Supply and Demand Trading in 2026

We have been trading supply and demand strategies for over ten years, and they have stood the test of time remarkably well. Supply and demand is...

Profitable trading is effortless, simple and does not require much stress. But most traders experience a very different reality and are constantly in a reactionary state where they emotionally try to force a winning trade. Of course, this leads to mental exhaustion and a lot of frustration because this is not how trading is supposed to be.

Traders often message me that they lack confidence and that they just don’t know how to approach the markets because no matter how hard they try, the results are not good.

The key phrase here is “trying hard”. The amateurs do not spend less time in front of their charts, compared to the professionals. Often, the amateurs even spend (read: waste) a lot of unproductive and poor-quality screen time.

Amateurs always try to will their trades into profits and they believe that the more they do, the better their chances are. They then come up with excuses to jump in early, scale in and out randomly, change indicators trying to outsmart the markets and going to lower timeframes to get a better picture – or so they believe.

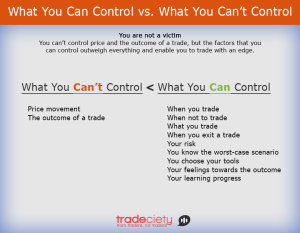

This is a truly exhausting approach because those traders try to control the one and only thing that a trader has no control over: the price!

It is completely out of your control what the price does, where it goes and how fast it moves.

This amateur approach is like a swimmer who constantly looks left and right during a race, obsessing about his opponents while losing important seconds because he is distracted. At the same time, no matter how much the swimmer keeps focusing on his opponents, they will not slow down because of that.

During the race, the swimmer must focus on what he has full control over: his technique and his pacing. Those are the only things that truly can make a different at that moment.

In the trading context, when the trade is on it means that a trader focuses on what he has control over: his entries, his order placement, how he applies his rules and how he manages himself. Anything else is just noise and higher influences.

At any given time, anything could happen in the markets and it is not only limited to regular price behavior. A central bank or a government can make an unexpected announcement or a geopolitical happening can impact markets significantly.

As a trader, it is not your job to outsmart the markets and you don’t have to predict what is going to happen next. As we will see shortly, a trader has endless possibilities and that he is in total control over his own well-being.

Let’s start with the biggest advantage of a trader. You are the one who is deciding when to enter the market and when to just sit on the sidelines. If you don’t like what you are seeing on your charts, you just do nothing. Therefore, only if you feel certain that you have an edge, you enter a trade.

Amateur traders make the mistake that they believe they have to be in the markets all the time. You only need a few good trades every month to come out ahead. Live to trade another day. The more you understand that you don’t HAVE TO trade, the better your performance will be.

And here comes the second huge advantage for you as a trader. Once you are in a trade, you are not stuck and a victim to whatever the market wants to do with you. At any point in time, you can push the button and be out.

If you see that price is going towards your stop loss order, don’t just sit there, but take action and close the trade manually to minimize losses. And when you are in profit, but you see signs that price is reversing, don’t give it all back and monetize on your gains.

You are in full control all the time. Although you can’t control the outcome of a trade, you have major influence about how much you are winning and losing and when you want the trade to be over.

Every trader is different and therefore you have to find the tools that fit naturally for you. Whereas some traders prefer to use indicators to make trading decisions, some prefer to trade pure price action and a third group uses a combination of both.

But it does not end there. You can also choose from a variety of tools. Different indicators, oscillators or momentum, tools such as moving averages or Fibonacci, candlestick analysis or support and resistance are just some of the tools that you can choose from.

And it gets even better. Whereas some traders think that the lower timeframes are too noisy and hectic, other traders prefer these fast-moving charts. You can pick your investment horizon and when you make trading decisions completely self-determined.

There is no reason for a trader to trade based on a trading method that does not fully complement his personality.

The fear of failure is a big issue for many struggling traders. Ask yourself objectively:

Is your current trading set up in a way that makes success likely?

Many traders will probably have to answer this question with a NO because they do not give trading the seriousness it requires and deserves. They approach trading like a hobby where they hope to somehow get lucky. But they do not put in the time to understand their system, plan their trades in advance, journal trades, review trades and work on themselves. Of course, success is not possible with such an approach.

Confidence comes from knowing that you gave it your all when it mattered. In swimming, confidence can exist when you know that you worked hard every day, you improved your technique, you watched your diet, you reviewed your training sessions and you have a good coach. When it then comes down to the race, the swimmer can say without regrets that no matter what happens, he gave it his everything. Of course, this can also be a very uncomfortable place to be in because maybe failure then means that he is not good enough and, thus, does not give it everything during the training to leave some room for excuses!?

But even knowing WHY you do certain things you do them can be liberating because you can finally understand yourself, your motives and your core values. Without it, people blindly stumble through life without realizing why their results never match their expectations. Improvement becomes impossible in such an environment because you are always just trying to fix the sympthons and not go to the route of your problems.

“You cannot control what happens to you, but you can control your attitude toward what happens to you.” – Brian Tracy

Revenge-trading and overexcitement are just two reasons why traders lose much more money than necessary.

Emotions and psychology play a big role when it comes to trading, success or failure, but keep in mind, they are created in your head and you are the one who is enabling and controlling them.

A loss is a loss. It’s inevitable, part of the game and no matter how good you are as a trader, you will lose countless trades. The harder you try to fight losers, the more money you will lose eventually. Instead, embrace the loss, be happy that you cannot lose any more and appreciate the fact that your mental capital is freed up again.

On the other hand, there is also no reason to get excited about a winning trade. A winning trade should be normal. Yes, it’s great to make money and that’s why we are all in this game for in the first place, but a trader should never get overexcited. Move on, follow your plan and treat trading as a business.

Although you can’t control everything, you have great advantages and you control almost all other components in trading.

A trader is not the helpless victim to whatever the market wants to do to him, but he is the one who is in full control ALL THE TIME! Once a trader acknowledges this fact, his trading will realize a shift and he can often approach trading from a more open-minded and effortless way.

We have been trading supply and demand strategies for over ten years, and they have stood the test of time remarkably well. Supply and demand is...

3 min read

Choosing the right trading journal is essential for traders wanting to analyze performance, refine strategies, and improve consistency. In this...

3 min read

“95% of all traders fail” is the most commonly used trading related statistic around the internet. But no research paper exists that proves this...