Supply and Demand Trading in 2026

We have been trading supply and demand strategies for over ten years, and they have stood the test of time remarkably well. Supply and demand is...

5 min read

Rolf

Feb 2, 2016 7:00:00 PM

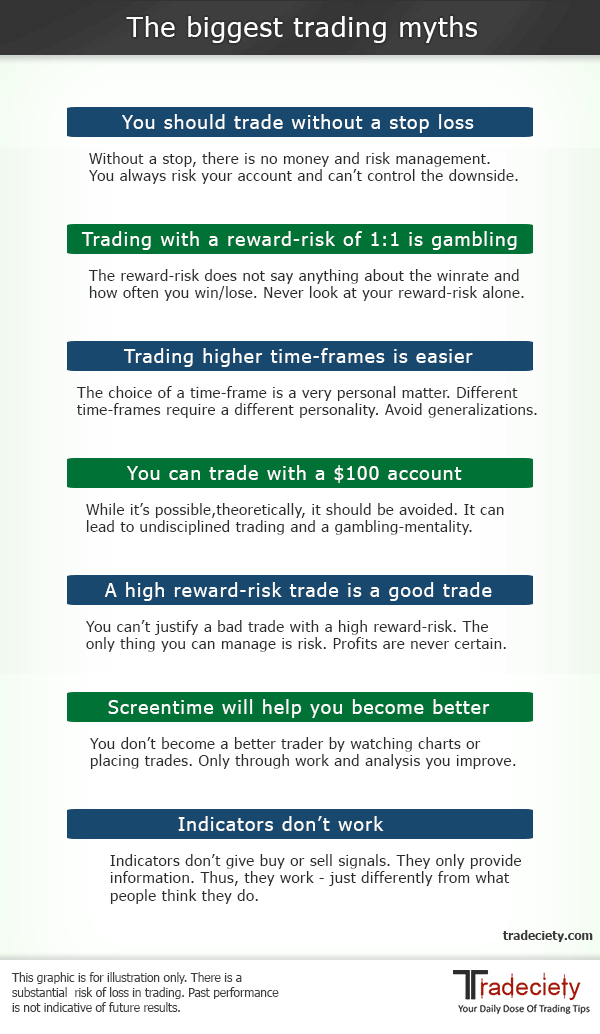

It is surprising that so many myths and misconceptions in the trading world have been around for all those years. When you listen to traders talk, you often get the impression that those myths have become “common knowledge” in trading. This article sheds light on the 10 most commonly believed trading myths, why they are false and why believing them can actually harm your trading.

As a spot trader, trading without a stop loss is wrong on many different levels. The fact that you can’t control your position size, can’t perform a solid risk management and that you are only one step away from losing your trading account on one single trade are just three reasons why trading without a stop loss has to be avoided at all costs.

The main reason why traders don’t use stops is because they believe that their broker hunts stops. If you are using a legit and regulated broker, you don’t have to worry about stop hunting whatsoever. It is much more likely that you are just placing stops where everyone else is placing their stop, which makes it very easy for the professionals to squeeze them. Never ever trade without a stop.

Every hour of every day, there is a discussion about leverage going on between traders. But what is it that makes trading with leverage such a controversial topic? The answer is in the previous point.

In its essence, leverage is neither good nor bad, it is just a tool and a mechanism. What makes trading with leverage dangerous is ignorance and a lack of knowledge.

Trading with a large amount of leverage and huge position sizes can be is financial suicide. When price starts going against you and you are using leverage, a small loss will turn into a huge loss and wipe out your account fast.

A reward-risk ratio of 1:1 means that your winning and losing trades have the same size. But it doesn’t tell you how many winners and losers you have. If, over the course of 100 trades, you have 60 winning and 40 losing trades, even with a reward-risk ratio of 1:1, you will make money.

A system with a reward-risk ratio of 1:1 can be very profitable if the other parameters of your trading play along. You can even have a reward:risk ratio less than 1:1 and still make money with a historical winrate of greater than 50%.

Further reading: The ultimate guide to reward:risk ratio

A winrate of 50% means that you will have the same amount of winning and losing trades, but it does not tell you anything about the size of your winners and losers. If your winners are slightly bigger than your losses, even a winrate of 50% will make money.

Some of the most successful traders have trading systems with a winrate of less than 50%, but their winning trades are much larger than their losers. Never judge a trading system based on the winrate alone!

Higher time-frames are not easier to trade and lower time-frames are not harder either. The choice of your time-frames is a very personal matter. Trading higher time-frames can be the hardest thing ever if you don’t have the skillset to do it. If your strengths are geared around fast execution and emotional stability, lower time-frames might be more lucrative.

A “one size fits all” recommendation does not work in trading. You have to find what works for you and audit yourself. Believing those myths and following generalizations usually always leads to bad trading. You have to find out for yourself what is working for you.

Further reading: What’s the best timeframe for your personality?

Theoretically you could start trading with $100 these days. With all the leverage out there, some brokers even use the $100 trading account argument as their marketing slogan. However, trading such small accounts should be avoided for a number of reasons:

It’s impossible to perform a reasonable position sizing and risk management approach with small accounts. A 1% position size on a $100 account is $1. How serious can you really be when only risking $1? And how likely is it then that you manipulate your stop loss order and end up with a $2 or $3 loss instead? It doesn’t sound much but you just increased your risk by 100% and 200%.

Traders who trade trading accounts that are too small often adopt bad trading behavior, become undisciplined and are more likely to engage in gambling-like trading. It is very hard to unlearn those unhealthy patterns later on.

How often have you told yourself that it is ok to take a trade that does not really meet all your criteria but it had such a big reward-risk ratio that you thought it’s worth it!? Justifying bad trades with a potentially high reward-risk ratio is a common behavior, but it’s a really bad one too.

The only thing that you can control about your trade is the risk and how much you are going to lose – this is done by setting a stop loss and correct position sizing. However, you have no control over the potential outcome. A large reward-risk ratio does not say anything about the trade itself and if the trade does not meet your criteria, all you are doing is entering a bad trade that has a higher probability of losing – regardless of the potentially large payout.

Just staring at a chart won’t help you become a better trader. Becoming better at anything is not achieved by performing the act itself, but throughout practice, preparation and analysis.

A soccer player does not become a better player during the 90 minutes he plays each weekend and a tennis player does not improve his skills during the few sets he plays against an opponent. It’s the same in trading; you don’t become a better trader through placing trades, but only through preparation, performance review and actively working on your edge and your trading.

Don’t waste your time glued to a screen. Make a constant effort to plan your trades in advance, create a detailed trading plan, set alerts during the trading sessions to you don’t have to monitor charts, and then perform a detailed post-trading performance in your trading journal.

Most traders are ignorant when it comes to using and understanding indicators. Indicators do not provide buy or sell signals. Indicators only take the price information you see on your charts, perform calculations and then visualize the results.

Once a trader understands that the purpose of an indicator isn’t to give buy or sell signals, but to turn price information into an easily digestible format, he can use indicators much more effectively. It’s your job as a trader to interpret the indicator information; it’s not the indicators job to predict price movements.

Further reading: Indicators work! But you don’t know how to use them

This is another generalization and as usual, generalizations are rarely right. The reasoning behind the 1% position size is that you are “indifferent” about the potential losses. Is that true? But why can’t you be indifferent about a 2%, 4% or 6% loss? Isn’t it more of a personal matter how well you can handle risk?

The optimal position size depends on a variety of factors and personal preferences. The winrate of your system tells you how likely losses and consecutive losses are; the average reward-risk tells you how fast you can recover from drawdowns potentially; and your personal risk tolerance tells you how good you can handle (large) drawdowns.

Again, one size fits all is usually never applicable and you have to audit yourself and your strategy.

Do you know of any other myth that has been around for ages and traders just accepted it as the truth? Please leave a comment below to discuss it with the Tradeciety-nation.

We have been trading supply and demand strategies for over ten years, and they have stood the test of time remarkably well. Supply and demand is...

3 min read

Choosing the right trading journal is essential for traders wanting to analyze performance, refine strategies, and improve consistency. In this...

3 min read

“95% of all traders fail” is the most commonly used trading related statistic around the internet. But no research paper exists that proves this...