Supply and Demand Trading in 2026

We have been trading supply and demand strategies for over ten years, and they have stood the test of time remarkably well. Supply and demand is...

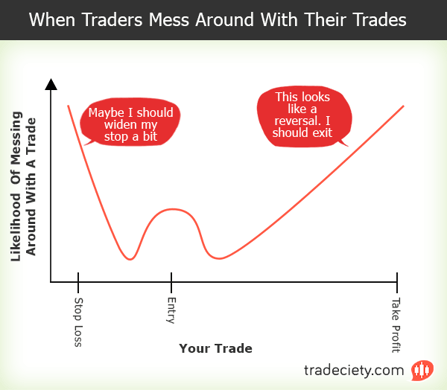

The majority of the time traders only talk about entries and techniques on how to find the best trades, but is finding the right entry really that important? Finding ways to time trade entries is not as easy as it sounds, but the difference between a consistently losing and a consistently winning trader lies not in the way how trade entries are being chosen.

Not many trading books will tell you the following and the average trader is certainly not aware of the importance that the last bit of a trade has for a trader’s overall performance:

Managing the last 10% of a trade is one of the hardest things that a trader has to deal with, and how a trader handles these situations will determine whether he will lose or make money consistently.

After price has moved far in your favor and just needs a little push to make it to your take profit level, traders are the most prone to messing around with trades (similar to when price is about to hit the stop loss order). Our fear and greed responses, who are deeply interwoven with our psyche, are the drivers of this protective behavior. If for example you are up $950 on a trade and your take profit order is set at $1000, why should you risk losing much more than those 50 bucks you can make?

Conversely, if you are an overly aggressive trader, your problem will not be closing trades too early, but risking too much, in order to see whether price will make it beyond your actual take profit order. Both, closing trades too early and being too greedy, will result in a variety of problems for a trader’s performance that we will discuss in the following.

Especially for day traders, when the holding time of a trade and the take profit distance are short, messing around with a trade just when price is about to hit the take profit order, will have significant impacts on the long term performance. The table below shows how the trading metrics change when a trader exits a trade before his actual take profit order is being hit – the calculations are based on a take profit distance of 50 pips, a stop loss distance of 25 pips and, therefore, a risk:reward ratio of 2:1.

| Take Profit in Pips | Risk:Reward | Required Winrate to Profit | |

| Actual Take Profit | 50 Pips | 2:1 | 33% |

| Early Exit | 45 Pips | 1.8 : 1 | 36% |

| Early Exit | 40 Pips | 1.6 : 1 | 38% |

The average trader will now think that those statistics don’t look that terrible and wonder why we make such a big deal out of it… Your risk:reward ratio provides you with the required winrate that you have to achieve in order to make consistent profits long term – it’s one of the most important statistics for a trader. If you consistently cut your winners short by exiting a few pips before your actual take profit order, you are changing the whole outlook of your trading strategy which is a deadly scenario for a trader. Therefore, you should not only monitor the risk:reward ratio when you enter a trade, but also when you exit the trade and compare those two statistics.

Again, many traders will say that they already protect their profits by moving stop loss orders closer to current price, but if we take a closer look, what they are doing has nothing to do with protecting profits. Unless you have a repeatable and rule-based approach for managing stop loss orders to protect your profits, you are just moving your stop behind price because you do not understand price movements and are scared to give up profits.

Again, many traders will say that they already protect their profits by moving stop loss orders closer to current price, but if we take a closer look, what they are doing has nothing to do with protecting profits. Unless you have a repeatable and rule-based approach for managing stop loss orders to protect your profits, you are just moving your stop behind price because you do not understand price movements and are scared to give up profits.

It’s rare that price just takes off and heads straight for your take profit. Usually, price moves in waves back and forth and if you move your stop loss orders too close to current price, your stop loss can easily get hit although price would have gone to your take profit afterwards. The closer price comes to your take profit order, the more pronounced this effect is because the profits you risk giving back are greatest then.

The way to protect your profits in a reasonable way is to find a systematic and repeatable approach. First, you have to come up with rules for how you will manage your stop loss orders, write them down and religiously apply them to your trades. After a while you are able to analyze the effect on your performance with your trading journal. If you make money, keep the approach and if you are losing money, find a new approach and test it. Managing your trades in a systematic way will eliminate uncertainty and emotion based trading as well.

Sometimes you have to exit a trade early or it will turn into a losing trade, but when is it the right thing to do and when are you just a victim of your fear and greed responses? Of course, that’s the million dollar question, but there are ways how to deal with this issue professionally. Moving stop loss orders around can be a very dangerous thing for your performance if you don’t know what you are doing or if you trade very volatile instruments. Therefore, many traders prefer not to touch their stop loss and take profit orders during the duration of a trade, but they are closely observing their charts to spot possible reversal signals.

Sometimes you have to exit a trade early or it will turn into a losing trade, but when is it the right thing to do and when are you just a victim of your fear and greed responses? Of course, that’s the million dollar question, but there are ways how to deal with this issue professionally. Moving stop loss orders around can be a very dangerous thing for your performance if you don’t know what you are doing or if you trade very volatile instruments. Therefore, many traders prefer not to touch their stop loss and take profit orders during the duration of a trade, but they are closely observing their charts to spot possible reversal signals.

Depending on the trading strategy you follow, there will be several ways how to differ between a minor retracement that should not scare you out of a position and a reversal where taking profits is the best thing to do. Again, unless you find a systematic, measurable and repeatable approach, you are randomly making trading decisions and are far away from managing trades like a professional. Therefore, find a way how your trading strategy can tell you whether price is retracing or reversing. These could be things like price closing below a certain moving average vs. just penetrating it, a candle formation, breaking lower highs/lows, a specific indicator setting and so forth. Write your rules down, apply them to a large enough sample size and analyze the performance. It’s as simple as that.

All previous points are highly related to the last problem, why trading the last part of your trade is so difficult. Especially inexperienced traders can not stop watching their floating account balance and worry about every tick that goes against them and celebrate every up-tick that brings the price closer to the take profit order. You will certainly have read before that watching your so-called P&L is not a good thing to do – but why is that so?

All previous points are highly related to the last problem, why trading the last part of your trade is so difficult. Especially inexperienced traders can not stop watching their floating account balance and worry about every tick that goes against them and celebrate every up-tick that brings the price closer to the take profit order. You will certainly have read before that watching your so-called P&L is not a good thing to do – but why is that so?

We have said before that inexperienced traders are victims of their fear and greed responses and by watching the changing account balance while being in a trade, they are more likely to interfere with their trades. The reason is that they usually haven’t developed a sophisticated trading approach and the knowledge how to read and judge price movements. They will therefore continuously move stop loss orders around without having any plan what they are doing, or prematurely exiting trades because they fear giving back profits. They believe that they are acting like a real trader by constantly ‘doing something’ on their price charts, but they couldn’t be further away from the truth.

The previously explained approach to find systematic and repeatable ways to cope with uncertainty and avoid emotion based trading is the only way to manage your trades professionally. If you then also stop watching your account balance while being in a trade, you can significantly increase your trading performance and feel more relaxed during a trade.

As we’ve seen in this article, mismanaging the last part of your trade can have significant impacts on your overall trading performance and it’s therefore important to find a professional way how to deal with these situations. Although there is no one-for-all type solution for this problem, being aware of the previously describes points will serve as a guideline what you should pay attention to in order to avoid common mistakes. The following points sum up the article:

We have been trading supply and demand strategies for over ten years, and they have stood the test of time remarkably well. Supply and demand is...

3 min read

Choosing the right trading journal is essential for traders wanting to analyze performance, refine strategies, and improve consistency. In this...

3 min read

“95% of all traders fail” is the most commonly used trading related statistic around the internet. But no research paper exists that proves this...