Supply and Demand Trading in 2026

We have been trading supply and demand strategies for over ten years, and they have stood the test of time remarkably well. Supply and demand is...

3 min read

Rolf

Aug 13, 2015 8:00:00 PM

Setting stops is a very underrated and misunderstood concept are in trading. Your stop loss placement impacts your trading performance on so many levels. It decides over the reward:risk ratio of your trades and, thus, determines the expectancy of your trading system. It also determines how adaptable your trading strategy is overall. In trading, there are 3 different stop loss types that we will discuss in the following article.

Confluence stops are the most commonly used stop loss type. For confluence stops, traders use moving averages, support and resistance levels, previous highs and lows, Fibonacci retracements, trendlines and channels.

Cons: Traders usually use very obvious price levels with the confluence stops which make them vulnerable to stop runs. Especially technical traders who just place their stops on the other site of support and resistance levels, price action patterns and highs and lows often notice that their stops just get barely hit before price reverses back into the original direction.

Tip: If you notice that price repeatedly takes out your stops by just a few points, either add more confluence levels or add a little padding to your stop loss and set it outside the obvious ‘danger zone’.

Volatility stops are often used by professional traders, whereas the average retail trader is often not even aware of this technique; throughout the market wizards book series you can see that many traders follow a volatility based stop loss approach.

So, what is a volatility stop? It is a stop loss methodology which adapts to changing market conditions. When volatility is high, traders use a larger stop loss to account for greater market swings. When volatility is low, traders use a more conservative stop loss.

Stops and profits are interconnected. Thus, when setting a stop loss further away, in times of high volatility, a trader should also widen his targets to counter the effect of a reduced reward:risk ratio and to capture larger price swings. On the other hand, when volatility is low and stops are set closer to the entry, the profit should also be set closer because price won’t travel as far and might turn ahead of your profit otherwise.

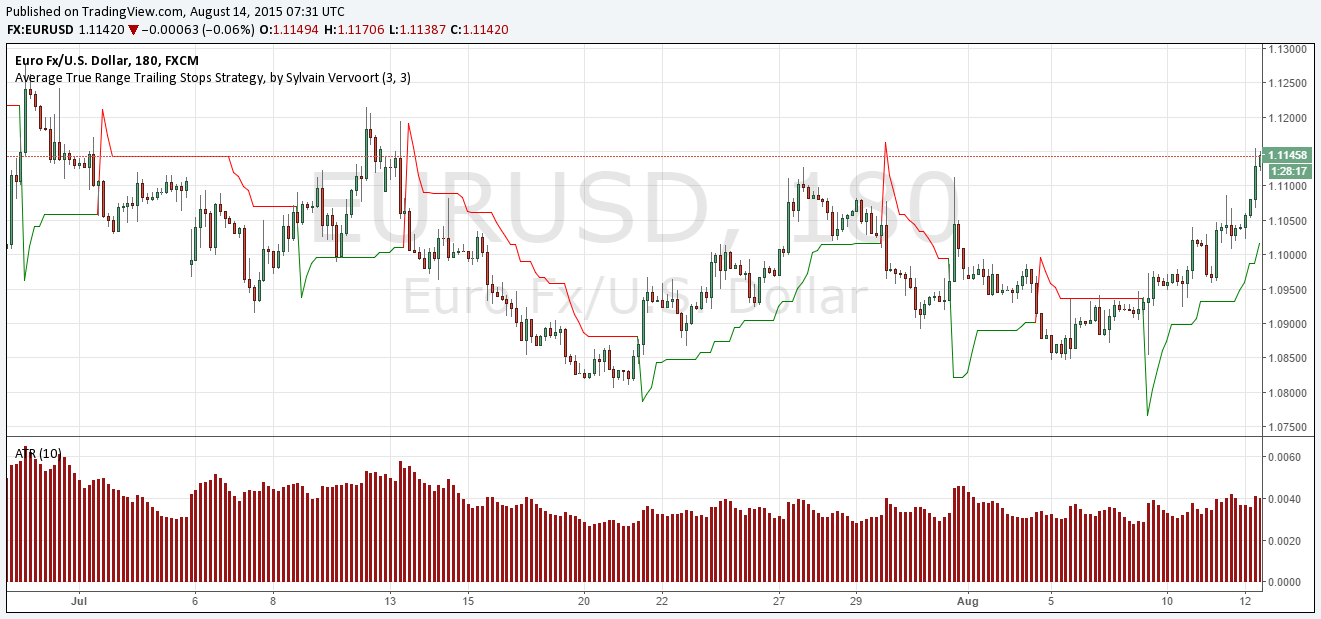

The screenshot below shows the EUR/USD chart with the ATR indicator (Average True Range) which analyses the size of past price swings and candle-size. Hence, a high ATR signals that past volatility is relatively high and price tends to move further within the time-horizon of a candle. Of course, there are more ways to go about measuring volatility and one can choose to use the VIX (see second image below), analyze the size and shape of Bollinger Bands®, or apply other volatility based tools to his charts.

The time-based stop loss approach can also be used in addition to the confluence and/or volatility stop. It is more a dynamic variable of stop loss placement, rather than a stand-alone technique which helps traders put price and their trade in relation to the markets.

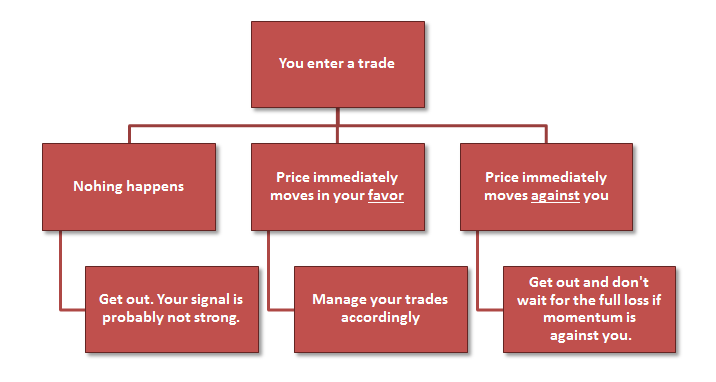

How often did you enter a buy trade, but nothing happened for hours afterwards and price just hovered around your entry price? If you bought a stock and anticipated higher and rising prices, but nothing happened and your trade just goes nowhere, it is very likely that your trade idea is not working out. In such cases, traders would do better to exit their trade and wait for the next trade signal, rather than wait and hope that price starts doing something. A time-based stop loss approach would suggest exiting trades with long phases of inactivity and sideways movement.

Another example where a time-based stop can be useful is when you enter a trade and it goes against you right away. If you bought a stock because a price action pattern or other technical triggers suggested higher prices, but the trade doesn’t unfold as anticipated, it’s usually a better idea to just exit the trade. The old saying goes that cutting losses is important, but it’s more important to know WHEN to cut your losses; a time-based stop is the tool can help you here.

A time-based stop loss helps you avoid being exposed to uncertain and other-than-expected trade scenarios. Never forget what your original analysis and your trade idea was once you are in a trade.

The good news is that all previously discussed stop loss types can be combined in an efficient way to take your stop placement to the next level. Whereas the confluence stop is your basis of how you determine where to set a stop in the first place (don’t forget to add the extra padding!), volatility and time-based stops are add-ons which add a layer of robustness and professionalism to your stop loss game.

We have been trading supply and demand strategies for over ten years, and they have stood the test of time remarkably well. Supply and demand is...

3 min read

Choosing the right trading journal is essential for traders wanting to analyze performance, refine strategies, and improve consistency. In this...

3 min read

“95% of all traders fail” is the most commonly used trading related statistic around the internet. But no research paper exists that proves this...