Supply and Demand Trading in 2026

We have been trading supply and demand strategies for over ten years, and they have stood the test of time remarkably well. Supply and demand is...

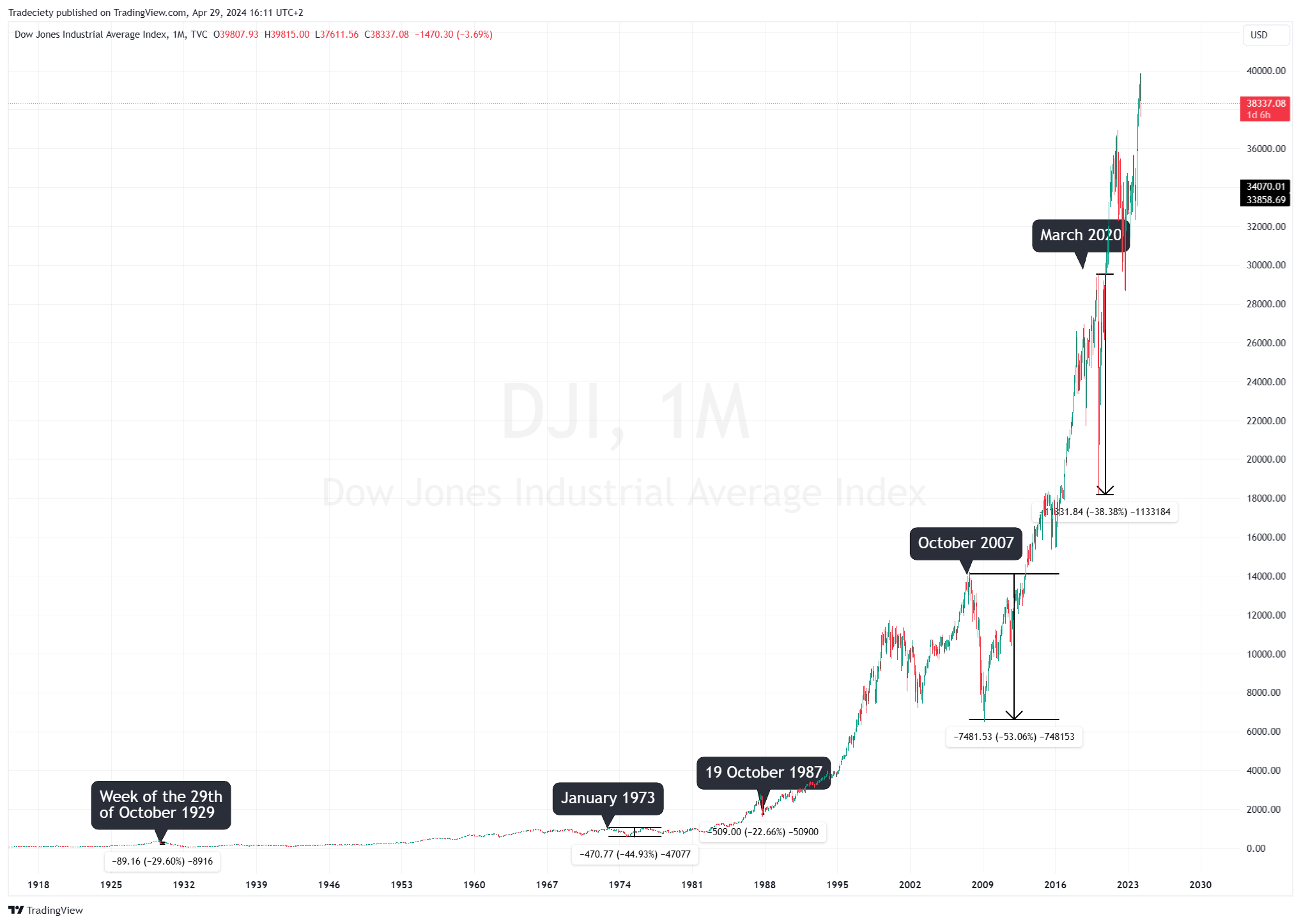

The past century has been a wild ride for investors. This article explores ten of the most dramatic plunges the stock market has witnessed, from the tech-fueled Dot-com bubble burst to the global economic shock of the COVID-19 pandemic. Each crash offers a unique story, exposing vulnerabilities in the system and highlighting the interconnectedness of financial markets worldwide.

Fueled by the excitement surrounding the internet revolution, the late 1990s saw a surge in internet companies, often nicknamed "dot-com" companies due to their .com web addresses. Investors poured money into these startups, driving stock prices to dizzying heights. The NASDAQ, an index heavily weighted towards tech stocks, skyrocketed over 400% between 1995 and 2000.

However, many of these companies lacked a clear path to profitability, relying on future potential rather than current earnings. In 2000, the bubble burst. Investor confidence waned, and stock prices plummeted. The NASDAQ lost over 80% of its value by 2002, wiping out trillions of dollars. While the internet revolution continued, the crash exposed the dangers of investing in companies based on hype rather than solid fundamentals. The aftereffects were felt for years, serving as a cautionary tale for future tech booms.

The Global Financial Crisis, sparked by the collapse of the U.S. housing market in 2008, sent shockwaves through the world's economies. At the heart of the crisis were risky loans bundled together into complex financial instruments called mortgage-backed securities. When homeowners began defaulting on their mortgages, the value of these securities plummeted, causing major financial institutions to crumble.

This domino effect led to a dramatic decline in stock markets worldwide. The Dow Jones Industrial Average, a key U.S. index, plunged over 50% from its peak in October 2007 to its trough in March 2009. Millions of people lost their jobs and homes as businesses cut back and credit froze.

The crisis exposed weaknesses in financial regulations and lending practices. It took years for the global economy to recover, highlighting the interconnectedness of financial systems and the potential consequences of unchecked risk-taking.

Black Monday, October 19th, 1987, remains etched in financial history as the biggest one-day percentage decline ever recorded on the Dow Jones Industrial Average. In a single day, the Dow Jones plunged a staggering 22.6%, wiping out nearly a quarter of its value. Panic selling gripped markets worldwide, with other major indexes experiencing significant losses as well.

The exact cause of the crash remains a subject of debate. Some theories point to program trading, a relatively new practice at the time, that may have amplified the selling pressure. Others suggest a confluence of factors like rising interest rates and a weakening dollar contributed to the downturn.

Despite the severity, the market recovered relatively quickly. The Dow regained its pre-crash level within two years. However, Black Monday served as a stark reminder of the stock market's vulnerability to sudden drops and the potential for psychological factors to play a significant role in market movements.

The rapid spread of the COVID-19 pandemic in early 2020 triggered a dramatic plunge in stock markets worldwide. Investors, gripped by fear and uncertainty about the economic impact of the virus, rushed to sell their holdings. The S&P 500, a broad index of U.S. stocks, plummeted over 30% from its February 2020 peak in a matter of weeks. This represented the fastest decline into a bear market (a 20% or more drop) in history.

The crash wasn't limited to a single sector. Stocks across industries, from travel and hospitality to manufacturing and retail, experienced significant losses. However, the downturn proved to be relatively short-lived. Due to swift government interventions and stimulus measures, the markets rebounded sharply.

The COVID-19 crash highlighted the vulnerability of stocks to unexpected events and the potential for global crises to disrupt financial markets. It also showcased the role of government policies in mitigating economic downturns.

Japan's Asset Price Bubble of the late 1980s was a period of inflated stock and real estate prices fueled by easy credit and speculation. Land prices in major cities soared by over 400%, and the Nikkei stock index, a key Japanese benchmark, tripled in value. This seemingly unstoppable growth attracted even more investment, further inflating the bubble.

The bubble burst in 1989, with the Nikkei plummeting over 80% by 1992. Property values followed suit, experiencing significant declines. The economic consequences were severe. Banks saddled with bad loans from collapsed investments became risk-averse, hindering lending and economic growth.

Japan entered a period of stagnation known as the "Lost Decade." Deflation set in, and economic growth remained sluggish for years. The bubble's collapse highlighted the dangers of unchecked speculation and the importance of a balanced approach to economic growth.

The 1973 Oil Crisis sent shockwaves through the global economy. In response to political tensions in the Middle East, Arab members of the Organization of the Petroleum Exporting Countries (OPEC) imposed an oil embargo on several Western nations. This triggered a sudden and dramatic spike in oil prices – nearly quadrupling in just a few months.

The impact on stock markets was swift and severe. The Dow Jones Industrial Average plunged over 45% during this period, reflecting the economic uncertainty and inflationary pressures caused by the energy crisis. Beyond the stock market, the crisis led to gas shortages, long lines at pumps, and a scramble for alternative energy sources.

The Oil Crisis forced countries to re-evaluate their dependence on foreign oil and spurred investment in energy conservation and alternative fuels. It also highlighted the interconnectedness of global markets and the potential for geopolitical events to disrupt the flow of essential resources.

The 1998 Russian financial crisis was a brutal blow to the country's nascent market economy. Years of economic mismanagement culminated in the ruble losing over half its value against the dollar in a single day. This devaluation triggered a domino effect – debt defaults, bank failures, and a deep recession. The GDP shrunk by over 5%, and inflation skyrocketed to 84%.

While the initial crisis subsided, the ruble's troubles weren't over. Since 2015, the currency has faced renewed devaluation pressures. Factors like falling oil prices, Western sanctions imposed after the annexation of Crimea, and capital flight (investors pulling money out of Russia) have all contributed to the ruble's decline.

The Great Depression, a period of severe economic decline that began in 1929, wasn't triggered by a single event, but rather a bursting stock market bubble. The Dow Jones Industrial Average plummeted over 80% by 1932. This wasn't just a financial meltdown; it had devastating real-world consequences.

Unemployment soared to a staggering 25%, meaning millions of Americans lost their jobs. Factories shut down, farms went bankrupt, and breadlines became a grim reality. The human cost was immense, with families struggling to put food on the table and homelessness becoming widespread.

The Great Depression wasn't confined to the U.S. The interconnectedness of global markets meant the crisis spread worldwide. While the depths of the depression eased by 1933, it cast a long shadow, taking years for economies to fully recover. This period is a stark reminder of the fragility of economic prosperity and the ripple effects of financial crises.

Black Tuesday, October 29th, 1929, marked a turning point in history. It wasn't the first day of the stock market crash, but it was the most dramatic. Panic selling gripped Wall Street, with a record 16 million shares traded. The Dow Jones Industrial Average plunged over 12% in a single day, wiping out billions of dollars in wealth.

This wasn't just a one-day event. The crash continued for months, with the Dow ultimately losing over 80% of its value. Black Tuesday became a symbol of the Great Depression, highlighting the fragility of the booming stock market of the 1920s and ushering in a decade of economic hardship.

In conclusion, history shows us that stock market crashes are inevitable. While some crashes, like the Great Depression, led to devastating economic consequences, others, like the COVID-19 downturn, proved to be temporary blips - at least for now. Understanding these historical events can help investors navigate future periods of volatility and make informed decisions in a complex and ever-changing financial landscape.

We have been trading supply and demand strategies for over ten years, and they have stood the test of time remarkably well. Supply and demand is...

3 min read

Choosing the right trading journal is essential for traders wanting to analyze performance, refine strategies, and improve consistency. In this...

3 min read

“95% of all traders fail” is the most commonly used trading related statistic around the internet. But no research paper exists that proves this...