Supply and Demand Trading in 2026

We have been trading supply and demand strategies for over ten years, and they have stood the test of time remarkably well. Supply and demand is...

3 min read

Rolf

Sep 26, 2017 8:00:00 PM

As traders, we lose every day, we make bad decisions, we miss profits and cut losses too late. We could already all be millionaires by now. Trading is brutal and we’re being shown our limitations and shortcomings every single day when we face the markets. Even the best trade can be viewed as a bad trade if you tell yourself that you could have made more and missed out. And no matter how much money you make, you could have made MUCH more easily.

This quickly leads to a downward spiral when you cannot be satisfied with the results and always believe that you could make more. You see the huge move where you just got a small part, we see the other traders showing off huge profits and we then compare it with our own mediocre (at best) results.

If you want to become a good trader, you have to learn to live with shortcomings and ‘failure’. Or, in other words, you have to accept that perfect trading is impossible and as long as we act within the boundaries of our system, we can be satisfied with our decisions.

Here is a list with phrases and thoughts that every trader has during an average trading day. It’s important that you recognize them when they appear because only then can you manage them and see them for what they are. A trader who helplessly gives into his thoughts of failure will make bad trading decisions and the negative effect will reinforce itself:

All those ifs, shoulds, coulds and would haves need to be eliminated from your trading vocabulary. This is easier said than done and we have been conditioned to follow those patterns all our lifes because they also help us to keep improving if we look for things that we could have done better. In trading, it doesn’t work like this and here are some personal tips for how you can overcome this pitfall.

1. Define your rules

It all starts here. You need to have clear and well-defined rules. Even better, write them down and understand why you have them. You need to establish rules for every part of your trading: market selection, entries, trade management, position sizing, exits, cutting trades etc.

Traders who have no rules or no defined system never understand what they are actually doing and they easily fall into this ‘failure mindset’. If you have no guidelines, you never really know what you should be doing and you tend to use the phrases from above and doubt your trades and decisions.

I recommend, take a few hours and become crystal clear about your trading and your strategy. And if you see that you don’t have one, then start looking for one.

2. Look at your trades objectively

Instead of beating yourself up all the time, look at your trades and ask yourself if, given the information at that time, could you really have made a better decision? And, did you act within the boundaries of your system and your rules? It’s totally fine to miss a big move if your system didn’t give you a signal.

Instead of beating yourself up all the time, look at your trades and ask yourself if, given the information at that time, could you really have made a better decision? And, did you act within the boundaries of your system and your rules? It’s totally fine to miss a big move if your system didn’t give you a signal.

You can’t catch all the moves all the time. All you need is a repeatable process that allows you to catch some of the moves, some of the time.

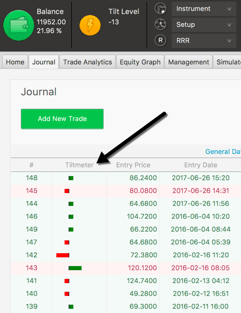

In the Edgewonk trading journal, you can also use the Tiltmeter for this purpose and as long as your Tiltmeter is green, you’re on the right path and you’re respecting your rules.

3. Stop comparing yourself

Trading is neither a team sport nor are you competing against other traders. It’s so easy to get discouraged or frustrated by looking at what others (supposedly) achieve.

In trading, all you need to do is try and execute the best trades possible within your system and your rules. You have to try and be better than you were last week or last month. Work on yourself, track your trades and behavior and keep improving.

Traders have to be somewhat isolated and do their own thing. I know that this is hard as humans are social creatures and we always try to check what others are doing and how we compare to that, but in trading this is hindering you.

4. One trade doesn’t matter

And, finally, you need to understand that judging your trading on a trade to trade basis means certain death as a trader. In trading, the outcome is totally random and even the best trade will fail and there is nothing you can do about it. Do not over-analyze things and do not try to look for reasons why a particular trade could have failed.

Get yourself a trading journal, track your trades, review them objectively and look for common patterns in your trading, instead of attributing too much meaning to single events.

We have been trading supply and demand strategies for over ten years, and they have stood the test of time remarkably well. Supply and demand is...

3 min read

Choosing the right trading journal is essential for traders wanting to analyze performance, refine strategies, and improve consistency. In this...

3 min read

“95% of all traders fail” is the most commonly used trading related statistic around the internet. But no research paper exists that proves this...