Supply and Demand Trading in 2026

We have been trading supply and demand strategies for over ten years, and they have stood the test of time remarkably well. Supply and demand is...

When I started trading, I quickly noticed that I am much more comfortable spotting reversals than finding conventional trend-following or range entries and to this day I am a pure reversal trader (learn more about my strategy here). However, I was still losing money and I blew a couple of trading accounts and a few thousand Dollars before I seriously started looking into why I was failing.

Once I started auditing my trades and performance, I saw that I made some pretty good trade calls but then I always kept repeating the same mistakes and I gave back my profits and then some. However, my findings during my performance audit were liberating because I saw that my mistakes were following the same patterns and although I was still a very rookie trader, I knew from the books that I had read that those seemed to be common problems. Let me briefly sum up my problems and mistakes back then and I am sure that many of you will find yourself here too:

Somewhere around that time I read the trading book “Pit Bull: Lessons from Wall Street’s Champion Trader” from Marty Schwarz and it was the right book at the right time. He mentioned that he was using moving averages as a directional filter and he also talked about utilizing checklists. I had heard this all before but now after my performance audit it made much more sense and I thought that if a ‘market wizard’ was using such simple tools like a checklist and a regular moving average, maybe it would also work for me.

I then went back to the drawing board and started applying different types of moving averages and I went from faster EMAs, to very long term moving averages, until I found my perfect fit. My fastidious record keeping showed that the 20 SMA worked great – it gave the best signals and it kept me out of many losing trades at the same time.

I know, you were probably hoping for something more drastic and spectacular but you have probably heard that ‘keeping it simple’ is the way to go. And this is so true! So let me explain why I give the 20 SMA so much credit, how it helped me turn my trading around and how I use it. Today, the 20 SMA builds the core foundation of my trading strategy. But as you will see, there is nothing magic about the 20 SMA but it’s only about what you can do with it.

For the most part, I only take trades into the direction of the 20 SMA. This means that I only take short trades when price breaks (and closes!!!) below the 20 SMA and I only consider long trades when price breaks above the 20 SMA.

I usually start watching Forex pairs for potential reversals when they are trending very strongly and it’s tempting to enter a reversal trade too early because you want to get in at the best possible price. The 20 SMA rule keeps me out of such trades because once price breaks the 20 SMA, price has already reversed from the absolute top.

Tip: When using the 20 SMA rule, only make trading decisions when the candle has closed. Avoid making mid-candle decisions because price often shows a fake break attempt at the 20 SMA during the duration of a candle.

(video has been removed – if you want to learn more, take a look at our pro area and learn to trade with us)

More: Go to my free Forex introduction video series

Once you start following rule #1, you can often catch great entries. If, after a rally, price starts reversing and then breaks the 20 SMA with a strong candle, you are often very early during a completely new trend.

Here it is important to think a little outside the box: there is nothing magic about the 20 SMA and it’s a pure filter-tool. Thus, we don’t look for candles that just barely break the 20 SMA, but we want strong ‘momentum candles’ that show that price is shifting from one trending phase into a new one.

At the beginning, I made the mistake that I was only following a fixed selection of 3/4 Forex pairs, day in and day out. As a swing trader, this is the worst thing you can do because you end up forcing trades during market periods that don’t suit your trading style.

As a reversal swing trader, I should only be trading Forex pairs that are in a strong trend with high momentum and that show early signs of fading momentum. The 20 SMA is also the ultimate tool here: when I select my Forex pairs for the trading week ahead, I only look at Forex pairs that have been moving above or below the 20 SMA for quite some time and that haven’t broken the 20 SMA recently. Also, you only want Forex pairs that show a 20 SMA with a steep angle. This alone already eliminates all low-momentum and range-bound markets that don’t go well with reversal trading.

Being more selective with the markets that I trade had a big impact on my overall trading.

Read: How I create my weekly watchlist

Very quickly after I established the 20 SMA rule in my trading, I saw a major improvement in my trading. Granted, this rule alone didn’t make me a profitable trader, but I saw the huge improvement in my performance and it gave my confidence in my system.

Very quickly after I established the 20 SMA rule in my trading, I saw a major improvement in my trading. Granted, this rule alone didn’t make me a profitable trader, but I saw the huge improvement in my performance and it gave my confidence in my system.

In hindsight, I can see that this is a very overlooked aspect of profitable trading. Everyone is hoping for a trading strategy that gives them consistent results while they jump from one method to the next, adjust indicators and settings, change entry rules or take completely random trades. Inconsistent trading decisions ALWAYS lead to inconsistent trading results which then leads to more inconsistent trading behavior.

Once I started using the 20 SMA and I saw the change in my trading, I gained trust and my trading decisions became more consistent which then lead to more consistent results. When I go through my trading journal, I can see that my trades now almost look IDENTICAL and whenever I see a trade that looks different, I immediately know that I screwed up. Strive for consistency in decision making!

As humans we are experts at fooling ourselves; we usually always know what the right thing to do is but we still come up with excuses or reasons why it’s better for us to do the opposite. Whether it’s about diet, exercise, studying, staying sober, or trading.

As humans we are experts at fooling ourselves; we usually always know what the right thing to do is but we still come up with excuses or reasons why it’s better for us to do the opposite. Whether it’s about diet, exercise, studying, staying sober, or trading.

Early on, I always caught myself second-guessing the 20 SMA rule and I still went before the candle close or ahead of the 20 SMA because I thought I was going to miss the move or I could get more money. Well, we all know how this ends 😉

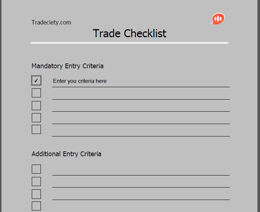

In his book, Marty Schwartz said that he was still using (after decades of making millions as a trader!!!) a laminated checklist before every trade. I didn’t have any alternatives and I had nothing to lose, so I started utilizing the checklist tip as well and I created a checklist before every single trade with the signals I needed and things that needed to happen before I was allowed to enter a trade. It might sound silly but it’s much harder to break your rules if you see it black on white that what you are doing is wrong and when you have to actively convince yourself that not listening to your checklist is the right to do.

I made a special video about all the tools and daily helpers that I use: My 3 most important daily helpers (click to watch)

All those tips help me fight my biggest problems and it made me become more selective, trade way less and help me understand when my trading system performs best.

I am still not perfect and sometimes I mess up, but those unnecessary mistakes have become less and I attribute a big part of my improvement to those simple hacks.

I am not saying that the 20 SMA rule is ideal for everyone and I know that it won’t work for all types of trading systems, but let this just be an inspiration for your own trading: look at what is causing your problems, think what could fix them and then work on your process.

We have been trading supply and demand strategies for over ten years, and they have stood the test of time remarkably well. Supply and demand is...

3 min read

Choosing the right trading journal is essential for traders wanting to analyze performance, refine strategies, and improve consistency. In this...

3 min read

“95% of all traders fail” is the most commonly used trading related statistic around the internet. But no research paper exists that proves this...