Supply and Demand Trading in 2026

We have been trading supply and demand strategies for over ten years, and they have stood the test of time remarkably well. Supply and demand is...

As shown in a previous article, there are many different trading styles, and finding the one that fits your personality and also makes the most sense to your thinking is important in order to become a profitable trader. After choosing the trading style, a trader can choose from a variety of tools, indicators, concepts and other methods to analyze and make sense out of the price data that he sees on his charts. In the following article we provide an overview of the different tools a trader can choose from.

Price action analysis and price action traders mainly, sometimes exclusively, focus only on the information they can obtain by analyzing price information. By price information, we are referring to the line graph data, candlesticks or bar graph information. The two most commonly followed approaches are either analyzing and interpreting individual candlesticks and bars, or looking at a sample of past candlesticks and then trying to find patterns and formations in them that potentially provide information what is likely to happen next.

The reasoning behind this approach is that patterns repeat themselves and that past price movements can provide an indication of what is likely to happen next. Thus, price action traders believe that markets are repetitive in their nature and that predictive power is present if price information is analyzed effectively. In the advanced section we provide in-depth articles and guides about the different styles and ways to use price action information.

Together, with price action, indicators are the most common methodologies when it comes to analyzing charts. Indicators, in their core, take price data and information, apply a formula to it and then transform it into visual information and plot it on your charts. Indicators are typically found below the price action area, although some indicators (such as Bollinger Bans, moving averages) will be drawn right into the price chart.

Different kinds of indicators with specific characteristics and different purposes exists and a trader has to choose from a wide variety of indicators based on the type of analysis he wants to make and also which market conditions are present. Trend-following indicators can possibly identify trends, evaluate the strength of a trend or if a trend is likely to be over. Range-indicators (oscillators), on the other hand, can be used during range-bound markets to identify possible turning points.

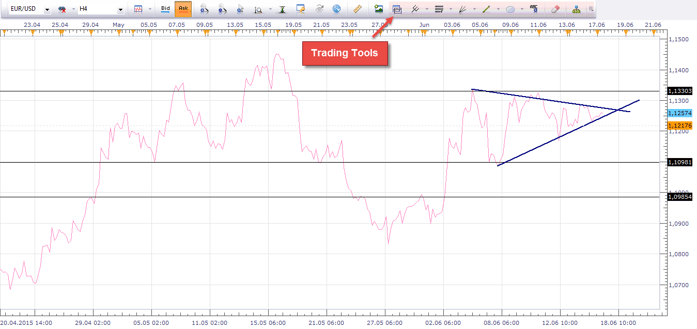

Another category of trading methodologies is the trading tools which are typically used in combination with either price action or indicator trading as an additional information source.

The most popular trading tools and concepts are support and resistance (horizontal lines in your price chart), trendlines and channels (diagonal lines in your price chart), the Fibonacci tool, the Gan fan and angles or Andrew’s pitchfork.

Trading tools follow the same premises as price action or indicator trading; the belief that past price behavior and price information can be used to forecast what is likely or possible to happen in the future is what drives traders towards these tools.

Fundamental traders follow a different approach and sometimes, do not even look at price charts to make decisions. Other times, fundamental information is used as an additional layer of information for price action or indicator traders that can help identify the broad market direction and the sentiment.

Fundamentals include important economic data such as interest rates, GDP figures, NFP and employment data, corporate earnings or other political and geopolitical data or events that can have an impact on the way price manifests and moves. Also, political and geopolitical conditions and events fall under this category.

We have been trading supply and demand strategies for over ten years, and they have stood the test of time remarkably well. Supply and demand is...

3 min read

Choosing the right trading journal is essential for traders wanting to analyze performance, refine strategies, and improve consistency. In this...

3 min read

“95% of all traders fail” is the most commonly used trading related statistic around the internet. But no research paper exists that proves this...