4 min read

How to Review Your Trading Data - 6 Simple Steps

Have you ever reviewed your trading journal and felt lost? Many traders struggle to identify patterns and make sense of their performance. But what...

Trading is 90% psychology in my opinion. Although we might have a great system as traders, the way we execute our system is determined by our psychology and by our mental state.

The way we judge our performance and our trading are determined by our emotions.

You can see the best setup but if you are coming from a series of losses, you might hesitate or trade too small because you lack confidence. And if you just experienced a good run, you will often end up taking bad trades because you are over-confident. When you exit a profitable trade too soon or close a loss too late, emotions are the driving factors behind your decisions as well. And, of course, the big problems such as revenge trading, chasing or over-leveraging are all also a product of our emotions and our inability to manage them.

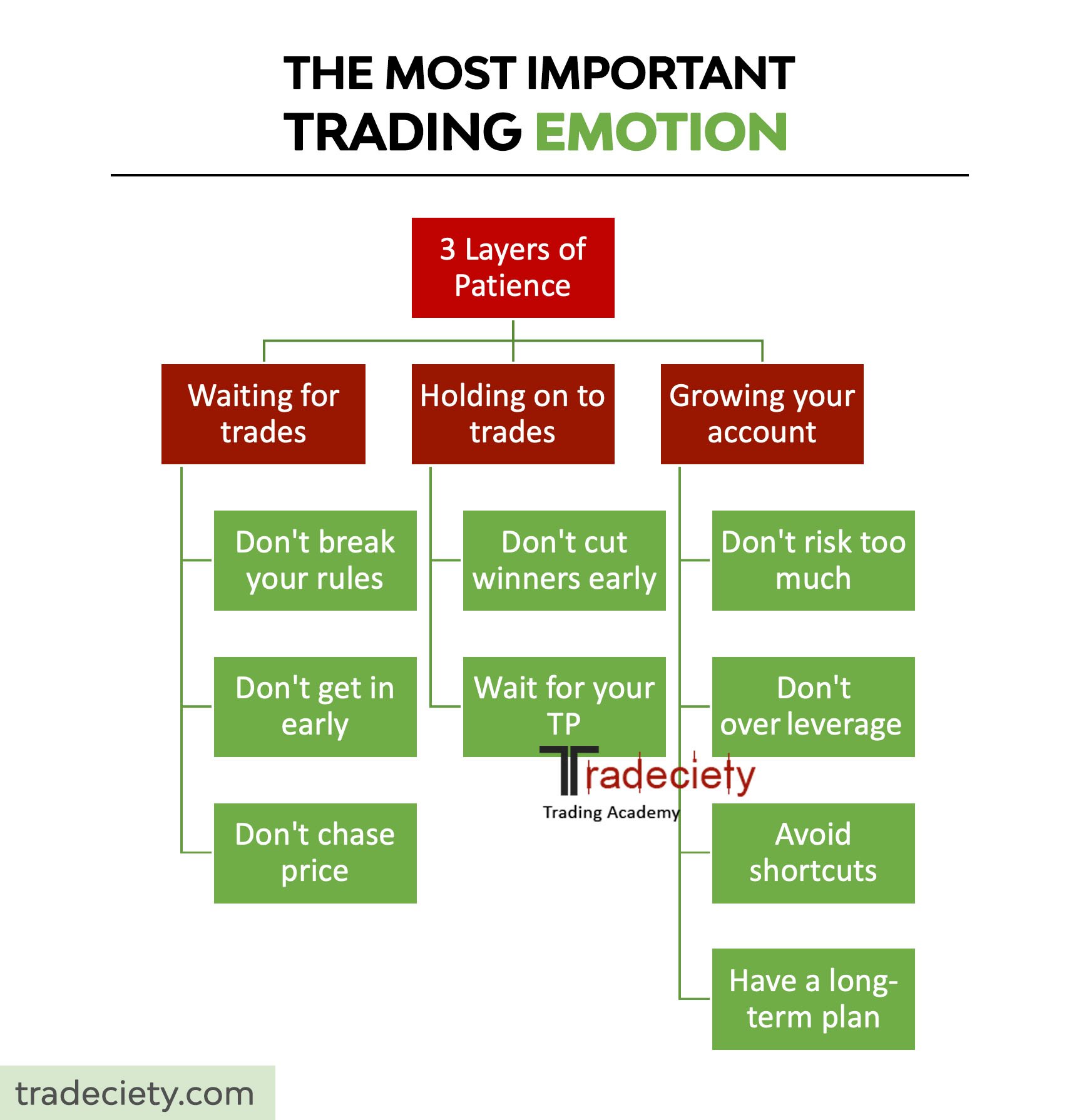

However, I believe that one specific trading emotion stands above all: Patience. Or better a lack of patience. In my latest podcast, I talked about why I believe that patience is the most important trading emotion / skill.

What do you think? Let me know in the comments below and I would love to hear your thoughts about patience and trading emotions in general.

4 min read

Have you ever reviewed your trading journal and felt lost? Many traders struggle to identify patterns and make sense of their performance. But what...

3 min read

The following is a guest post from Michael Lamothe.

I'm Michael Lamothe, and today marks an extraordinary milestone: the first anniversary of "The...

3 min read

It's easy to get discouraged by losses and question your every move. But what if there was a way to track your progress, learn from mistakes, and...