Supply and Demand Trading in 2026

We have been trading supply and demand strategies for over ten years, and they have stood the test of time remarkably well. Supply and demand is...

Trading is all about finding patterns and being in tune with the rhythm of the markets. Although all traders will probably agree with the previous statement, most don’t really know about the rhythms that repeat themselves every day in front of their eyes. Every instrument, market, stocks or Forex pair has its own unique personality and follows different principles, and getting to know the markets you trade is essential when it comes to making the best trade decisions. Volatility cycles and time of day are just 2 examples of how rhythms and patterns work in trading and they show why it’s so important to really pay attention.

Always keep in mind that the prices of financial markets move because humans interact with each other. Prices are driven by emotions, expectations and opinions. Furthermore, humans follow certain patterns and rhythms. Understanding this and knowing that the people who move the markets see this as their jobs where they show up each morning and leave at night is critical. The life and work cycle of traders often determines how markets move each day and we will show you how strong the impacts of this are.

A Forex pair is made up of two individual currencies and each currency belongs to a different country – or zone, in the case of the Euro. Each currency is typically most actively traded during the market hours of the specific national market. For example, the Euro is most actively traded during the Frankfurt and London open; the Japanese Yen is most active during the Tokyo session and the US-Dollar is active during the New York session. Although this is probably not new to most traders, the degree to how strong the individual sessions influence the movements of currency pairs is significant.

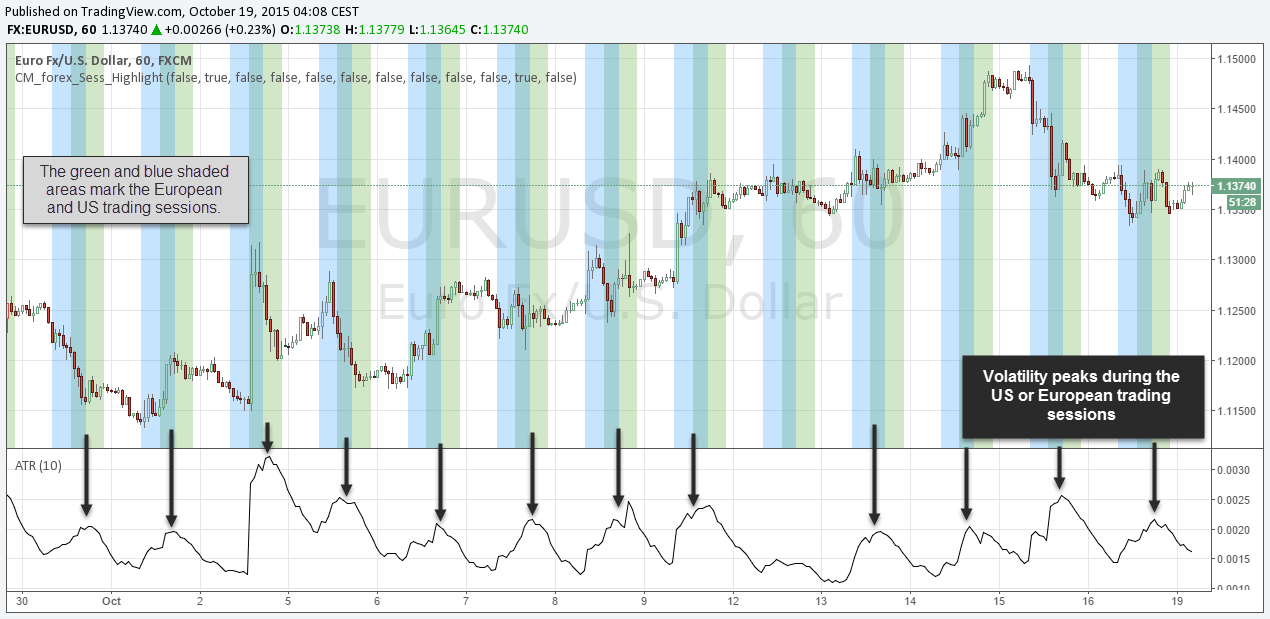

The screenshots below show this behavior; the color shaded areas in the price window highlight the individual trading sessions of the currencies traded and the ATR indicator at the bottom describes the volatility and the size of the candlesticks.

The EUR/USD shows the effect of time of day volatility nicely. As soon as Frankfurt and London open, volatility picks up and the ATR starts to rise and it usually peaks during the early New York session when Europe and the US trade simultaneously.

The EUR/JPY shows a similar pattern, but it usually peaks at the end of the Tokyo session when Asian traders trade by themselves.

For the USD/CAD Forex pair, the US session alone is the most important one. Although you see volatility rising before New York opens, the height of daily activity is reached during the US session.

This daily rhythm cannot only be found in the Forex market, but also stocks and indices show repetitive behavior. Often, the phenomenon of time-of-day volatility is even more pronounced within the stock market because the majority of traders are made up of nationals and the trading hours are limited.

The screenshot below shows the DAX and the horizontal lines mark the beginning of each trading day. The ATR at the bottom shows that volatility and daily activity peaks twice per day usually. The first peak occurs after the market opens and the second one after the noon break. When the market opens in the morning, traders try to position themselves for the coming day and also market open specific trading strategies are common to exploit the early volatility. Before the market closes, volatility and momentum slow down as traders get ready to leave home.

The screenshots above show how significant repetitive activity cycles are; day after day, the markets repeat themselves and the same things happen over and over again. But how can you make use of that information and how can it help you become a better trader? Here are the two main take-away messages:

#1 Know the characteristics of the markets you trade

One size fits all does not apply to trading. Every market and instrument has its own unique personality and characteristics. Traders often make the mistake that they take one trading system and apply it across different markets. A trading system has to be tailored to a specific market and the way you place stops, take profits and how you manage your trades should adapt to changing market conditions.

If you are seeing mixed results in your trading, take a look at the markets you trade. If your markets fall into different time-zones but you still treat them equally, you might have found a way to improve your trading.

#2 Schedule your day and pick the perfect markets

If you are a trader who lives in Europe and if you work in a 9 to 5 job, your trading time is probably limited to the evenings. By that time, London and Frankfurt will already be closed and also Asia and Australia are not active; your best choice is to look for US-related markets to find active and moving instruments.

On the other hand, if you live in the US and work 9 to 5, you are probably better off trading Asian and Australian related markets. And as an Australian, you can trade the European sessions.

It is surprising that most traders just arbitrarily pick the markets they trade and never think about the underlying dynamics. Choosing your markets correctly is very important and by understanding how time of day works in trading you can make much better decisions.

For the Forex time-zone indicator we used tradingview.com. Just open up a Forex pair, click on indicator and type in “session”. The screenshot below shows you which indicator we used. In the settings you can then disable specific trading sessions, if you don’t want to see them on your charts.

We have been trading supply and demand strategies for over ten years, and they have stood the test of time remarkably well. Supply and demand is...

3 min read

Choosing the right trading journal is essential for traders wanting to analyze performance, refine strategies, and improve consistency. In this...

3 min read

“95% of all traders fail” is the most commonly used trading related statistic around the internet. But no research paper exists that proves this...