3 min read

Scientist Discovered Why Most Traders Lose Money – 24 Surprising Statistics

“95% of all traders fail” is the most commonly used trading related statistic around the internet. But no research paper exists that proves this...

If someone would ask me about the primary reason why people fail in trading then I’d say it is because they truly don’t understand probabilities and drawdowns.

“You have to learn to lose before you can win” – who hasn’t come across this quote in his trading career? And didn’t everyone immediately think “of course I can lose, I lost many trades before and I never felt upset.”

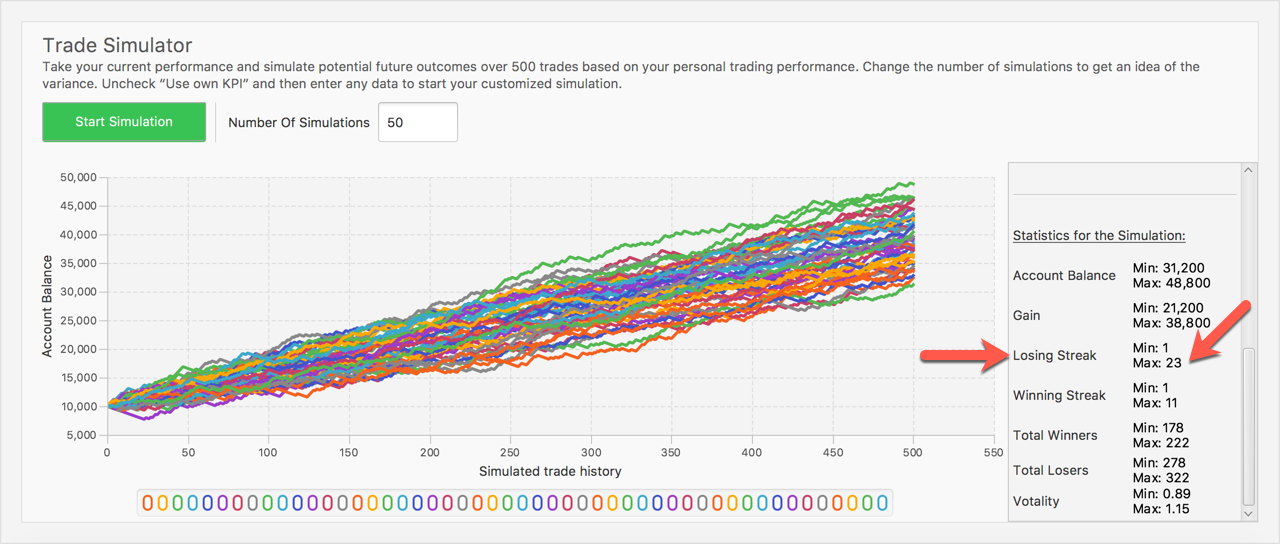

But do you really understand the implications of what it means to trade with a winrate of 40-50%? Trading with a winrate of 40%, you will experience losing streaks of 20 losses in a row. And you will be underwater (below your equity peak) 80% of the time or even more with an average RRR of 3:1. Basically, this means that 8 out of 10 days you will go to bed with a hole in your pocket. But yet, this strategy is highly profitable, and also a fairly realistic scenario for a real-world trading strategy, by the way. Take a look at the simulated equity curves taken out of the Edgewonk simulator.

Would you kill for an equity curve like that? Yes, I know a lot of people that would. But…would you kill yourself after a losing streak of 23 losses? Yes, most of the people I know, would, too. Or at least, they would stop trading that strategy. Or change it. Or switch to another one. Or cry under their blankets, full of anxiety, unable to open another trade. At the least, it would mess with your trading, leading you to perform below optimum, further increasing that losing streak.

This is a simulation over a sample of 500 trades, assuming you take 2 trades a day as a daytrader, this is a normal year of trading. This means, you will be in a state of regret most of the time, even on your good trades that eventually become winners (4 out of 10!), you will still experience drawdowns. This will utterly and completely destroy you until you accept that this is how trading works.

I am really 100% positive on the fact that people lose because they don’t know how to lose and then they start self-sabotaging and the downward spiral of destruction begins.

Also, when you start trading a strategy, ALWAYS assume that you will start with a drawdown right away. Most people start trading a strategy, their first 5 trades are losers, and then they quit. Well, guess what, statistics don’t care about where you want to be right now in your data sample. There is a great talk about this topic which I will link below.

There is not much more to be said about this. If you don’t know how to lose, you will always lose. And you must accept that you will be underwater most of the time. You will be in a drawdown most of the time. And you will feel anxious and upset about yourself and your trading most of the time. Sit down and think about what this really means for your trading. Have you ever had a 10-loss streak (or longer) in your trading career and stuck with your strategy? If not, well, then you know why you are not profitable yet. Drawdowns are like burpees. They will never get easier and they will always laugh at you. But if we power through, the results will come.

3 min read

“95% of all traders fail” is the most commonly used trading related statistic around the internet. But no research paper exists that proves this...

3 min read

Trendlines can be great trading tools if used correctly and in this post, I am going to share three powerful trendline strategies with you.

3 min read

Choosing the right trading journal is essential for traders wanting to analyze performance, refine strategies, and improve consistency. In this...