Supply and Demand Trading in 2026

We have been trading supply and demand strategies for over ten years, and they have stood the test of time remarkably well. Supply and demand is...

4 min read

Rolf

Aug 28, 2015 8:00:00 PM

Analogies are a great way to illustrate complex concepts. They help explain ideas which are often not intuitive at first glance. The following 9 sports analogies highlight some of the most important trading concepts. Violating only one of these principles often leads to inconsistent trading results. By understanding a few simple ideas and applying them to your own trading you can greatly increase the effectiveness of your trading routine.

“In professional tennis, about 80% of the points are won; in amateur tennis, about 80% of the points are lost.”

The statistic above says that the amateur players lose their matches not because their opponent is too strong, but because they make too many mistakes themselves. The same is true for trading. It is not the market who is to blame for your trading. Your own decisions and actions cause trading losses. When you violate your risk principles, take trades that are too big, add to losing positions, break your entry rules, engage in revenge-trading, try to make up for past losses and impatiently take bad trades that don’t match your criteria, those are the things that are responsible for trading failure and it’s only you who is to blame.

Instead of going for the home run and risking striking out, be ok with hitting singles and doubles. You won’t see the professionals wildly swinging their bats risking it all just to maybe, somehow hit a home run. Instead, they focus on following their regular routine and do what they have done thousands of times before. They know that by continuously making point after point, they stand a much greater chance of winning.

The best traders also know that they have to follow their routine and always stick to their rules to steadily grow their trading account. Arbitrarily opening trades that are against your rules, hoping to somehow land the big winning trade that will offset all your losses is not a valid strategy.

[sociallocker id=”16666″]  The team who will eventually come out ahead is the one who has both, a good offense and a good defense. It’s of no value if your offense is exceptionally good when your defense can’t keep opponents from scoring. On the other hand, the best defense means nothing when your offense can’t score.

The team who will eventually come out ahead is the one who has both, a good offense and a good defense. It’s of no value if your offense is exceptionally good when your defense can’t keep opponents from scoring. On the other hand, the best defense means nothing when your offense can’t score.

You have heard it before: trading is all about great defense. But it’s not entirely true. Only if you are good at offense AND defense, you have a chance. Knowing when not to trade or risk less is essential for a good trader and it keeps him from losing money in rough times. On the other hand, a trader also has to know when to be more aggressive with his position sizing and when to let his winners run.[/sociallocker]

Boxing is a great example when it comes to being prepared and having a game plan. A boxer only has to face one opponent at a time. Boxers study their opponents in-depth before they get into the ring. And when it’s time to fight, they will have a specific and unique game plan at hand which is tailored around their opponents’ strengths, weaknesses and unique features. This plan changes from fight to fight because every match and every opponent is different and required a different tactic.

Traders need a trading plan where they analyze current market conditions, price action and other parameters. Then, they have to come up with specific trade ideas and potential trade setups. Traders have to be prepared for every possible outcome and know exactly what they are going to do under which circumstances. If something catches you off-guard and you haven’t done your homework, you shouldn’t compete and step back to analyze the situation.

It’s very obvious that you shouldn’t move to where the puck has been, but instead move to where it’s going to be. You don’t have to be an ice hockey pro to understand this simple principle, but the implications for trading are important.

Traders focus too much on the left side of their charts. They put too much emphasize on the past. During uptrends, traders keep on calling tops and open short trades into higher moving prices, instead of seeing what is really going on and joining the obvious trend. Think ahead and put everything into context, or otherwise you will be taken out of the game.

Amateur chess players lose their focus too fast and engage in revenge-hitting after their opponent has eliminated an important figure of theirs. By making impulsive moves without thinking about the consequences they expose their other figures to great danger and open the path for their opponent to do even more harm.

Amateur chess players lose their focus too fast and engage in revenge-hitting after their opponent has eliminated an important figure of theirs. By making impulsive moves without thinking about the consequences they expose their other figures to great danger and open the path for their opponent to do even more harm.

The good trader, like a good chess player, has to think one move ahead and not lose his focus. After a losing trade, don’t just open a new trade because you want to prove that you were right. It is better to step back, reassess the situation and then come up with an improved game-plan.

A season in games like soccer, football, basketball, baseball and hockey easily consists of 30 or more games. Although it is frustrating to lose, it is often not as important to win every single game to reach the overall goal to be number 1 at the end of the season. After a loss, the best teams analyze what went wrong, where they made mistakes and how to correct their behavior for their next match.

In trading, an effective review process will make sure that you don’t repeat the same mistakes twice. After a loss, analyze what caused the loss, check if you made any mistakes and what you could have done better. Then, write down your lessons to remember them for the next time. Traders without a review process in place, or who do not keep a trading journal avoid a learning effect and are doomed to repeat the same mistakes over and over again.

If you are a forward, you know that it’s your job to catch rebounds. A point guard is the team’s best passer and handler and a shooting guard’s job is to get the ball in the hoop. Their position and task is tailored around their own unique talents and skills to ensure that they can make the most of their skills.

Traders, also, have to find their personal strengths and identify what they are best at. It all starts with choosing the right market. Are you a stock, futures, forex or options trader? Are you better with price action, do you need indicators or a mix of both? Are you better at trading higher or lower time frames? Do you prefer high or low volatility trading environment?

Answering these questions is not easy and it is a process. Thus, blindly following other peoples’ trading strategies is often not the best thing to do. You have to find your own way as a trader.

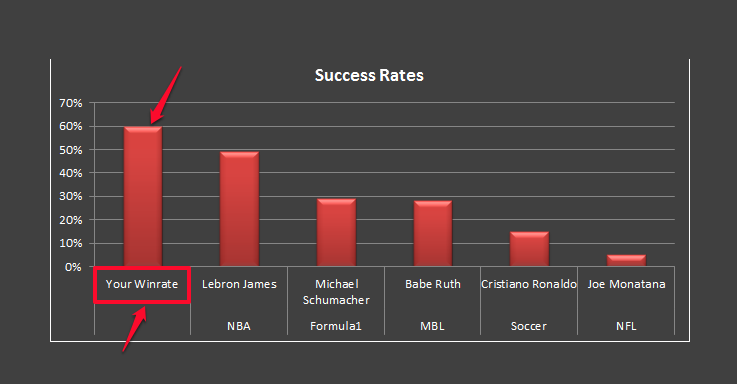

Traders spend the majority of their time looking for trading methods that promise a higher winrate whereas they are often much closer to success than they know. In sports, like in trading, it is not the person with the highest winrate who is going to be #1 in their field, but the person who consistently brings his best game every single time.

Especially in trading, having a high winrate is not important at all. It all comes down to the right balance between winners and losers. Trying to find that one special trading method with a perfect winrate will keep you from making real progress as a trader.

We have been trading supply and demand strategies for over ten years, and they have stood the test of time remarkably well. Supply and demand is...

3 min read

Choosing the right trading journal is essential for traders wanting to analyze performance, refine strategies, and improve consistency. In this...

3 min read

“95% of all traders fail” is the most commonly used trading related statistic around the internet. But no research paper exists that proves this...