4 min read

How to Review Your Trading Data - 6 Simple Steps

Have you ever reviewed your trading journal and felt lost? Many traders struggle to identify patterns and make sense of their performance. But what...

2 min read

Rolf

Feb 20, 2017 7:00:00 PM

It is a well-known fact that volume, as you see on your Forex pairs, is actually not ‘true’ volume and is really only ‘tick volume’ implying simply the number of ticks that price moved in that given time frame.

Real volume – as used in other markets like stocks – is, of course, the number of units of the trading instrument actually traded in a given time period.

The two are vastly different interpretations of the phenomena but the argument going with tick volumes in Forex – and also perhaps what made them an acceptable trading tool among Forex traders – is that for a decentralized over the counter (OTC) market like Forex, it is near impossible to gather any real and complete information on order flow. Hence tick volumes need to be used as proxy for real volumes.

The underlying logic is that with increased order flow, price should generally move more ticks, therefore, printing a larger tick volume bar on your free meta trader platform.

We also have some ‘innovative’ Forex brokers, actually releasing real-time order flow executed through their platforms for a more accurate number on Forex volumes for their dear customers. While that’s sweet, it hardly provides any real insight into the global Forex market built on trillions of dollars of daily trade. What these tools essentially show is only a tiny glimpse of an already minuscule and non-authoritative segment of retail trading in Forex.

But before you decide to dump away your Volume indicators, I do have some good news. Volumes in Forex do work! Period.

Thinking about it, tick volumes may not be giving us real-time order flow cues, but they are giving us a fair idea about how rapidly price is moving in a particular direction (more rapid price movement equals higher tick volumes). As a price action trader, this bit of information can be gold when put in tandem with other relevant information.

While I am a believer in using tick volume in Forex, I do not believe in applying full blown volume-based trading strategies such as volume spread analysis (VSA) that is used often in centralized markets with known real volumes.

With Forex it is important to understand that tick volumes are still just a proxy for real volumes and your competitive edge in the market cannot be built upon proxy indicators for true momentum.

I like to use tick volumes in Forex as a secondary validation for strength (or lack thereof) of the market. And as you will see in a bit, it can lend important clues in developing an overall understanding of the direction that price is trading in.

It is reasonable to assume that if price is trading in the right direction, traders should have a keen interest in pushing their order buttons, hence propelling order flow as well as tick volume (price should move more rapidly covering a higher tick count).

On the contrary, if price is trading in the opposite direction (such as pulling back while in a strong uptrend) the move should be associated with lower trading volumes: both in terms of real order flow, as well as tick volumes (price should be moving rather slowly covering a lower tick count per period).

Staying within the context of what I just said, how exactly should a true breakout from a vivid chart pattern look via tick volumes? If you said big volume bars indicating strong momentum, you are right! Would you be worried about a possible fake breakout if volume bars did not print higher at a breakout point? I’d likely be biting my nails off if I was in a breakout trade at the point.

Let’s put this into perspective and throw some sense into what I have just said.

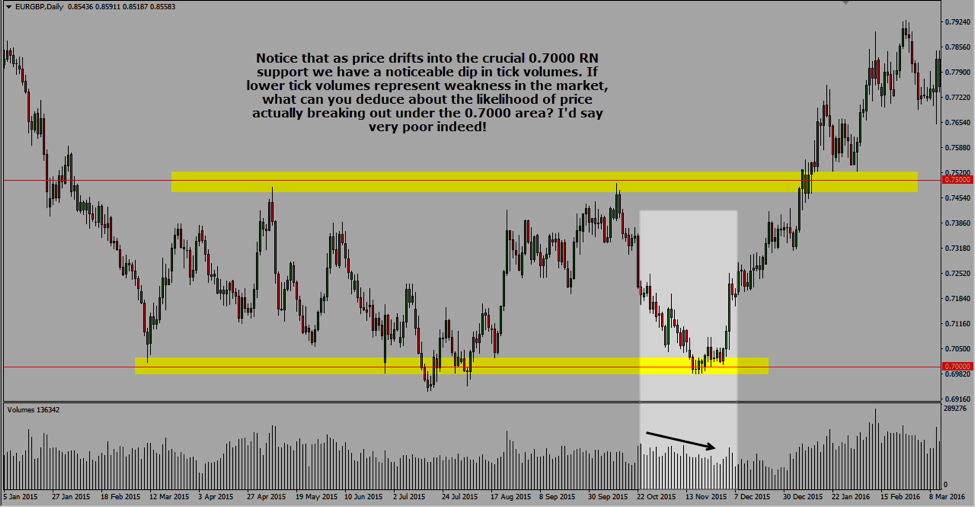

We are looking at the EUR/GBP daily chart with an interesting range-bound market stuck within the 0.7000 and the 0.7500 price levels. Let’s use tick volumes to deduce price action moves on this one:

You can see pairing tick volume information with other powerful bits of price action information like horizontal support and resistance levels can help expand your understanding of why the market is moving the way it is.

I would caution against using tick volume information as the sole trigger to a trade, but when equipped with other aspects, it can serve as a killer filtering tool helping you choose the best of the best trades.

4 min read

Have you ever reviewed your trading journal and felt lost? Many traders struggle to identify patterns and make sense of their performance. But what...

3 min read

The following is a guest post from Michael Lamothe.

I'm Michael Lamothe, and today marks an extraordinary milestone: the first anniversary of "The...

3 min read

It's easy to get discouraged by losses and question your every move. But what if there was a way to track your progress, learn from mistakes, and...