Supply and Demand Trading in 2026

We have been trading supply and demand strategies for over ten years, and they have stood the test of time remarkably well. Supply and demand is...

3 min read

Rolf

Feb 20, 2017 7:00:00 PM

The Forex market is a decentralized market which means, in contrast to the stock market, there's no central exchange tracking every single Forex transaction. So, unlike stocks, there's no single source for "true" trading volume in Forex trading. However, that doesn't mean volume is useless in Forex. By looking at relative volume, traders can still gauge market activity. This tells them whether trading is picking up or slowing down, which can be a valuable clue for spotting potential trends and making informed decisions.

True volume refers to the total (actual) number of contracts traded. Relative volume, however, compares current activity to an average over time, highlighting changes in trading intensity.

The two are vastly different interpretations of volume analysis but the argument going with tick volumes in Forex – and also perhaps what makes them an acceptable trading tool among Forex traders – is that for a decentralized over-the-counter (OTC) market like Forex, it is impossible to gather any real and complete information on order flow. Hence tick volumes need to be used as a proxy for real volumes.

The underlying logic is that with increased order flow, price should generally move more ticks, therefore, printing a larger tick volume bar on your free meta trader platform.

We also have some ‘innovative’ Forex brokers, actually releasing real-time order flow executed through their platforms for a more accurate number of Forex volumes for their dear customers. While that’s sweet, it hardly provides any real insight into the global Forex market built on trillions of dollars of daily trade. What these tools essentially show is only a tiny glimpse of an already minuscule and non-authoritative segment of retail trading in Forex.

But before you decide to dump away your Volume indicators, I do have some good news. Volume analysis in Forex can work!

Thinking about it, tick volumes may not be giving us real-time order flow cues, but they are giving us a fair idea about how rapidly the price is moving in a particular direction (more rapid price movement equals higher tick volumes). As a price action trader, this bit of information can be gold when put in tandem with other relevant information.

While I am a believer in using tick volume in Forex, I do not believe in applying full-blown volume-based trading strategies such as volume spread analysis (VSA) which is used often in centralized markets with known real volumes.

With Forex it is important to understand that tick volumes are still just a proxy for real volumes and your competitive edge in the market cannot be built upon proxy indicators for true momentum.

I like to use tick volumes in Forex as a secondary validation for the strength (or lack thereof) of the market. As you will see in a bit, it can lend important clues in developing an overall understanding of the direction that price is trading in.

It is reasonable to assume that if the price is trading in the overall trend direction, traders should have a keen interest in pushing their order buttons, hence propelling order flow as well as tick volume (the price should move more rapidly covering a higher tick count).

On the contrary, if the price is trading in the opposite direction (such as pulling back while in a strong uptrend) the move should be associated with lower trading volumes: both in terms of real order flow, as well as tick volumes (price should be moving rather slowly covering a lower tick count per period).

Staying within the context of what I just said, how exactly should a true breakout from a vivid chart pattern look via tick volumes? If you said big volume bars indicate strong momentum, you are right! Would you be worried about a possible fake breakout if volume bars did not print higher at a breakout point? I’d likely be biting my nails off if I was in a breakout trade at that point.

Let’s put this into perspective and throw some sense into what I have just said.

We are looking at the EUR/GBP daily chart with an interesting range-bound market stuck within the 0.7000 and the 0.7500 price levels. Let’s use tick volumes to deduce price action moves on this one:

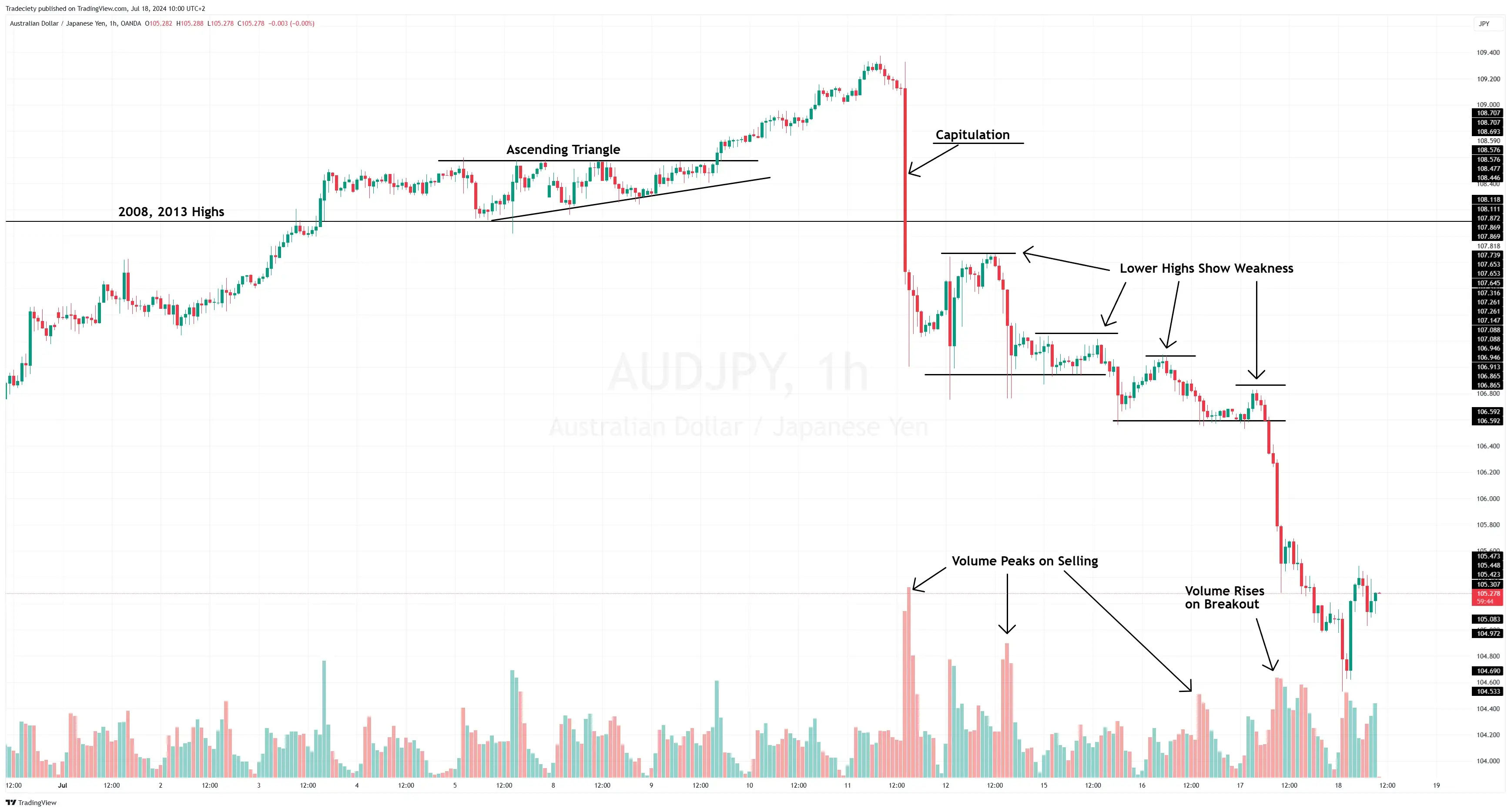

After a strong uptrend, the market topped out with a heavy capitulation move lower. Although trading sudden capitulations is not recommended because they happen too fast and without prior warning, they still provide important cues about the sentiment.

After the capitulation, the price made lower highs. Interestingly, the volume spiked on the red downward candlesticks, confirming the strong interest in bearish trading. The bullish candles, on the other hand, showed a decline in volume.

When the breakout into fresh lows occurred, the volume spiked again. Strong bearish candles accompanied by higher than usual volume can be a great trend-following signal.

The trend continued lower after the strong volume breakout. For now, the price has bottomed out and volume starts rising with bullish candles. Bearish trend-continuation traders should wait for new bearish signals supported by volume spikes and should look for volume drying up on the bullish moves.

You can see pairing tick volume information with other powerful bits of price action information like horizontal support and resistance levels can help expand your understanding of why the market is moving the way it is.

I would caution against using tick volume information as the sole trigger to a trade, but when equipped with other aspects, it can serve as a great filtering tool helping you choose the best of the best trades.

We have been trading supply and demand strategies for over ten years, and they have stood the test of time remarkably well. Supply and demand is...

3 min read

Choosing the right trading journal is essential for traders wanting to analyze performance, refine strategies, and improve consistency. In this...

3 min read

“95% of all traders fail” is the most commonly used trading related statistic around the internet. But no research paper exists that proves this...