Supply and Demand Trading in 2026

We have been trading supply and demand strategies for over ten years, and they have stood the test of time remarkably well. Supply and demand is...

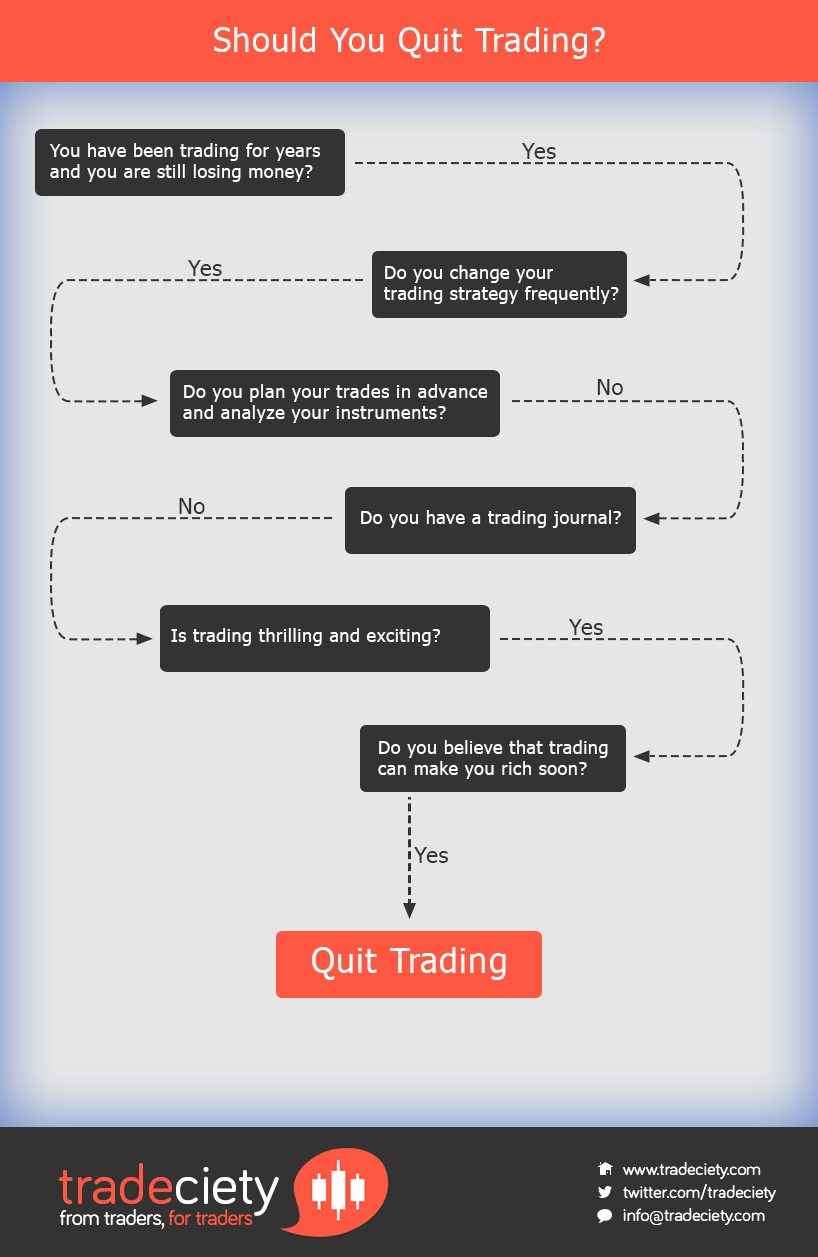

The average trader believes that he just has to get enough screen-time, find the one indicator that gives him the best entries and hope that markets are finally going back to ‘normal’ so that he can be a profitable trader. Trading is hard and it takes many years until you can be a profitable trader, but 99% of all traders will never get there even after years of trading. If you have been involved in trading for a few years you will probably know some people who still look like bloody amateurs after many years of trading and are as far from becoming a profitable trader as they were when they first started out. The way the average trader approaches trading has nothing to do with how you transform yourself into a professional trader. In the following we explore the top reasons why traders do not make progress and why their beliefs will always hinder them from becoming profitable. While you go over the list, be honest to yourself.

Although it might take several years to become a profitable trader, most people are still as far away from becoming profitable as they were when they first started out. If you have not made any progress and your equity curve is still steadily pointing downwards, you are failing.

The second most important thing trades get wrong is that they believe that their trading strategy is not working when they are losing money. Every time you change your trading strategy, you start from zero. The professional trader understands that a profitable trading strategy is nothing that you have to find by accident and that is working right from the start, but something that you have to develop and constantly improve on.

If you still do not have a trading journal, you are doomed to fail. If you now say that you do not need a trading journal, you are even more in trouble. If you do not journal, there is no way that you can improve and become a profitable trader.

If you arrive at your trading desk and do not know what to look for, you are setting yourself up for failure. When you find yourself flipping through timeframes, hunting for an entry signal, becoming a profitable trader is out of reach. Your weekends and the time before and after trading sessions should be filled with market analysis and trade planning.

Trading should be somewhat boring when done correctly. As a trader you have to follow the exact same routine day after day, all your trades should look identical and a big part of your day should consist of paper work and crunching numbers. If you find yourself being entertained and excited when trading, you have the mentality of a gambler and not understood the nature of trading.

Trading is no way to get rich quick. It is even arguable if you will ever be able to make more money than with your current job. Traders who believe that trading can make them rich are more likely to quit trading when they find out that trading does not work that way. If you can accept that it will take 5 or 10 more years until you MAYBE can live from your trading, you stand a chance.

The most important thing is that you are honest to yourself and regularly perform an honest self-check. Most traders are completely delusional about their current standpoint, where they see themselves and how to think to get there. Do not waste your time chasing the wrong dreams. But if you are serious about trading, do what is necessary rather than believing that trading is an easy way to get out of your current position.

We have been trading supply and demand strategies for over ten years, and they have stood the test of time remarkably well. Supply and demand is...

3 min read

Choosing the right trading journal is essential for traders wanting to analyze performance, refine strategies, and improve consistency. In this...

3 min read

“95% of all traders fail” is the most commonly used trading related statistic around the internet. But no research paper exists that proves this...