Supply and Demand Trading in 2026

We have been trading supply and demand strategies for over ten years, and they have stood the test of time remarkably well. Supply and demand is...

The pinbar is a very popular candlestick pattern and many traders use the pinbar to make trading decisions. I get a lot of questions about pinbars and most traders are very frustrated because they just can’t seem to make them work. But why is that?

The pinbar can be a great trading signal, but if you don’t know how to trade it, you’ll easily lose a lot of money. Here are the main reasons why most traders lose using the pinbar:

A few years ago, the pinbar might have been a good signal but today, you’ll see squeezes, failed pinbars and very delayed signals all the time. The reason is that all traders act the same way on pinbars and the professionals use that knowledge to drive price in a way that forces amateurs to lose money.

In this article I will help you understand pinbar trading in a better way and explain how you can improve the setup quality of pinbars.

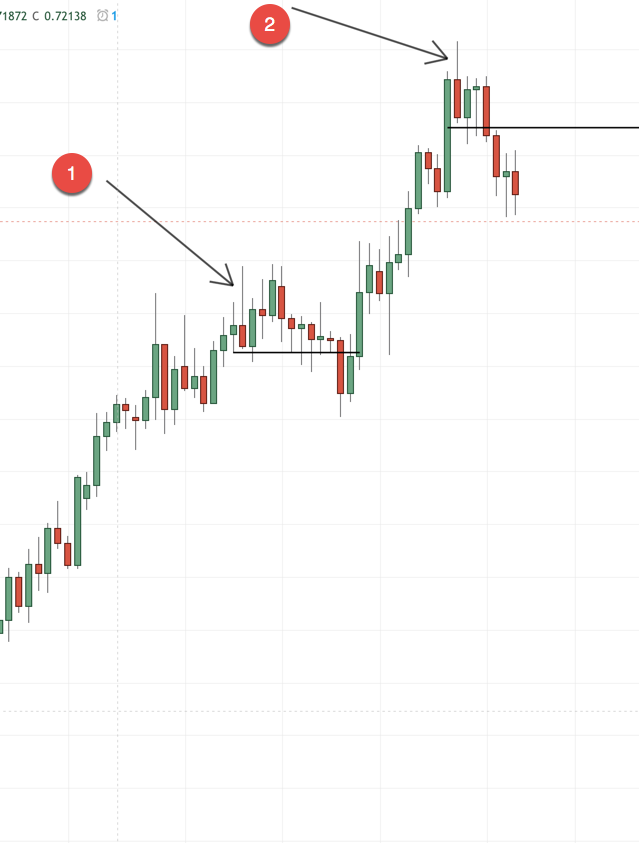

Let’s start by looking at the two possible scenarios and what can happen when we look at pinbars:

1. The failed pinbar

When looking at historic charts, it’s easy to scroll over failed pinbars because they don’t stand out. But more often than not, pinbars will fail and only looking at the great pinbars that would have predicted a new reversal is very misleading.

The pinbar marked with (1) shows a failed pinbar. By the time it formed, it did look like a classic failed breakout with a double top. But the pinbar never “broke” and price was never able to move beyond the lows of the pinbar. It took price 11 candles to close below the low of the pinbar.

2. The perfect pinbar

This pinbar is nearly perfect, although it probably would have fooled most traders too. It took 3 candles for price to close below the low of the pinbar and most traders would have lost money on this pinbar because price went against them first.

By the way, this scenario would also have classified as a reversal based on our pro swing trading strategy – something you will learn more about in our pro trading area.

Here we can see the 2 most important rules for pinbar trading:

In our pro room, we regularly trade the Head & Shoulders as one of our setups and below you see a classic trap. After a clear head and shoulders and a clean neckline break, price immediately posted a pinbar, scaring off all the traders that acted on the pinbar. Afterward, price went higher and after I took the screenshot, price continued its uptrend – but most traders who correctly identified the Head & Shoulders did not make any money because they interpreted the pinbar incorrectly.

In such a scenario, although we do see a pinbar, it never broke and, thus, never gave a signal. What happened here in reality was that price made a new high, broke above the previous highs, signaling the end of the downtrend. The pinbar shows that the buyers were able to push price into new highs, something that we haven’t seen throughout all the downtrend. Although the buyers were not as strong to keep price up, the pinbar never gave a signal and buyers continued to step in and move price higher after the pinbar.

Click: Read more about momentum analysis

I marked a few more pinbars below and they will help us distinguish between “good” and “bad” pinbars.

The first green arrow shows a successful pinbar and price immediately closed below the low of the pinbar on the next candle.

The second pinbar shows a very interesting failed breakout. Although price moved lower on the candlestick after the pinbar, it retraced all the way and closed higher. Professionals, of course, know that the amateurs will blindly jump on the pinbar and they make it look like price will sell-off, just to trap the amateurs shortly after.

The third pinbar shows a pinbar that never got “triggered” and price just went sideways after the pinbar for over 8 candles. I know that it can be emotionally hard to resist the urge to jump into the market after such a great pinbar, but you have to learn when not to trade.

In my opinion, the pinbar by itself is a very weak signal and should never be traded on its own. In my own trading, I rarely use the pinbar and if so, it is just one of many confirmation signals. Any 1-candle pattern is too weak to trade it on its own and it lacks context. Multi-pattern candles or formations should always be preferred.

Another problem I see when it comes to pinbars is that the pinbar is a very obvious and well-known signal and the professionals use the pinbar to trap the amateurs and squeeze them out of their positions – read more: The bull and bear trap.

You should only use the pinbar as additional confirmation, as we do it in our pro area, and focus on the two pinbar rules: 1) a pinbar has to break before giving a signal and 2) the sooner a pinbar breaks, the better the signal. If you do that, you can improve the quality of your trading and avoid the common problems many traders have.

We have been trading supply and demand strategies for over ten years, and they have stood the test of time remarkably well. Supply and demand is...

3 min read

Choosing the right trading journal is essential for traders wanting to analyze performance, refine strategies, and improve consistency. In this...

3 min read

“95% of all traders fail” is the most commonly used trading related statistic around the internet. But no research paper exists that proves this...