Supply and Demand Trading in 2026

We have been trading supply and demand strategies for over ten years, and they have stood the test of time remarkably well. Supply and demand is...

3 min read

Rolf

Apr 11, 2024 1:39:03 PM

The following is a guest post from Michael Lamothe.

I'm Michael Lamothe, and today marks an extraordinary milestone: the first anniversary of "The Trading Mindwheel." I extend my deepest appreciation to Rolf for inviting me to share this journey with you all. Reflecting on the past year, it's been a voyage of discovery, growth, and profound impact, not just for myself but for traders worldwide who have embraced the ethos of the book.

I'm Michael Lamothe, and today marks an extraordinary milestone: the first anniversary of "The Trading Mindwheel." I extend my deepest appreciation to Rolf for inviting me to share this journey with you all. Reflecting on the past year, it's been a voyage of discovery, growth, and profound impact, not just for myself but for traders worldwide who have embraced the ethos of the book.

Why write another book on trading psychology? The answer lies in the pervasive influence of beliefs and mindset on every facet of trading. When I embarked on my trading journey, I encountered myriad challenges, many of which stemmed from my own beliefs about the market, risk management, and, fundamentally, about myself. The trading world is saturated with strategies and techniques, yet the cornerstone of sustained success—psychology—often remains underexplored. "The Trading Mindwheel" is my endeavor to bridge this gap, drawing from 25 years of trading experience and the distilled wisdom of countless books and mentors.

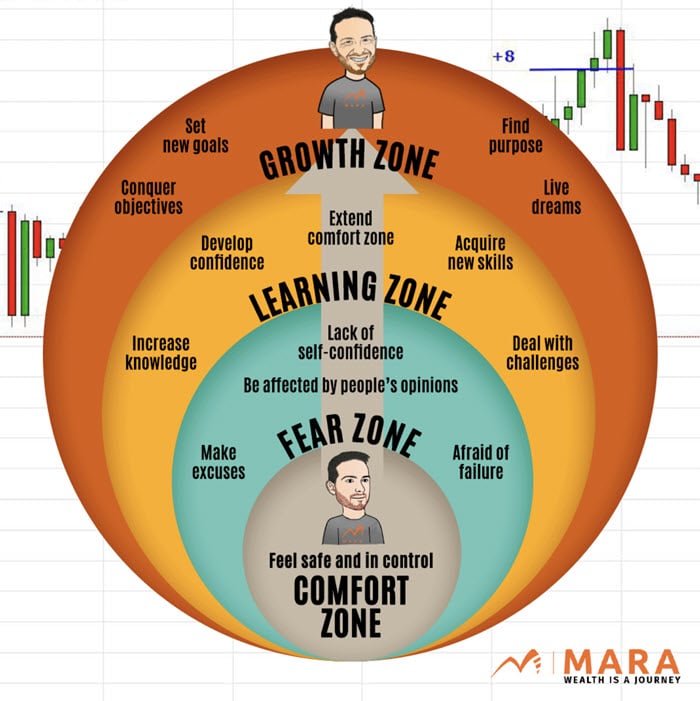

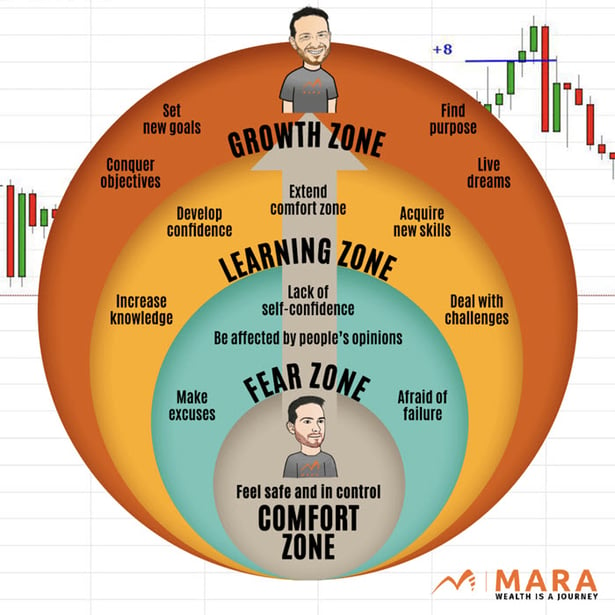

At its core, trading psychology transcends strategies. It delves into the belief systems that shape our trading decisions. From how we analyze stocks or forex to how we perceive risk and our capabilities, every aspect is influenced by our mindset. This realization was the catalyst for "The Trading Mindwheel," aimed at equipping traders with the knowledge to explore and refine their belief systems, fostering a holistic approach to trading.

Among the myriad insights shared in the book, the concept of "white knuckling" stands out—a metaphor borrowed from my personal trainer, encapsulating the struggle of trying too hard to control the uncontrollable. In trading, this can manifest as overleveraging, overtrading, or relentlessly pursuing a failing strategy, often leading to significant emotional and financial tolls. The antidote? Embracing relaxation, discipline, and a process-oriented mindset, are key themes explored through the book’s chapters.

The feedback on "The Trading Mindwheel" from the trading community and my mentors, including luminaries like Mark Minervini, has been nothing short of transformative. Mark’s foreword in the book, emphasizing the importance of not just reading but studying the material, highlights the profound impact of the book on traders at all levels. This encouragement and validation from the community have been a source of immense pride and motivation, reinforcing the book’s value and relevance.

Journaling and post-analysis are pivotal in the trader’s journey toward self-improvement and mastery. Tools like Edgewonk play an indispensable role, enabling traders to track their progress, identify patterns, and refine their strategies. This process of reflection and analysis is integral to developing a deeper understanding of one’s trading practices, a theme that "The Trading Mindwheel" emphasizes extensively.

As we venture into the future, the intersection of technology, AI, and trading psychology presents unprecedented opportunities and challenges. The narrative often revolves around whether technology can replace human judgment and intuition in trading. My stance, as elaborated in the book, is that technology should augment, not replace, the trader’s skill set.

On the one hand, you have Tony Stark. I highly skilled inventor who with the help of AI can develop a suit that transforms him into a superhero.

Contrast that with Vector from the Minions movie. Even with loads of technology at his disposal, and unlimited funds thanks to his father who runs ‘the bank of evil’ since Vector lacks any skill at all, the best he can do is develop a gun that launches fish at people.

I argue that technology, when coupled with knowledge and skill, can transform an ordinary trader into a formidable one. Conversely, without a solid foundation, technology can amplify flaws and misconceptions.

In a nutshell, be more like Tony Stark, less like Vector.

Reflecting on the year since the release of "The Trading Mindwheel," the journey has been one of significant achievements, learning, and community building. The development of tools like the "Danger Signals" indicator, designed to help traders manage trades more effectively, stands a testament to the book’s ongoing impact and my commitment to providing practical value to the trading community.

As we look to the future, the role of trading psychology, bolstered by technological advancements, will only grow. Platforms like Edgewonk are at the forefront, offering traders insights and analytics that were previously only attainable through massive amounts of time and effort. This evolution points towards a future where trading psychology, equipped with the tools of technology, enables traders to achieve greater awareness, precision, and success.

I'm profoundly grateful for the journey "The Trading Mindwheel" has taken me on this past year, and the stories of transformation and success from the trading community have been the greatest reward. As we celebrate this milestone, I invite you to embark on (or continue) your journey with "The Trading Mindwheel," exploring the depths of trading psychology and harnessing its power to transform your trading.

"The Trading Mindwheel" is more than just a book; it's a companion on your trading journey, offering insights, strategies, and reflections to guide you toward sustained success. I look forward to hearing your stories, insights, and how the book has influenced your trading path.

Thank you once again to Rolf and the Tradeciety community for this opportunity to share. Here's to continued growth, learning, and success in our trading journeys.

Warmest regards,

Michael Lamothe

We have been trading supply and demand strategies for over ten years, and they have stood the test of time remarkably well. Supply and demand is...

3 min read

Choosing the right trading journal is essential for traders wanting to analyze performance, refine strategies, and improve consistency. In this...

3 min read

“95% of all traders fail” is the most commonly used trading related statistic around the internet. But no research paper exists that proves this...