3 min read

Scientist Discovered Why Most Traders Lose Money – 24 Surprising Statistics

“95% of all traders fail” is the most commonly used trading related statistic around the internet. But no research paper exists that proves this...

95% of traders are all over the place. No process, and if they have a process, it’s clustered and too complicated. The flowchart of their trading, if they have one, looks like a gigantic maze with loopholes rather than a straight line with clear exits. Why, oh why? Because FOMO, the “fear of missing out”. In an effort to capture every huge market move, they complicate their trading process so much that in the end, they will lose more money than if they would just coin flip their entries and get out at 2:1, no matter what.

Sounds familiar? Yeah, I know, I know. It’s all about the circle of competence. My circle of competence is quite small in comparison to the opportunities out there each day. In fact, it is so small that I won’t catch 99,9% of the moves happening in the markets, and I am proud of that.

Being a one-trick-pony is amazing, it feels good. And it makes money. I have written about this already in one of my last articles, The Most Powerful And Easiest To Trade Chart Pattern. Now, I want to go a bit deeper into that topic.

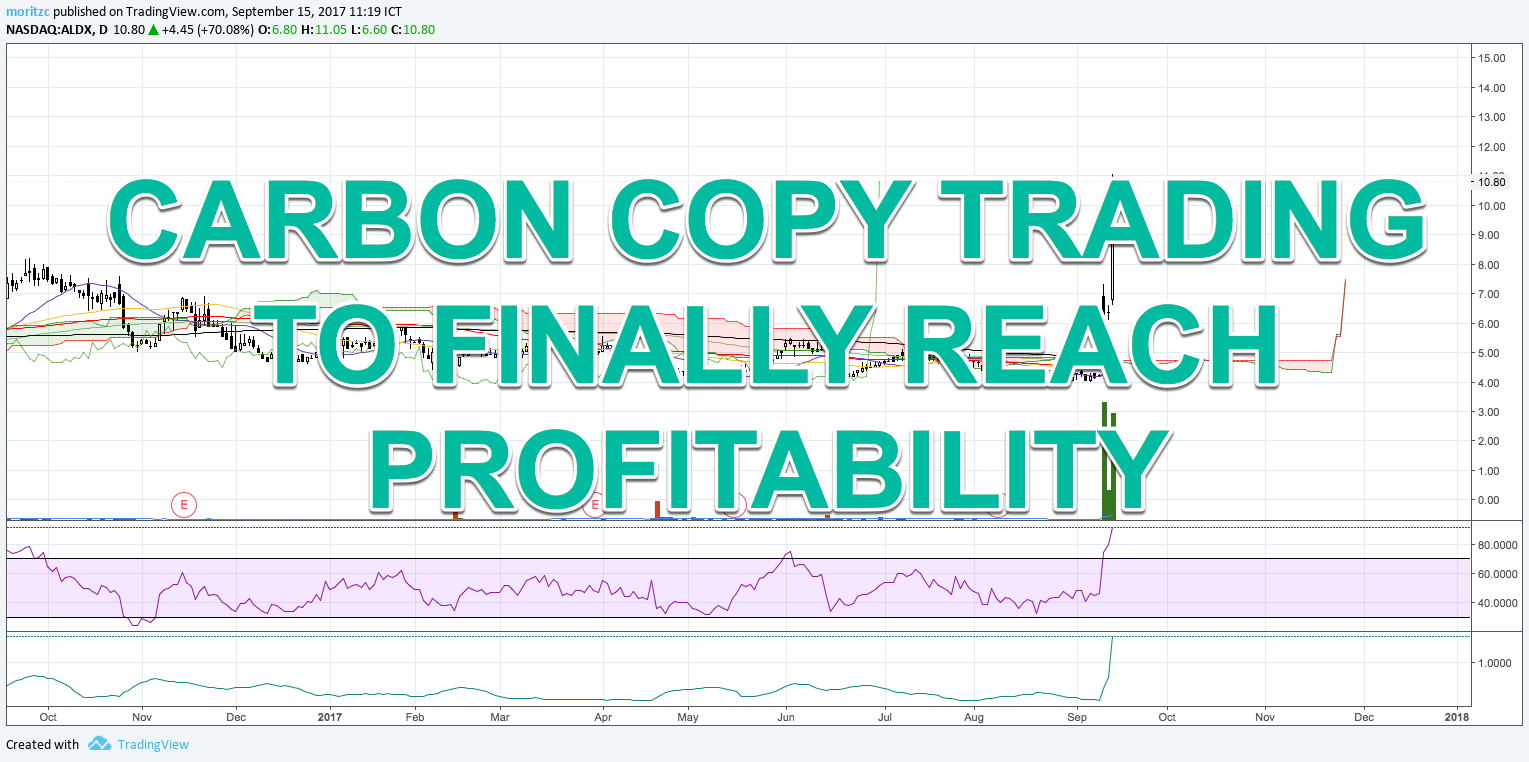

Today, I will share with you 6 trades. 4 carbon copies of each other (well, almost – there are subtle differences, maybe you can spot them), and 2 deviations of those copies to show you the difference. Here they are.

Now, first things first. No, I am not going to tell you what indicators I have on the charts, and at what settings, it doesn’t really matter. I want you to focus on the similarities between setups 1-4 and the differences to setups 5 and 6.

And there are also, as I said, subtle differences between setups 1 through 4, even though they look like pretty much the same damn trade. Can you spot them? I am sure, you can. Now this is what you want to do for your own trading – have a playbook of screenshots for your trades. You can do this in Edgewonk, for example.

You can very quickly assess the quality of your trading by flipping through screenshots of all your entries and looking at the similarity of your entries. Are they carbon copies of each other? Well, awesome! You can use your playbook to prime for a trading session, for example. Or print out the charts and hang them next to your monitor so you know exactly what you are looking for.

If they are not similar, well, you got some work to do. Start with 3 criteria. See if you can nail that. And while you look for trades that are carbon copies of those 3 criteria, record more things in your journal that make sense – fundamentals, additional indicator criteria, closing strength of bars, and so on.

Then you check all the past trades where you had only 3 criteria, and see whether you can find a 4th criteria what would have kept you in most of the winners, but out of many of the losers,while not reducing your sample size from 100 to 10, – a probability booster, so to speak. There is a sweet-spot between expectancy and sample size.

If a filter boosts your expectancy from 20$ to 50$ per trade but reduces your sample size from 100 to 10 trades a year, that isn’t worth much because without the filter you would make 2000$ (100×20$), and with the filter 500$ (10×50$). Of course, it would reduce your volatility and you could then risk more money per trade, making up for the lost trades. Is it worth it? That is up to you to answer, psychologically, financially, and so on.

If you find something, great, add it to your lists of criteria before entering a trade until you are at roughly 5-10, which is plenty enough for one setup.

And during that process, you might find that there are setups that don’t fit your criteria (i.e. setups 5 and 6 are NOT carbon copies of 1-4, but they have similarities to each other – we are already moving up and are a bit later in the trend than the base breakouts of 1-4), but very well could make their own setup.

At first, you exclude these setups from your trading until you mastered the first setup – that means, it has a positive expectancy, you know exactly what to look for, basically, it has to become a “dream” setup – you could trade it in your dreams.

Then, once you have that nailed down, you can get to those setups that failed to make it into your trading plan the first time around, and start repeating the process while setup #1 pays your bills. Just don’t overload on information, if you feel like you are getting exhausted or emotionally drained from trading too many setups, stick to your first one. You are not an algorithm, after all.

The psychological factor plays a huge role when it comes to how many setups we can trade, many of the most successful traders only trade 1 setup, and then slight variations of it or not even that. That is totally fine.

Following this process, it should be very easy for you to spot that one setup that happens a few times each week, or only 1-2 times each week, and has a positive expectancy. Think of it like prototyping – you make a blueprint, then you send that plan to the factory to create a prototype for testing before you go into mass production with it.

Once you have that efficient prototype based on the blueprint you created, you can go into mass production i.e. follow the blueprint to produce many, many more products or trades. Makes sense? I sure damn hope so, because yes, your profitability in trading depends on your ability to create and follow blueprints to the dot.

After all, your trades are your product – would you run a company that produces a different product each time? Or would you buy from a company where you never know what you are going to get because they deviate from their blueprint each day and produce random crap? Hell no.

Create a blueprint following the process I described above, then create carbon copy trades. That is how you make money in this business. That is really the only way.

3 min read

“95% of all traders fail” is the most commonly used trading related statistic around the internet. But no research paper exists that proves this...

3 min read

Trendlines can be great trading tools if used correctly and in this post, I am going to share three powerful trendline strategies with you.

3 min read

Choosing the right trading journal is essential for traders wanting to analyze performance, refine strategies, and improve consistency. In this...