3 min read

Scientist Discovered Why Most Traders Lose Money – 24 Surprising Statistics

“95% of all traders fail” is the most commonly used trading related statistic around the internet. But no research paper exists that proves this...

Far more than 95% of traders lose money consistently. Knowing this fact which also has been proven by market research, wouldn’t it be the most obvious thing to just bet against the crowd? You are right! But knowing what the general public does is not as simple and traders had to come up with a creative, yet highly effective way to find out what the crowd is doing and then just take the opposite trades.

In this article we show you why the Put/Call ratio is one of the most effective ways when it comes to ‘betting against the crowd’ and how you can use it for your own trading.

In a nutshell, Puts and Calls are options which allow the buyer to buy (Call option) or sell (Put option) a certain financial instrument (stocks or commodities for example) within a certain period. Traders would therefore buy a Call option if they believe that prices are going to rise, and buy a Put option if they believe that prices will fall.

The Put/Call ratio is, therefore, a ratio that symbolizes the crowd’s sentiment in regards to stock market direction. When the Put/Call ratio is high, it signals that there are more Put buyers than Call buyers and that option traders believe that prices will go down. When the Put/Call ratio is low it means that there are more Call buyers than Put buyers and, therefore, option traders believe that prices will go up.

High Put/Call ratio = More Puts are traded than Calls which signals that the crowd is bearish

Low Put/Call ratio = More Calls are traded than Puts which signals that the crowd is bullish

Before we get into learning how to use the Put/Call ratio for your own trading, we have to find the correct Put/Call ratio. Not all option traders are pure amateurs and lose money consistently; using the wrong Put/Call ratio can result in a disaster. Therefore, we have to find out what the amateurs are doing.

The so called Equity Put/Call ratio is the ratio we will have to analyze if we want to find out what the amateur traders are doing, whereas the Index Put/Call ratio symbolizes the professional traders who don’t only trade better but also have different investment objectives than the average speculating trader we want to target.

There are a few myths why traders lose money and they are as follows:

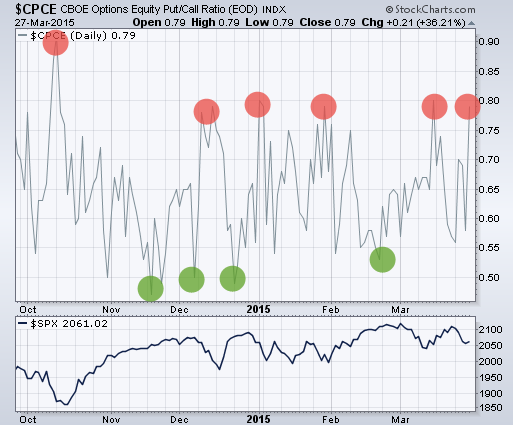

The Equity Put/Call ratio shows nicely that amateur traders actually do exactly this. The screenshot below shows exactly that option traders buy more Puts than Calls AFTER price has declined; the red arrows show a high Put/Call ratio when the price has already fallen. Conversely, the green arrows indicate a low Put/Call ratio when price has rallied and therefore, amateur traders buy when price is high.

As you can see, the myth that amateurs sell when prices are low and buy when prices are high can be confirmed when using the Equity Put/Call ratio and this is why trading against the crowd is possible with the help of this ratio.

Chart via Stockcharts.com

When using the Put/Call ratio to bet against the amateur traders, you have to look for extreme values on the Put/Call ratio. Whenever the Put/Call ratio shows extremely high or low values, it might signal that amateur traders are flocking together and positioning themselves in a wrong way.

The information the Put/Call ratio provides is even more valuable when you can see extreme spikes on the Put/Call ratio after a significant rally or decline, or near tops and bottoms. Amateur traders rarely make educated trading decisions, but trade on what they think is high/low and they are usually the last traders to enter a trend.

So by seeing extreme reading on the Put/Call ratio after rallies or declines, you should be warned that the average trader is making a mistake and is going to lose money. The Put/Call ratio can serve as a reality check for your own trading as well. If you think that price is too high or that a rally can’t go on any longer, check the Put/Call ratio to see whether the consistently losing traders are thinking the same.

Chart via Stockcharts.com

As we have seen, the Put/Call ratio can be an excellent tool to check your own opinions about price and to gather information about the trading behavior of the consistently losing traders. It’s a fact that more than 95% of traders lose money and with the Put/Call ratio it is possible to trade against the losing traders.

Stockcharts.com offers an easy to handle Equity Put/Call ratio. The Equity Put/Call ratio has the code $CPCE and if you want to compare it with the Put/Call ratio of professional traders, you can use the Index Put/Call ratio code which is $CPCI.

3 min read

“95% of all traders fail” is the most commonly used trading related statistic around the internet. But no research paper exists that proves this...

3 min read

Trendlines can be great trading tools if used correctly and in this post, I am going to share three powerful trendline strategies with you.

3 min read

Choosing the right trading journal is essential for traders wanting to analyze performance, refine strategies, and improve consistency. In this...