Supply and Demand Trading in 2026

We have been trading supply and demand strategies for over ten years, and they have stood the test of time remarkably well. Supply and demand is...

I have been trading for over 12 years by now and I have seen it all. With my students, I share my setups every week. And in the video below, you can see a sample of my trades, how I analyze the market and what I trade:

Trading is 90% waiting and 10% doing something. The waiting part is the most important and, of course, also the most challenging one.

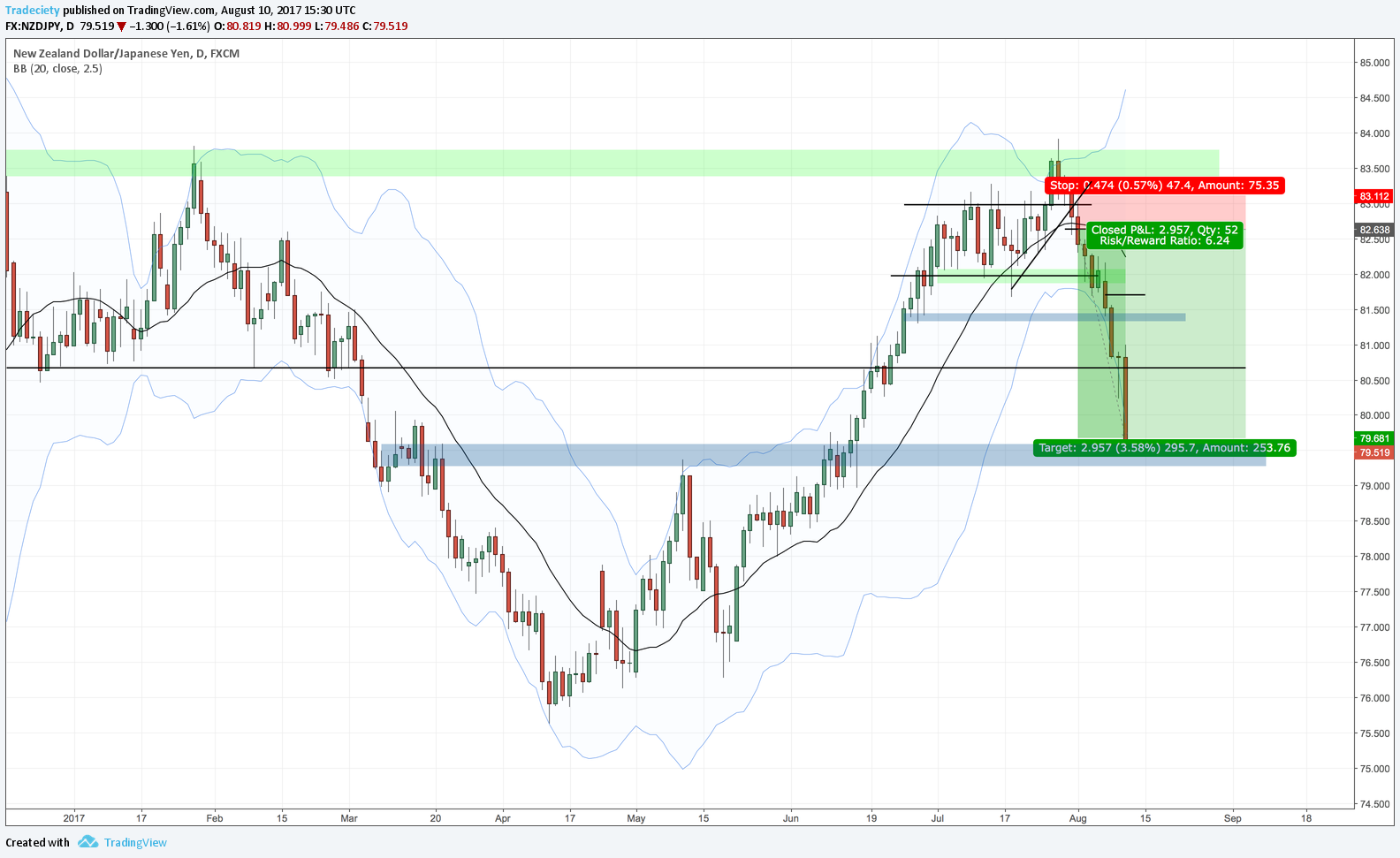

I was stalking the NZDJPY for weeks and I posted this trade 2 weeks before the actual trade signal came. By the time I posted the potential setup, the chart did look ripe for a reversal and I had a gut feeling that a sell-off was very likely.

I know many traders who jumped the gun and entered this trade way too early. It is very common for traders to accumulate losses during such early entries because they act on their gut feel and not based on signals and then once the real signal comes, they are either too scared to pull the trigger again or they have lost so much that even a winning trade won’t be enough to make a difference.

Just like every weekend, I share my best setups with our students and this one was outlined well in advance as well.

The trade has reached take profit target 3. I extended my take profit target twice on this trade and made over 200 pips on this trade in total.

I follow all Forex pairs and many Futures and commodities to have a wide variety of setups at my disposal each week. This way I can be very selective and only take the absolute best trades.

If you want to take your trading to the next level, here are a few very important tips:

We have been trading supply and demand strategies for over ten years, and they have stood the test of time remarkably well. Supply and demand is...

3 min read

Choosing the right trading journal is essential for traders wanting to analyze performance, refine strategies, and improve consistency. In this...

3 min read

“95% of all traders fail” is the most commonly used trading related statistic around the internet. But no research paper exists that proves this...