Supply and Demand Trading in 2026

We have been trading supply and demand strategies for over ten years, and they have stood the test of time remarkably well. Supply and demand is...

This is a very controversial topic and one that, if understood correctly, can make the difference between a losing and a consistently profitable trader. So let’s get it out right away: Entries don’t matter! This is, especially if you are a new trader, hard to grasp and many people will not agree – keep on reading and it will become clearer. By the end of this article, everyone will understand why entries are not as important as they think.

Most traders are always looking for better indicators, new trading tools or change (read: mess with) their trading rules because they believe that finding “better” entries will make them better traders. Let me tell you, the way you define entries has very little to do with your success or failure as a trader.

But what is it then that you should be looking for to become a better trader?

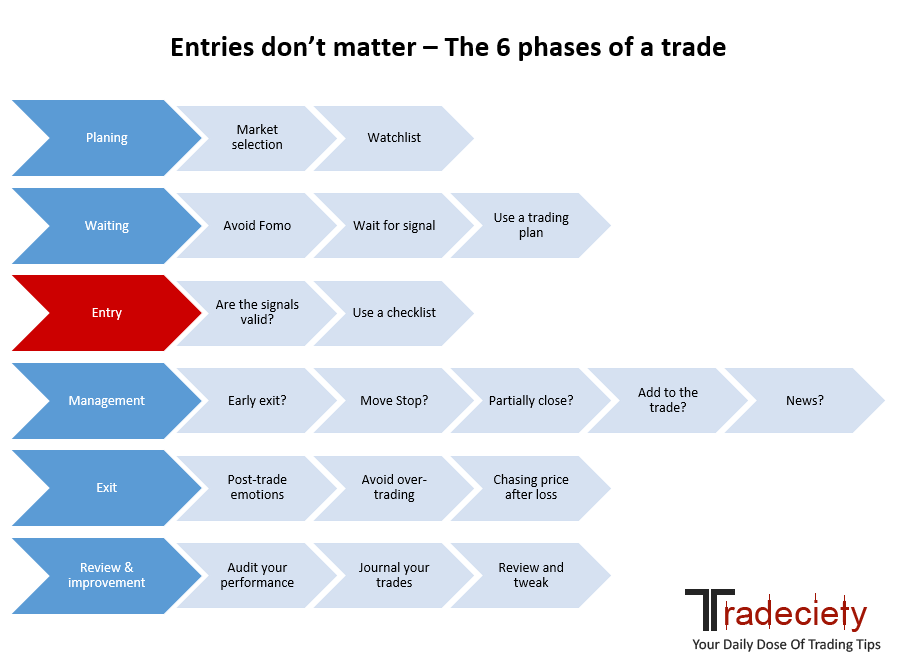

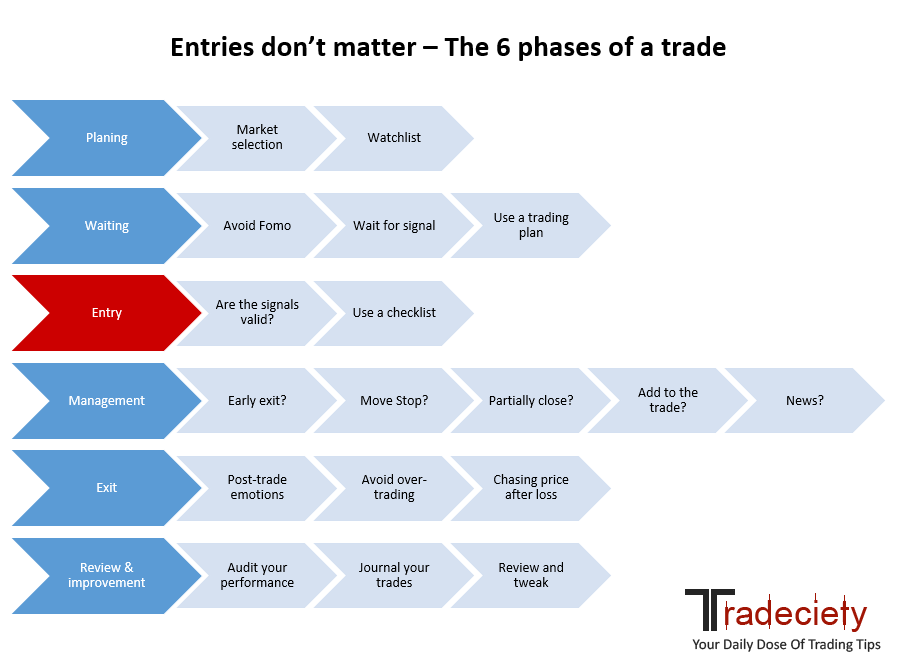

Every trade has 6 stages and it doesn’t matter what type of trader you are, all traders will go through the same 6 phases – the entry is just 1 one them. So let me walk you through the different phases and explain what they mean and the importance of them.

This is a step most traders miss and they don’t know how to select the right chats. You have to know which market suits your trading style and method. If you are a trend trader, look for markets with early explosive momentum moves; when you are a range trader, look for clearly defined boundaries and when you trade reversals, look for signs of fading momentum after a trend.

Every good trade starts by carefully screening the markets you consider trading, eliminating the ones that don’t show promising conditions and keeping the ones that could potentially generate a trade soon.

WAY more important than entries and entering trades is staying out of trades that you shouldn’t be in. Knowing when not to trade is an extension of the previous point and after you have created your watchlist, you sit back and wait until price generates a trade on your screened markets.

For most traders, avoiding more trades would greatly benefit their performance. Just take a look at your past performance and evaluate how your trading performance would look like if you hadn’t taken all the trades you knew you shouldn’t be in.

Read more: 9 situations when not to trade

If you have done your work prior up to this point, have carefully selected your watchlist and waited patiently for a signal to occur, all you have to do now is to confirm that you are seeing a valid signal:

The trade entry is nothing more than pulling the trigger when your criteria are met. Ask yourself if you should really be taking the trade. A checklist is the ultimate tool ultimate tool here that will help you make better trading decisions.

Once you are in the trade, you have to continuously make new decisions and evaluate the situation:

At the same time, you have to avoid micro-management at all costs. Micro-management means that you keep watching your trade tick by tick and continuously fiddle around with your trade.

Most traders spend all their time trying to find better entries so that once they are in a trade, they don’t know what to do and then completely mess everything up.

You can probably already see that pre-trade actions (waiting for the right market selection and conditions) and in-trade decisions (trade management) have a huge impact on your overall trading performance. Trade entries seem to lose their importance more and more.

Exiting, in the actual sense, is an extension of trade management decisions. However, there is also an emotional component to exiting trades and the post-trade decisions.

Exiting a losing trade and then seeing price turn around can easily lead to chasing price and re-entering the market with a less than ideal trade, purely driven by emotions.

Staying in a losing trade too long can eat up your emotional capital and then distort your perception on your next trade.

Exiting a winner too soon and seeing how much you have missed can create inner tension and also lead to over-trading. And so on…

Thus, it’s not only important to know what to do before or during a trade, but your thoughts and feelings after a trade can easily influence your next trading decisions.

If you don’t think that this step doesn’t belong to the 6 different trade stages, you are missing out. Whereas most losing traders will never look at a closed trade again after they have exited the position, the professional understands the importance of post-trade analysis.

The trader who carefully audits his past trades is less likely to look for a different entry method because he understands his trading method and performance better. At the same time, he can make small adjustments based on his past performance which allow him to continuously improve his method, instead of jumping from one method to the next and never seeing any kind of consistency.

The goal of a trader has to be to achieve consistency in the way he executes his trades. Falsely believing that his whole performance is based on the way he enters his trades can easily lead to wrong assumptions and then cause so-called “system-hopping” where he frequently changes method, hoping to find the “one thing” that will finally give him the right trade entries.

We have been trading supply and demand strategies for over ten years, and they have stood the test of time remarkably well. Supply and demand is...

3 min read

Choosing the right trading journal is essential for traders wanting to analyze performance, refine strategies, and improve consistency. In this...

3 min read

“95% of all traders fail” is the most commonly used trading related statistic around the internet. But no research paper exists that proves this...