Supply and Demand Trading in 2026

We have been trading supply and demand strategies for over ten years, and they have stood the test of time remarkably well. Supply and demand is...

The Ichimoku indicator is an all-in-one indicator that provides information about support/ resistance, trend direction and momentum all at the same time. The Ichimoku indicator is a potent trading tool, but many traders feel overwhelmed when looking at all the lines and information that the indicator gives them and then often misinterpret the Ichimoku signals. In this article, we will dissect the tool and show you step by step how to use the Ichimoku indicator to make trading decisions.

The Ichimoku indicator is made up of 2 different components:

1) The Conversion and Base lines: Those look like moving averages on your charts, but they are not as we will see

2) The Ichimoku Cloud: The Cloud is the most popular aspect of the indicator because it stands out the most.

Please note that I am focusing on the momentum and trend-following aspects of the Ichimoku indicator for this article. The lagging span of the Ichimoku is left out by choice since it does not add much value.

We will now take a look at each component individually and then put it all together to help you find better trade signals.

As I said earlier, that the Conversion and Base lines look like moving averages on your charts, but they do something different. The Conversion and the Base lines show the middle of the 9 and the 26 period high and low. This means that they look back 9 and 26 periods (candles), take the highest and the lowest price levels during that period and then plot the line in the middle of that range.

In the screenshot below, the green and the red line are the Ichimoku Base and Conversion lines. For comparison, I also plotted a 9 period moving average in white on the chart; the moving average is very similar to the Conversion line, but does not match it 100%.

Tenkan Sen / Conversion Line: The middle of the 9-period high and low

Kijun Sen / Base Line: The middle of the 26-period high and low

The Conversion and Base lines have two purposes: first, they act as support and resistance during trends, just like moving averages. Secondly, they provide momentum information. When price is trading above the two lines and when the Conversion line is above the Base line, it signals bullish momentum. This is also very similar to moving averages: when the shorter moving average crosses above the longer moving average, it means that momentum is up and rising.

The Ichimoku Cloud is made up of a lower and an upper boundary and space in between the two lines is then often shaded either green or red. Let’s explore what this means.

The first and faster-moving boundary of the Cloud is the average between the Conversion and the Base lines. The second, slower-moving boundary is the middle between the 52 period high and low. An important characteristic of the Cloud is that it is projected 26 periods into the future.

Again, in the screenshot below we plotted two regular moving averages next to the Cloud and used an offset of 26 (shift the moving averages into the future). You can see that the moving averages are almost identical to the Ichimoku Cloud.

Seknou A – faster-moving boundary: The middle between Conversion and Base Line

Senkou B – slower moving boundary: The middle between the 52-period high and low

Important: The Cloud is shifted 26 periods into the future

The general idea behind the Cloud is very similar to the Conversion and Base lines since the two boundaries are based on the same premises. First, the Cloud acts as support and resistance and it also provides trend direction and momentum information. But since the Cloud uses a 52 period component (as opposed to 9 and 26), it moves slower than the Conversion and Base lines.

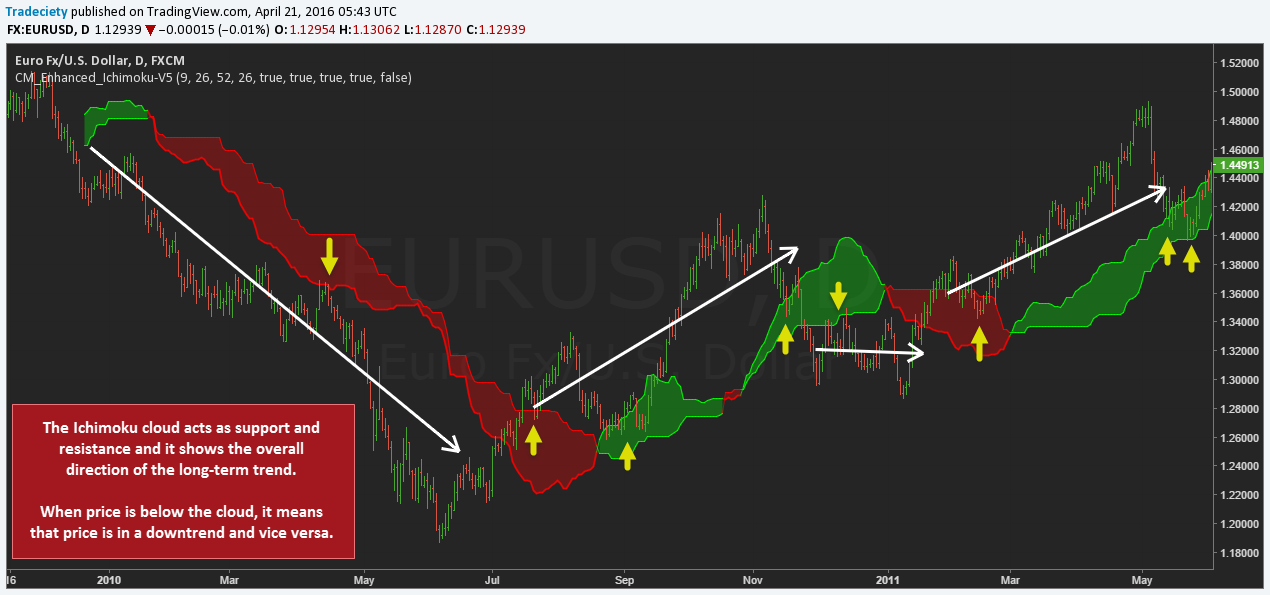

Basically, the Cloud confirms an uptrend when price is above the Cloud and a downtrend when price is below the Cloud. The space within the Cloud is a noise zone and trading here should be avoided. A rally is reinforced when the Cloud is green and a strong downtrend is confirmed by a red Cloud.

The Cloud, thus, is a way to trade with the longer-term trend and we can sum up our findings as follow:

Now that we have a solid understanding of what the individual components do and what their signals and meanings are, we can take a look at how to use the Ichimoku indicator to analyze price charts and produce trading signals.

With the help of the Ichimoku Cloud, traders can easily filter between longer-term up and downtrends. When price is below the Cloud, it reinforces the downtrend and vice versa. During strong trends, the Cloud also acts as support and resistance boundaries and you can see from the screenshot below how price kept rejecting the Cloud during the trend waves.

Thus, the Cloud is ideal when it comes to filtering between bullish and bearish market phases. However, as most momentum indicators, the Ichimoku Cloud loses its validity during range markets.

The Conversion and Base lines are the fastest moving component of the Ichimoku indicator and they provide early momentum signals. In the screenshot below we marked different points with the numbers 1 to 4 and we will now go through them to understand how to use the Conversion and Base lines:

1) The Conversion line crosses above the Base line which is a bullish signal. At that time, price was also trading above both lines which confirms the bullishness. Price dipped back into the Cloud for a moment, but found support. This could have been seen as an entry.

2) Price started to violate the Base line (yellow) which is a warning signal of a trend shift. The Conversion and Base lines also crossed into a bearish setup, further confirming the momentum shift. Finally, price entered the Cloud validating the change.

3) Price strongly crossed below the Conversion and Base lines and the Conversion line also crossed the Base line; both are bearish signals. At the same time, price was trading below the Cloud. All those signals confirm a strong downtrend and could have been used as a sell entry.

4) Price started to violate the slower Base line which is an early warning signal. Then, the Conversion and Base lines kept crossing each other, which further confirmed that momentum was shifting. Eventually, momentum died off and price consolidated sideways.

We are all about generating confluence which means combining different trading tools and concepts to create a more robust trading method. Our preferred indicator is the RSI and it works together with the Ichimoku perfectly.

When using the Ichimoku indicator to ride trends, it’s important to understand when the trend is over and when a potential reversal signals a trade exit. The screenshot below shows that by adding the RSI and looking for RSI divergences, it is possible to identify high probability reversals. If, after a RSI divergence, price crosses the Conversion/Base lines, a reversal is very likely and it can even foreshadow a longer trend reversal into the opposite direction.

Just as moving averages, the Ichimoku indicator can also be used for your stop placement and trade exits. When exiting a trend-following trade based on the Ichimoku signals, there are a few things you should know:

The conservative exit (1): A more conservative trader would exit his trades once the Conversion and Base lines cross into the opposite direction of the ongoing trend. Such a trader usually avoids a lot of the choppiness that exists before reversals happen. On the other hand, he might miss on future trend moves when price reverts back into the original direction; not all Conversion-Base line crosses lead to trend reversals.

The aggressive exit (2): A trader who wants to ride trends for a longer time exits his trade only once price breaks the Cloud into the opposite direction. The advantage is that he can sometimes hold trend trades much longer and is not as vulnerable to temporary retracements. On the other hand, he might exit some of his trades too late and could end up giving back a substantial amount of his profits because the Cloud-cross usually happens very late.

Overall, the Ichimoku framework is a very solid, all-in-one indicator that provides a lot of information at once. As we have shown, there is no secret when it comes to using and interpreting the Ichimoku indicator and the individual components are very closely correlated to trading based off of moving averages. Nevertheless, the Ichimoku indicator definitely has its place and traders who decide to follow such a trading strategy can create a robust framework. We also highly encourage to combine the Ichimoku indicator with other tools such as basic support/resistance principles, price action and chart pattern reading and, potentially, other indicators.

To sum it up, here are the most important things you have to know when it comes to trading with the Ichimoku indicator:

We have been trading supply and demand strategies for over ten years, and they have stood the test of time remarkably well. Supply and demand is...

3 min read

Choosing the right trading journal is essential for traders wanting to analyze performance, refine strategies, and improve consistency. In this...

3 min read

“95% of all traders fail” is the most commonly used trading related statistic around the internet. But no research paper exists that proves this...