataf (40-week average)

Source: Forex Volatility - Mataf (40-week average)

Besides finding Forex pairs that show sufficient levels of volatility, it is equally important to identify the Forex pairs that move during your active trading hours. It doesn’t help if you want to trade a specific Forex pair because the graphics above confirmed that it is a significant mover, but then the most active times fall outside of your active trading hours when you are busy at work or sleeping. This is especially true for day trading strategies and traders on the lower timeframes.

The 24-hour trading day is typically divided into 4 trading sessions: the first markets to open on Sunday night (when considering New York time) are Australia and Tokyo, followed by London and finally New York.

When visualizing the price activity of the different sessions, we get the following. We use New York (UTC-5) as a reference time for the following analyses.

The darker the green color, the more active a trading period; the lighter, the less active:

A great tool to analyze the different Forex sessions can be found on Babypips.

Although it is important to know when the most active trading hours are, different currency pairs respond differently to the market hours. Typically, you can say that a specific currency is the most active when its domestic stock market is open as well. This means that EUR crosses are most active during the London session, while the USD is most active during the New York Session.

When we are looking at the EUR/USD, this means that this Forex major is most active during the overlap between the London and the New York sessions when both stock markets are open. The EUR/USD also shows higher levels of activity during the London open (when New York is still closed) and during the New York afternoon session (when London is closed).

Source: EUR USD Volatility Chart: Euro vs US Dollar Volatility (myfxbook.com)

Trading activity and the daily trading cycle provide important implications for traders. Only if your active trading time falls into the most active hours for the EUR/USD, you should consider trading this Forex pair. If you are living in London and have a demanding day job during which you cannot look at the charts, the EUR/USD, and most other EUR crosses, are probably not a good fit for your trading because you can only trade during the less active trading hours, and finding trending trades is less likely.

When we look at the most traded Forex pairs, we can see right away that most of the most popular Forex pairs are not among the best movers. EUR/USD and USD/CAD rank lower on the volatility scale but are the first and third most traded Forex pair.

New traders often just search for the most popular Forex pairs and then start trading them without making any further inquiries. The most popular Forex pairs are not necessarily going to be the best fit for all traders. As we have seen, the overall volatility and the level of activity during one’s trading hours are significant factors when it comes to market selection.

Source: Most traded currency pairs in forex 2022 | Statista

Trading costs, commissions, and spreads don´t play a huge role in today´s world of competitive and low-cost brokerage offers. Forex majors are the least expensive markets, but Forex minors are usually still tradable, and their spread is not significant. However, Forex exotic pairs might be too costly, especially when trading on the lower timeframes where spread and commission can quickly make up a large part of your overall trading range.

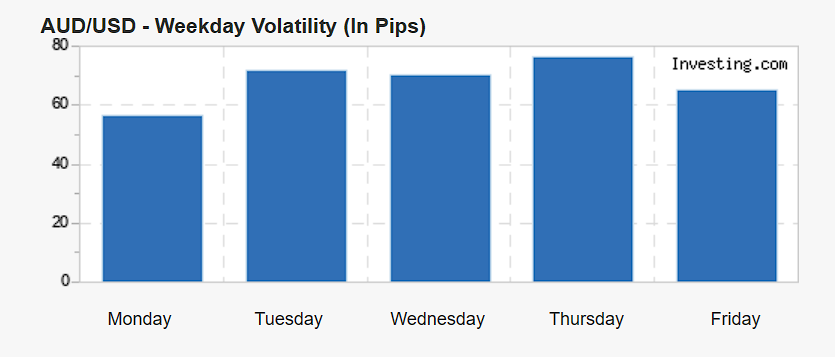

When it comes to examining the volatility by weekday, we can use the helpful Investing.com volatility tool. For most Forex pairs, there is no significant difference in the volatility levels by weekday. For some, as in the example of the AUD/USD below, Mondays will be slightly less active trading days. The reason is that the weekend break is affecting the total trading time. This is also the reason why some pairs might show lower volatility levels on Fridays. Some traders therefore choose to avoid trading early Monday before the London open and stop their trading on Friday after the London close.

Source: Forex Volatility Calculator - Investing.com

Source: Forex Volatility Calculator - Investing.com

The optimal choice when it comes to market selection and finding the best Forex pairs doesn’t have to be too complicated. If you are a day trader on the lower timeframes, the most important factors are your active trading times and finding a Forex pair that aligns with your time availability. Avoid trading Forex pairs that are most active outside of your trading times.

When you are a trader on higher timeframes, selecting Forex pairs that show a high level of volatility might be the right approach because it allows you to trade markets that have a higher likelihood of showing trending movements. Avoid low volatility Forex pairs because realizing high Reward:Risk ratio trades is not as likely.

We have been trading supply and demand strategies for over ten years, and they have stood the test of time remarkably well. Supply and demand is...

3 min read

Choosing the right trading journal is essential for traders wanting to analyze performance, refine strategies, and improve consistency. In this...

3 min read

“95% of all traders fail” is the most commonly used trading related statistic around the internet. But no research paper exists that proves this...