3 min read

Scientist Discovered Why Most Traders Lose Money – 24 Surprising Statistics

“95% of all traders fail” is the most commonly used trading related statistic around the internet. But no research paper exists that proves this...

2 min read

Rolf

Nov 7, 2015 7:00:00 PM

When people hear that you trade reversals they immediately believe that you try to predict a change in direction or follow the “catching a falling knife” trading approach.

It really important to understand that reversal trading is not a trading style that predicts whether markets are going to turn and try to trade the absolute high and low, but that reversal trading can (and should) be something very different.

The best reversal traders don’t predict, but they wait for CLEAR signs that the market HAS ALREADY turned. Reversal trading then moves away from “price predicting” to “price following” – or how I like to call it “reversal following”.

Trading and building an edge is all about stacking the odds in your favor. However, it’s important to focus on what’s really important and to avoid what is called “paralysis by analysis” which exists when you add so many tools, indicators, rules and price filters to your method that making a trading decision becomes too complex.

When it comes to your trading methodology ask yourself what you want to achieve and what the premise of your system is and then pick the tools accordignly. If you are a trend follower, you want to look for high momentum movements, preferably a break of support and resistance, with a lot of room and the support of the higher time-frame direction and/or fundamentals. If you are a reversal trader you look for fading momentum, support and resistance areas that can’t be broken and price confirmation of shifting powers between bulls and bears. The following three pillars describe what to look for in a reversal trade:

[bctt tweet=”When it comes to your trading methodology ask yourself what the premise is and then pick the tools accordignly…” via=”no”]

1) Price action indicating a reversal

The most important reversal price patterns are the 3 Inside Up, the Pinbar, the 3 Black Crows and the Engulfing pattern. It’s not so much about the patterns themselves (read here why), but what the path of price tells you about the underlying dynamics.

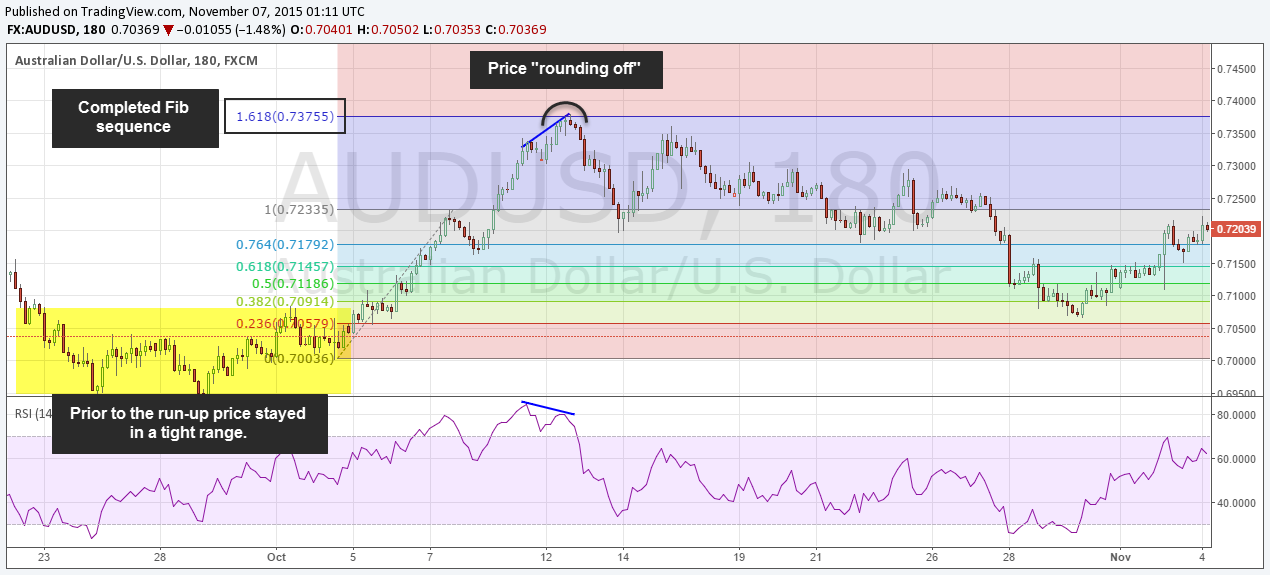

The screenshot below shows a recent reversal trade and the 3 Inside Up pattern confirmed the reversal finally.

2) Momentum divergence (fading momentum)

Fading momentum is important! Whereas many reversal traders just try to trade off of previous support and resistance (which is predicting), waiting for confirmed fading momentum can make a huge difference. The RSI (read more about the RSI here) or Stochastic indicator are good choices when it comes to analyzing momentum divergences and the screenshot above shows a reversal trade with a clear RSI divergence (among all other reversal signs).

3) A price area of interest

The last main pillar of a reversal strategy is to find reversals that happen at a logic price area. Most traders make the mistake that they just look for a divergence on their indicator and then hope the trade will somehow work out, while price trades somewhere in the middle of nowhere.

Taking reversal trades that happen at the “right” price are is key! For that you should start looking for false breaks of support and resistance levels or previous highs and lows. Fibonaccis are another other go to tool; here look for completed Fibonacci sequences (read our Fibonacci guide here). Both of the last two reversal trades had the location criteria going for them as the screenshots show.

If all these things come together, you often get a very precise signal of an imminent market reversal. Furthermore, by the time you see all of the 3 things on your charts, price will already have turned into the opposite direction, and ”reversal predicting” becomes “reversal anticipating”.

3 min read

“95% of all traders fail” is the most commonly used trading related statistic around the internet. But no research paper exists that proves this...

3 min read

Trendlines can be great trading tools if used correctly and in this post, I am going to share three powerful trendline strategies with you.

3 min read

Choosing the right trading journal is essential for traders wanting to analyze performance, refine strategies, and improve consistency. In this...