Supply and Demand Trading in 2026

We have been trading supply and demand strategies for over ten years, and they have stood the test of time remarkably well. Supply and demand is...

1 min read

Rolf

Mar 30, 2017 8:00:00 PM

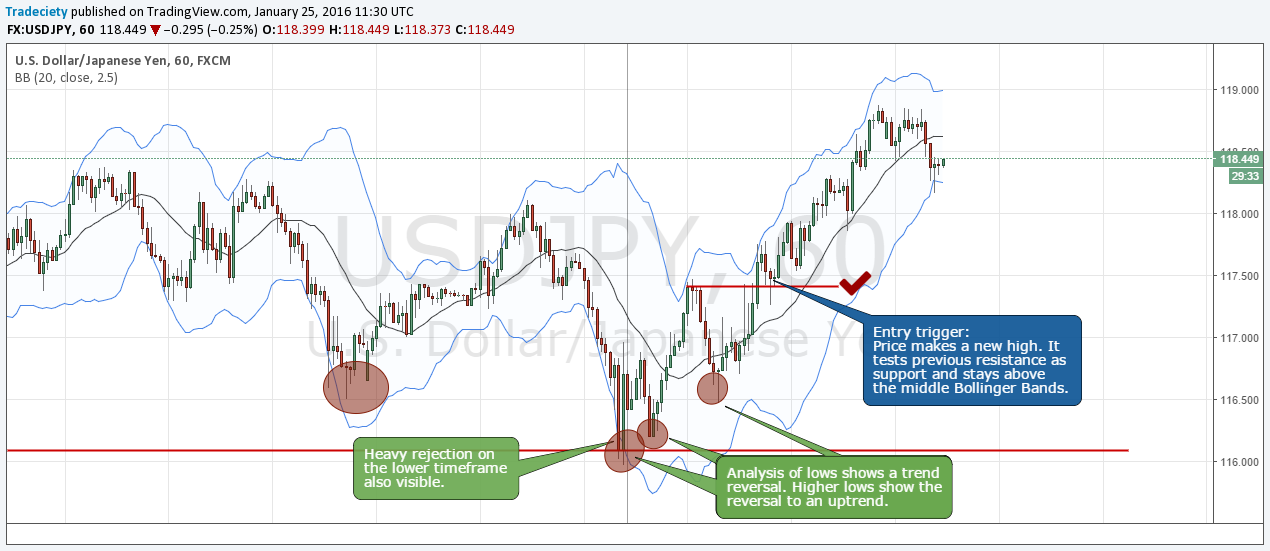

Successful trading is 90% waiting and 10% execution – which is the exact reason why trading is so challenging and typically leads to account blow-ups. I call myself a reversal trader but what this really means is that I catch trends very early on when they are just forming and then ride those trends with the momentum well before the regular trend following trader comes in.

Most traders who claim to be reversal traders are just trying to call tops and bottoms and predict market turns well in advance. Successful reversal traders enter WAY after the top or bottom has formed. To trade reversals profitably, you have to be ok with watching your setup unfold while you are standing on the sidelines and waiting for the perfect moment to jump on it.

This is the basis for all reversal trades. Zoom out to your higher time frames – usually the 4H or Daily time frame. Now draw lines at those level that really stand out and that have been the origin of previous price movements.

Both, support/resistance and supply/demand level concepts can be used to identify high impact price levels. The most important thing to keep in mind that trading those levels blindly – just with pending orders waiting at the level – has nothing to do with reversal trading and is purely predicting market moves and standing in front of an approaching train.

Often, reversals will happen in mid-air and not at your chosen levels – those are low probability trades and you shouldn’t start trying to get into such reversals.

Emotionally, reversal trading is among the hardest trading methods. So why do I still prefer this trading method? The reason is that, although it is difficult, not every trader is born to be a trend-following trader and some traders are naturally drawn to reversal trading. At the same time, every new trend starts out as a reversal and understanding reversals helps you understand the markets in very deep way.

Here are the 4 top reasons why reversal trading is so difficult for most people:

1 – Don’t use pending orders when price is approaching your level. Don’t stand in front of an approaching train

2 – Accept to miss the first part of the reversal. No calling tops and bottoms for you anymore.

3 – Even when you see signals on the higher time frame, you have to wait for a confirmed structure break on the lower time frame – waiting is a big part of reversal trading

4 – Not all reversals lead to entries. Don’t chase a move that did not give an entry

We have been trading supply and demand strategies for over ten years, and they have stood the test of time remarkably well. Supply and demand is...

3 min read

Choosing the right trading journal is essential for traders wanting to analyze performance, refine strategies, and improve consistency. In this...

3 min read

“95% of all traders fail” is the most commonly used trading related statistic around the internet. But no research paper exists that proves this...