Supply and Demand Trading in 2026

We have been trading supply and demand strategies for over ten years, and they have stood the test of time remarkably well. Supply and demand is...

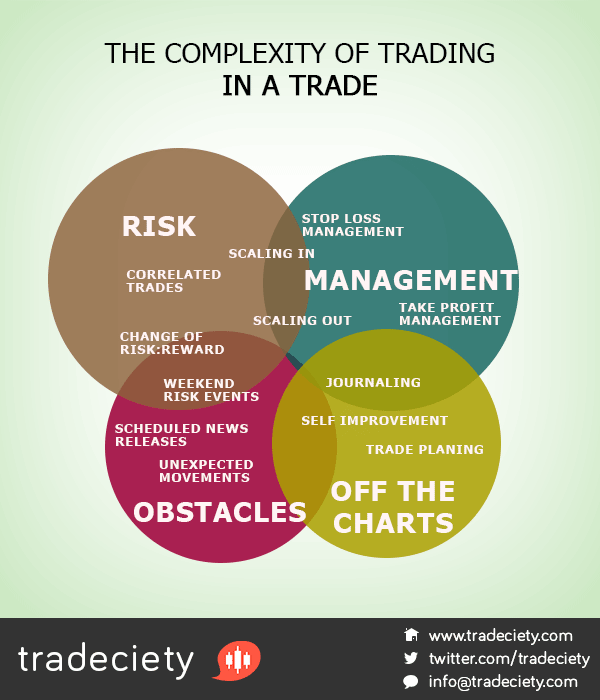

On the first glance, trading doesn’t seem to be that hard: you can either buy or sell, that’s it. At the same time, the potential profits a trader can make are limitless, especially when leverage is added to the equation. If you combine these two factors, they make the ideal couple for smart marketers and dodgy trading advertisers.

Many people become interested in trading because it seems pretty straight forward and if you only have to choose between your buy and sell button, it can’t be that hard, right?! But once you start to understand the whole concept of trading, you will notice that on any given day, you will have to answer a variety of complex answers and make decisions that will determine whether your trading strategy will win or lose money.

Before you even take your first trade, you have to answer a lot of questions that can be overwhelming to people who are new to the financial world. However, all aspects and concepts are interwoven and leaving out only one will tear a hole in your otherwise perfectly crafted trading strategy.

All the financial markets are very different from each other and every single one requires a totally different skill-set and mindset. Do you want to trade less leveraged stocks where a larger account is required, compared to the 24/5 forex market where leverage enables traders with only a couple of hundred Dollars to potentially make large profits? Do you prefer to trade the straightforward spot market or are you interested in the more complex options and futures markets? If you’ve made these first decisions, you have to select the instruments that will go in your watchlist and that you want to specialize in.

The time and the time horizon are the major influencing factors if you have to combine trading and your daily life, and it ties right in with the questions about your trading strategy as well. The question, of whether you want to be a day trader or a longer-term swing trader is connected to the timeframes you want to trade and it also determines the length of your holding time. If you are not a full-time trader yet, you will also have to find ways to combine trading with your regular life. Furthermore, you have to pick your trading tools, namely indicators and/or price action patterns. Whereas it’s a personal thing which one you prefer, the fact that there are thousands of self-proclaimed trading gurus that will try to sell you “the best and easiest” trading strategy out there, is the main reason why so many retail traders can never find their way towards profitable trading.

When you have answered the above questions, you are ready to move to the next step. When you have found your trading strategy, you should be very clear about entry criteria, the importance and priority of single entry criteria and also whether different entry criteria affect your winrate.

Then, ask yourself honestly, if you really have an edge. Did you backtest your trading strategy without cheating and lying to yourself? Did you demo-trade and treated demo trading as if you’d trade real money – if this is even possible? Are you prepared to adapt to changing markets – can you even measure if markets have changed?

And, of course, you will have to come up with a structured and thought out risk management approach. Alone the account size has a significant impact on your trading performance. Whereas your trading will be very sloppy if your account is too small, if your account is too big, your trading decisions will be controlled by fear and greed. Second, what is your position sizing strategy? Do you use an arbitrary percentage amount on each trade or do you vary position sizes based on the quality of setups? And last, what is the maximum exposure you are willing to accept on all your open trades and do you factor in correlations when opening new trades?

When you are clear about all the previous questions, you are ready to take a trade. But once you are in a trade, you have to deal with a whole different set of problems while being under the pressure of real market exposure. Therefore, it’s important that you have answered all the questions before entering trades so that you are ready to execute your trading plan without having to think too much. execute your trading plan without having to think too much.

The questions around risk involve the money and risk management concepts of scaling in and scaling out and increased risk and having to deal with similar trading decisions if you have open positions in correlated instruments. Furthermore, do you track the development of your risk:reward ratio throughout your trade? The way you deal with obstacles such as news events, unexpected political and geopolitical happenings and holding trades over the weekend will also depend on your risk management approach.

The risk concepts are also very closely tied to trade management questions. The most important questions about trade management are related to stop loss and take profit management. Do you actively move your stop loss order when the trade moves in your favor? If you answer with yes, instead of randomly moving around stops, come up with a sophisticated and tested stop loss strategy. The same holds true for your take profit orders. Most traders prematurely take profits because they mistake a minor pullback with a trend change. Therefore, write down your rules for stop loss and take profit management, test them and analyze their performance to see if you can do better.

And what happens off the charts is as important as your active trading decisions on your price charts. A solid trading plan, where you map out trading scenarios in advance and plan your trades before they happen is what separates a professional, profitable trader from a consistently losing amateur trader. The second most important tool for a trader is his trading journal. A trading journal is the place where a trader records all his past trades with the goal to find ways to tweak his edge and identify weak spots. The reason why so few traders have neither of the two is because it requires a lot of discipline and work, although it will make the difference between consistently losing and making constant profits.

Whereas trading looks very simple at the first glance, becoming a profitable trader requires a very professional mindset and attitude. A trader has to deal with a variety of highly complex issues on a daily basis, and he has to come up with sophisticated and tested ways to manage his trades before, during and after they occurred.

The goal of this article is not to scare you off, but to make you aware of the complexity of trading and offer you a guideline to use for your own day to day life as a trader and to get the most out of your trading strategy.

We have been trading supply and demand strategies for over ten years, and they have stood the test of time remarkably well. Supply and demand is...

3 min read

Choosing the right trading journal is essential for traders wanting to analyze performance, refine strategies, and improve consistency. In this...

3 min read

“95% of all traders fail” is the most commonly used trading related statistic around the internet. But no research paper exists that proves this...