Supply and Demand Trading in 2026

We have been trading supply and demand strategies for over ten years, and they have stood the test of time remarkably well. Supply and demand is...

There are many reasons to stop system hopping, but the one that always made the most sense to me is the one most overlooked. Just as markets have their periods of upswings, downswings, and consolidations, so do systems that perform better in trending or consolidating markets. So one could say that your equity curve actually follows the market waves, which makes a lot of sense.

Let’s take an example of someone doing very well with his system during an uptrend, then the market hits a consolidation and he starts to rack up some minor losses. Usually, markets consolidate more than they trend, simply due to the nature of the different market phases – if you look at any random chart you will see that a parabolic trend will happen in just a few candles, while a consolidation will take a lot more candles to play out. So after a short period of frantic wins, when consolidation sets in, our trader hits a downswing in his equity curve. This goes on for days, maybe for weeks, and slowly eats up his formerly made profits, or maybe will leave him just break even. The trader will assume that his system stopped working and look for gold elsewhere before all of his profits dwindle. Doing this will rob him of the chance to catch the next uptrend that will inevitably come. Every system, just as every market, is cycling through phases of uptrends, downtrends, and consolidations. As long as the uptrends are stronger in gains than the downtrends in losses, the system will turn a profit – if the trader can actually stay sane throughout periods of no wins.

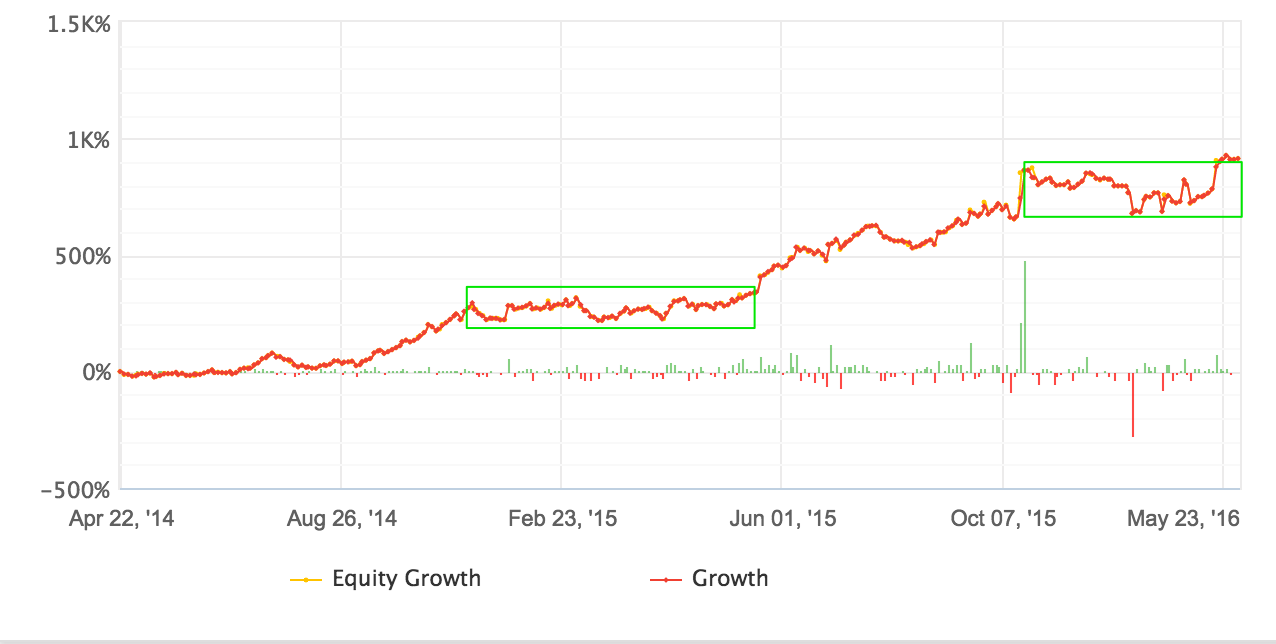

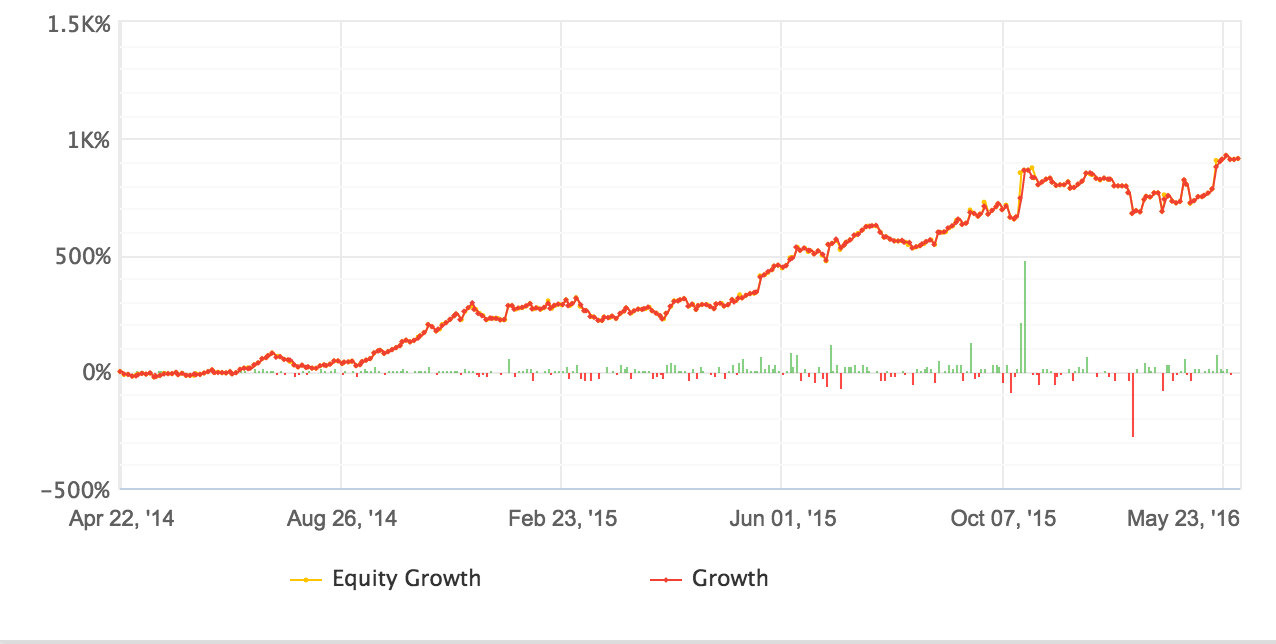

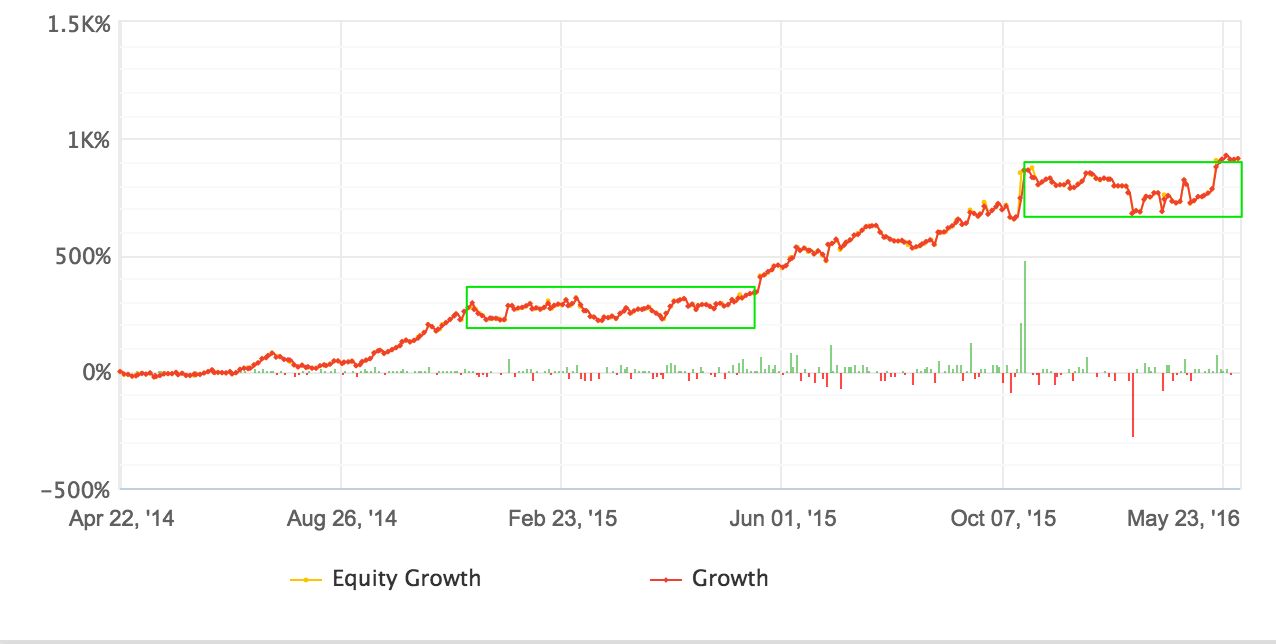

To clarify this, here is a chart of a strongly performing system.

Looking great, right? 1.500% in roughly two years, a trader’s wet dream. Anyone trading this must be the happiest and richest person on earth. However…

Look at the green rectangles. Those are phases where the system performs at breakeven for more than 6 months at a time. Can you really stay sane and true to your system in periods like these? I bet my underwear that 99,99% of traders would absolutely go insane during those months, even if they made a million bucks before that. They would start making severe trading mistakes, deter from their original strategy, or stop trading it altogether. And that is when the real problems start to happen. 6 months are a damn long time, especially as a daytrader – going through this is hell on earth, trust me. I’ve been there. But you cannot lose faith in your system, and you have to stay OBJECTIVE and keep going- business as usual.

Peter Brandt, one of the best traders of our time, says he experienced losing YEARS with his system. But over the past 5 decades, his system returned an average of 40% per year. This hurts to accept, but it is something you have to digest. You may very well have losing years and your system may very well still be working. All we can do in those periods is to assess two things.

1) How well did the market treat our system, e.g. in which manner did our setups play out?

2) How well did we apply our system to the market, e.g. execution and spotting of setups?

If 1) is a problem over a long period of time, it might be safe to assume that we have to adjust our system. If 2) is a problem, you better work on yourself and get those trades right, because, after all, the only thing that gives you an edge in this market is the proper and flawless execution of your system.

To stop trading a system during a downswing is absolutely the worst thing you can do as a trader. You will stop just before you hit an upswing, and then maybe demo trade another system, hit an upswing, switch to real money again just when the market cycles, and hit another downswing with your real money, then stop trading just before the market cycles again, and so on and so on.

Now, yes, there is also an element of luck to this, of course. If you start trading a system during a 1-year-losing phase, will you ever make it through that? No, you won’t. That’s a simple answer, but also a very true answer. There is an element of luck in trading as in every gambling endeavor. What we can do to circumvent this partially is backtest, backtest, backtest, to gain trust into our system, and proper risk management.

The absolutely worst thing that can happen to you is that you hit an extended losing phase like this just when you make the switch to being a professional full-time trader. You will probably end back up with your day job in that case. Happens. Rinse and repeat, next time you will hit an upswing.

The important lesson to take away here is that you have to objectively power through downswings and never fail to see the light at the end of the tunnel. Protect your downside and know that the upswings will come just as sure as the downswings – if you still have enough capital to play with when the upswing comes around, you will have made it as a professional trader, because then you have proven that you can stick 100% to a system in good as in bad times while not going broke, and that’s what it’s all about.

We have been trading supply and demand strategies for over ten years, and they have stood the test of time remarkably well. Supply and demand is...

3 min read

Choosing the right trading journal is essential for traders wanting to analyze performance, refine strategies, and improve consistency. In this...

3 min read

“95% of all traders fail” is the most commonly used trading related statistic around the internet. But no research paper exists that proves this...