Supply and Demand Trading in 2026

We have been trading supply and demand strategies for over ten years, and they have stood the test of time remarkably well. Supply and demand is...

4 min read

Rolf

Aug 29, 2016 8:00:00 PM

Although all trading disclaimers state that trading is risky, it doesn’t – or it shouldn’t – be too risky at all. What makes trading risky is the wrong execution, paired with a wrong mindset. The concept of risk in trading is often misunderstood and once we have completed our comparison between reckless trading – the way most amateurs trade – and controlled risk – the way trading should be – you will understand how to adjust your trading as well.

Your edge + You know how to manage risk = Controlled risk

No edge + A lack of risk control = Reckless trading

Reckless Trading |

Controlled Risk |

| You don’t know your system? Market conditions vary: high momentum trends, high volatility market tops, low volatility consolidations, low momentum trends or ranges, and the list goes on.

As a trader you have to understand when to trade, when your trading system fits the general market conditions and when to stay out. |

You know your edge. Professionals know when to trade. They understand their method 100% and they know the conditions that fit their style. But even more so, they understand how to model a trading system that fits their personality and character as well.

A trading method is something that has to be built around your personal strengths while making sure that your weaknesses don’t interfere with your decisions. |

| You don’t use a stop? There is not much to say here. If you don’t use a stop, you have failed right from the start. No stop, no risk control.

|

You respect your stop. Pros understand that having a stop is non-negotiable. But they also know that they have to adhere to their stop. They don’t mess with the stop once the trade is on and they take the loss when it comes. No questions asked. |

| You add to losses? Adding to losses – averaging down – is another classic amateur mistake. Unless you have planned to add to a loss beforehand and factored that in when you did your position sizing calculations, there is no reason to add to a loss. Ever.

|

You cut losses. Instead of adding to a loss, the professionals cut losses and scale out of their position when conditions worsen. Reducing risk and limiting the potential loss when conditions don’t look too well is the fastest way to improve your performance. |

| You get bigger after a loss? Trying to catch up and get your account back to break even is a cardinal sin and it shows reckless trading in its purest form. |

You have a position sizing method. The profitable traders have a clear cut position sizing strategy. They don’t put too much weight on any one trade and they understand that the odds are in their favor. |

| Your position size varies a lot? Inconsistent position sizing is a capital destroyer. Giving too much or too little weight on individual trades is wrong – unless you have clear rules. Impulsive position sizing has to be avoided because it increases account volatility.

|

You apply a flexible position sizing technique. Changing the position size based on past trading results has to be avoided. Instead, position size should vary based on your historical winrate, the reward:risk ratio, the setup quality and the amount of volatility you can handle. When trading multiple strategies, a flexible position sizing approach is often necessary.

|

| You have weekly goals? Having fixed daily, weekly or monthly goals creates unnecessary pressure. You can’t force trades. Trying to achieve a specific return leads to unforced errors and emotional trading without an edge.

|

You understand variance. You take the trades as they come. The concept of variance is important to understand and unless you have done everything correct and acted within the parameters of your trading, you will be fine. Losses are normal – learn to accept them and move on. |

| You have to make money? You don’t have a plan B if trading doesn’t work out? Even worse, the money in your trading account means too much to you and you can’t afford to lose it? Brokerage research found that such traders underperform significantly. If you “have to make it” you will fail – almost guaranteed.

|

One trade at a time. You don’t create unnecessary emotional pressure for yourself. You take what the market offers and you take it one trade at a time. On the other hand, you know that one trade is meaningless over the course of your trading career. The goal of a professional trader is it to make the best possible trades without getting the ego in the way.

|

| All your money is with your broker To protect yourself from broker related problems or systematic risk, we recommend only putting a fraction of your trading capital into your broker. If, for example, your trading capital is $50,000 only put 20% ($10,000) to your broker but still treat it like it was the full amount. Don’t use this approach to just increase the risk! |

Minimizing risk away from charts It all starts with choosing your broker wisely. Avoid bucket shops, look for segregation of funds, the broker’s regulation, customer support, don’t fall for welcome gifts, ask for negative balance protection and check the withdrawal policy. |

A big misunderstanding exists when it comes to variance and risk:

Variance describes the natural swings in your account balance that exists because of the nature of trading. Losses are normal and you can’t control which trade will end up as a winner and which trade won’t work out – even though the entry signals look identical.

Risk, on the other hand, exists when you don’t know what you are doing and when you put yourself in situations where you deviate from your trading plan, take trades that you shouldn’t be in or lose more money than planned.

Whereas variance is normal and a part of trading that can’t be avoided, risk can and has to be managed and controlled.

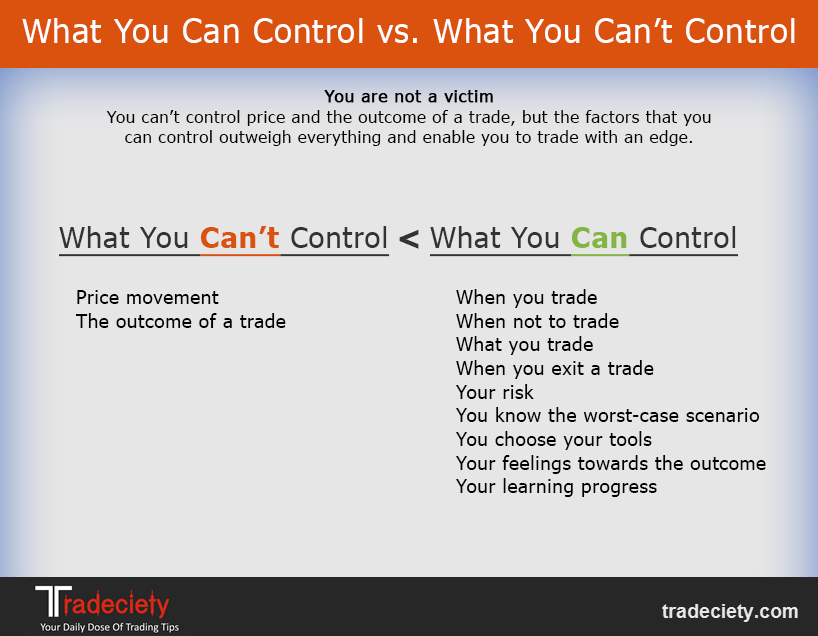

Of course, there are things out of your control and you have no influence over how price moves but if you have an edge, when you have a proven method and focus on the process and the things you can control and avoid a lot of the ‘risk’ factors that destroy so many trading accounts every day.

We have been trading supply and demand strategies for over ten years, and they have stood the test of time remarkably well. Supply and demand is...

3 min read

Choosing the right trading journal is essential for traders wanting to analyze performance, refine strategies, and improve consistency. In this...

3 min read

“95% of all traders fail” is the most commonly used trading related statistic around the internet. But no research paper exists that proves this...