Supply and Demand Trading in 2026

We have been trading supply and demand strategies for over ten years, and they have stood the test of time remarkably well. Supply and demand is...

Sometimes in my trading career, I have been lost among the trees. My charts were so cluttered I could not make one clear decision, yet produce one valid trade idea that I liked. Everything was gibberish, paralysis through analysis. Whenever I got a signal in one direction, other things I learned and watched gave me a signal into the other direction. It was time to weed out. And I am not even talking about indicators here. No, I am talking about the thing that everyone so religiously loves – candlesticks. It seems there has been a cult around these ever since Steve Nison, or whoever claims to have brought them to the West first, introduced them to us. Price action is king, yes of course it is. But to me, seeing the open, high, low, and close was just too much information to digest sometimes. So I started to play around a bit with different chart tips, tick bars, volume bars, renko bars, and so on. But it wasn’t until I switched to a simple line chart that suddenly I could see clearly again. A standard line chart shows us the close of each bar – basically, it is a simple moving average with a period 1 applied to the close. All candlesticks fanatics always preach to wait for the close of the bar, so why not only look at the close of the bar?

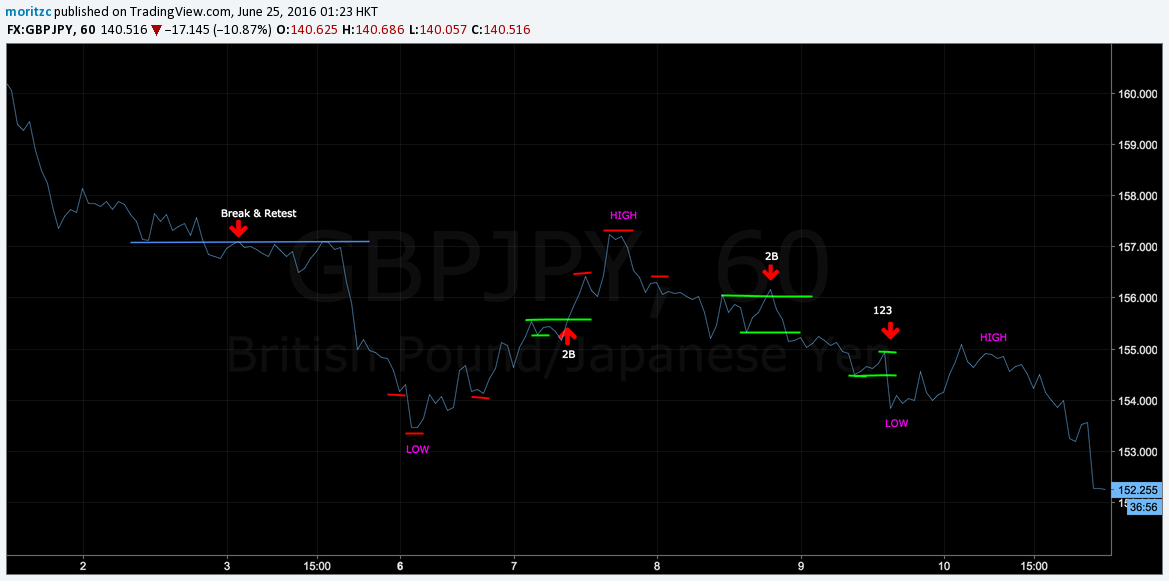

It’s weird how clearly chart formations, patterns, highs and lows, and even the direction of a chart, can be much easier read on a line chart – at least for me. Since then, I always have a line chart open whenever I trade candlestick charts, and I have even developed a strategy based solely on line charts, which is performing nicely for me. I know a lot of traders that have a massive problem defining the highs and lows that are important and ignoring the smaller swings in between, let alone determine trend direction or detect patterns like 1-2-3’s and I am pretty sure a line chart could help them a lot. Let’s take a look at what I mean.

Looking at this chart, I have trouble finding something tradeable. My eyes just don’t like it, maybe it’s just me, I don’t know. Sure, there are some things, but nothing that stands out, although price has been moving 500 pips and more in that period we see here. What can we see on the line chart, however?

Firstly, the head and shoulders formations are much easier to spot. But that’s not all. 2B-patterns (bull/beartraps) and 1-2-3’s, among others, are much easier to spot as well.

These are just a few of the ones I spot at the glimpse of an eye on this chart. Last but not least, even trend direction and the most important S&R levels and/or trendlines are easier to spot for me on these line charts.

Now when we switch back to candlestick charts, you will see that you see that every pattern I drew here actually cut through the wicks of the candles. This is how I have been drawing my S&R levels anyway, however doing it with the line chart makes it so much more obvious and easy on the eye. Sure, trained eyes will spot 1-2-3’s and the like just as easy as I do on a candlestick chart, but I never actually SAW these patterns on the candlestick chart UNTIL I saw them first on a line chart – that’s when they actually started to make sense to me. Other trades would point their patterns out to me and I would be saying ‘what, where? I don’t see a thing!’.

See what I mean? Maybe, at least I hope so. Now combining the power of the candlestick charts with pinbars, outside bars, strong bearish/bullish closes, rejection wicks, etc. with the power of the simplicity of line charts and their much easier pattern and trend recognition, is what really pushed my trading to the next level.

But to be honest, you don’t even need candlesticks to trade profitably – well, of course not, as there are a thousands ways to skin a cat. Take a higher timeframe line chart and when it points down, and your lower timeframe line chart points down as well, try to get in on a 1-2-3 or 2B pattern, and you have a (obviously discretionary) winning strategy. But that is a topic for another post.

Will switching to line charts make you a winning trader? No, of course not. But they will bring clarity and simplicity to a chart if you, just lile me, cannot handle the information overload of opens, closes, highs and lows, wicks and bodies, strong closes and weak closes, and so on.

Candlesticks, like any other visualisation of price, are an indicator – too many indicators simply will clog your thought process. I look for multi-bar patterns on the line chart, and get confirmation from single candlestick patterns on the candlestick chart – this makes trading so, so much easier. I dare you to give it a try because most likely you are way overestimating your information processing power and are just as slow as me. Trading is about pattern recognition, after all, and patterns are the easiest to see on line charts. There is a reason, why traders like Peter Brandt often post line charts on their blogs, drawing H&S, wedges, triangles, and what not on them.

What do you think, are line charts as visually appealing to you as they are to me, or are we missing out on vital information by trading them? Let us know in the comments below!

We have been trading supply and demand strategies for over ten years, and they have stood the test of time remarkably well. Supply and demand is...

3 min read

Choosing the right trading journal is essential for traders wanting to analyze performance, refine strategies, and improve consistency. In this...

3 min read

“95% of all traders fail” is the most commonly used trading related statistic around the internet. But no research paper exists that proves this...