Supply and Demand Trading in 2026

We have been trading supply and demand strategies for over ten years, and they have stood the test of time remarkably well. Supply and demand is...

I am a purely technical trader and I never ever trade the news or a big fundamental event. Some traders might say that it’s a mistake but trading news is like rolling the dice and it’s pure gambling.

When traders trade the news, they will usually wait for the actual numbers to be released and then bet on the direction of the news. Such traders usually have to make decisions quite quickly because the price can take off fast on news events. Why this is a really bad idea, we will see shortly.

Some traders told me that they don’t even wait for the news to be released and just place pending orders in the market before the event and then they just wait until the order is triggered. This takes gambling to a whole new level and I do not recommend it.

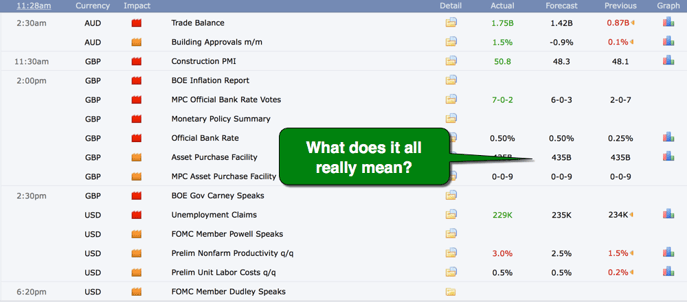

Forexfactory.com news calendar

Now comes the part which traders completely miss when it comes to news trading. The truth about news trading is:

You don’t trade the actual news. You trade peoples’ expectations and how the news are perceived.

Once I understood this and saw it on my charts, I stopped trying to trade the news altogether.

Price reacts to news in so many different ways and you can often see that price drops significantly after a good news release or it shoots up when the news are bad. We have seen it just last week and the GBP tanked across the board after an interest rate rike. Usually interest hikes are the main drivers for a currency’s appreciation but last week, the Pound got pounded 😉

Below you see that price initially spiked higher on the supposedly good news but within the same candle, price dropped like a stone.

Professional and profitable trading is here almost impossible because price turns so suddenly that you cannot react fast enough to get out of a losing trade without losing a substantial amount of money. Or, on the other hand, you cannot get in soon enough into a profitable trade and you end up chasing price. Whenever you catch yourself chasing a move without a plan, then you have made a huge mistake – it’s the sign of an amateur trader.

Recent NFP data showed us again why trading news is a pure gamble. We have seen stable data out of the Eurozone and more or less neutral NFP data out of the US. But price completely tanked here afterward. I got many emails from people who did not understand what was going on and I always replied:

You don’t trade the actual news. You trade peoples’ expectations and how the news are perceived.

So even though the news didn’t look like price could do much, we saw an extreme price reaction.

I do not even try to understand why a certain news event moves the market as it did, there is no point to it and finding a why for a single event won’t help you trade the news better the next time. The next time, the same news might not have an impact at all or even the complete opposite one. You just end up chasing your own tail without knowing what is going on.

There are many reasons why I prefer price action trading and technical analysis and here are the 7 most important ones:

You can see, trading pure price action is usually more efficient and less noisy. Of course, you cannot completely avoid the news as a trader, but you just have to learn how to “navigate around” the news which is usually much easier than trying to directly get involved into news trading.

We have been trading supply and demand strategies for over ten years, and they have stood the test of time remarkably well. Supply and demand is...

3 min read

Choosing the right trading journal is essential for traders wanting to analyze performance, refine strategies, and improve consistency. In this...

3 min read

“95% of all traders fail” is the most commonly used trading related statistic around the internet. But no research paper exists that proves this...