3 min read

Scientist Discovered Why Most Traders Lose Money – 24 Surprising Statistics

“95% of all traders fail” is the most commonly used trading related statistic around the internet. But no research paper exists that proves this...

A stop loss is not only one of the most important things a trader has to have, but executing it the right way and understanding what a stop loss actually is, is critical for trading success. Misunderstanding the logic behind a stop loss order will be disastrous for a trader. Revenge-trading and moving stop loss orders further away when price goes against you are just two of the trading mistakes triggered by a wrong belief about stops. Those mistakes are often the cause of significant losses for amateur traders and the reason why it is important to take a closer look at the logic and nature of stop loss orders.

A stop loss order should be placed at a price level where it cancels your trade idea and where your anticipated trade scenario is invalid. This is the one and only reason behind a stop loss order.

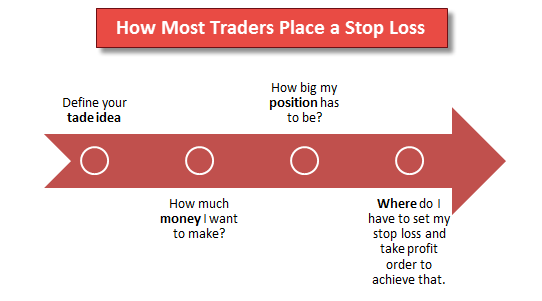

However, most traders follow a wrong and dangerous process. Amateurs first identify a trade entry, then they look for a potential profit and finally they choose a random stop loss level that allows them to trade with a decent reward:risk ratio and enables them to potentially achieve a certain profit. This could not be more wrong because it shows a complete misunderstanding of the nature of stops.

A stop loss order should be placed at a price level where it cancels your trade idea and where your anticipated trade scenario is invalid. Not at random price levels that enable a certain profit.

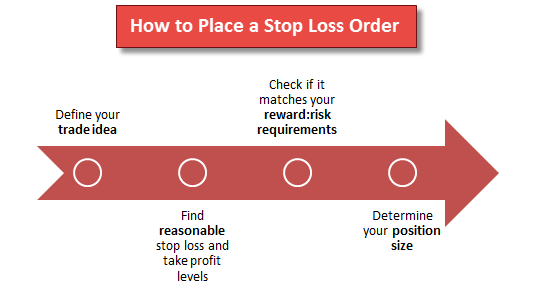

The optimal process of placing a stop loss order

The wrong approach that most traders follow when it comes to stop loss placement

A trader should have a trade idea in his mind and in his trading plan. Then he looks for a price level that would cancel his trade idea. For example, if you want to enter a long trade after a bounce off a double bottom, you have to define how much room you are allowing price to penetrate the double bottom. Below this point, you set your stop loss because it would cancel your trade idea.

The screenshot below illustrates the scenario. The green shaded area represents how much you allow price to go against your trade and where you still believe that your trade idea is correct. When price enters the red area, it has moved too far and a buy trade is not the right option anymore because it signals that a bounce off the support and previous low is not a reasonable assumption.

This point is a continuation of the previous statement. The reason why traders believe that their trade idea is still valid, even if price exceeds their stop loss level is because they overestimate the importance of their entry price. Just because traders don’t want to realize a loss, they hope that price will turn around and go back to their entry. At this point, they are trading completely based on hope and emotions and have completely forgotten about their original trade plan.

If your original trade plan was to buy a bounce off support at a previous low, then you should never forget your plan! Never! A price that goes too much against you, signals that your idea is not working out and that support is not holding. If price eventually turns, it has nothing to do with your idea or price support anymore and you should be out by then.

A common mistake is that traders move stop loss orders further away once price moves against them. However, this means that now price has to move even further so that you can make a profit. Looking at a trade that is going against you from this perspective often makes it much clearer why moving a stop loss further away is such a bad idea. Not only can you now realize a much greater loss, but your trade now has to move much further in order to make any money.

The screenshot below illustrates the concept. The trader initially bought at previous support and anticipated a bounce and a price move higher from there. The initial stop loss (1) signaled where his long trade idea would have been invalid. Remind yourself, when price reached his stop loss level, it would have signaled that he does not expect price to go to his take profit order anymore.

However, he decided to widen his stop loss order (2). Now, once price keeps going down, the distance between current price and the take profit order increases significantly and although his original trade idea was bullish, the overall chart looks very bearish and a price move all the way to the take profit order is very unlikely and not in line with his original trade idea.

[box type=”info” align=”” class=”” width=””]The idea is that when price reaches your stop loss level, you don’t expect it to go to your take profit order anymore. Staying in a trade that goes beyond your stop is not based on sound trading principles and a trading plan. [/box]

Ask yourself the following question before moving a stop loss order:

If you were not in the trade already, would you enter the trade with a stop loss at the price you are about to set it to?

Most of the time, the answer is no and you are better off by closing the trade and re-evaluating the scenario. Being in a trade often clouds our decision-making process because we are emotionally attached to the trade. Try to avoid such scenarios and always stick to your stop loss order.

3 min read

“95% of all traders fail” is the most commonly used trading related statistic around the internet. But no research paper exists that proves this...

3 min read

Trendlines can be great trading tools if used correctly and in this post, I am going to share three powerful trendline strategies with you.

3 min read

Choosing the right trading journal is essential for traders wanting to analyze performance, refine strategies, and improve consistency. In this...