3 min read

Scientist Discovered Why Most Traders Lose Money – 24 Surprising Statistics

“95% of all traders fail” is the most commonly used trading related statistic around the internet. But no research paper exists that proves this...

Do you use break even stops? Is your trading account not where you want it to be? Although understanding break even stops is not suddenly going to transform you into a winning trader alone, being aware of the common mistakes and the lack understanding price movements costs traders a lot of money.

There is nothing fundamentally wrong with moving your stops to break even, but the absence of common sense and the naiveté most traders have when it comes to moving their stops is often quite disturbing.

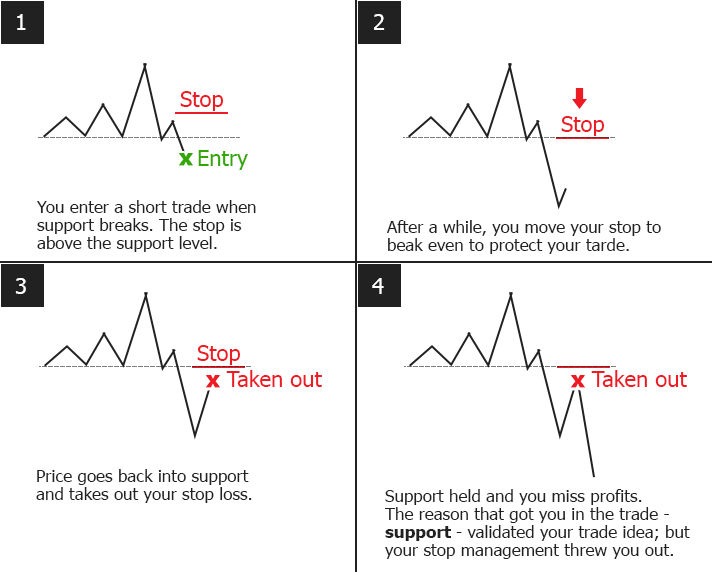

We will take a look at a very common trade scenario and observe why and how traders mismanage their trades and their stop loss orders.

Let’s assume you are selling a market after a break out support and your stop loss is above the support level. You have to ask yourself (or better, write it down):

What made me got in the trade? What is my rationale?

In this case, the trader would say something like:

I entered after support broke. Because the price level has held previously, the balance between buyers and sellers has shifted and I expect the price level to turn into resistance.

We will come back to that later, but it’s important to be clear about your trade motive upon entering the trade.

Price has moved in your favor and you see a little retracement. To protect your position, you move your stop loss to break even and you are happy because you now have a “free trade”.

Price has moved in your favor and you see a little retracement. To protect your position, you move your stop loss to break even and you are happy because you now have a “free trade”.

The truth is, nothing is free in trading. First, you entered the trade and risked your money by opening the position. Second, the trade has moved into profit and when it comes back to your entry, you end up with nothing; this scenario does not describe a “free trade”, but it shows that you are gambling with your unrealized profits.

However, the reason why a break even stop is often not the best solution will become obvious shortly.

As you had expected, price came back to your entry and took you out.

Price sells off again and leaves you with nothing but frustration and astonishment; in the end, everything played out exactly as you had anticipated. But let’s dissect what has happened.

First, you entered the trade because you saw the break of support and you expected the level to hold – which it did. But you moved your stop to the exact same price level that later confirmed your trade idea; scroll back up to see that your original trade idea was that support is going to turn into resistance. By now you should see why moving the stop loss in such a way is very irrational.

The example and the thought process should make it obvious why moving a stop to break even should be avoided that that there are much better alternatives to how you should manage your trades.

3 min read

“95% of all traders fail” is the most commonly used trading related statistic around the internet. But no research paper exists that proves this...

3 min read

Trendlines can be great trading tools if used correctly and in this post, I am going to share three powerful trendline strategies with you.

3 min read

Choosing the right trading journal is essential for traders wanting to analyze performance, refine strategies, and improve consistency. In this...