Supply and Demand Trading in 2026

We have been trading supply and demand strategies for over ten years, and they have stood the test of time remarkably well. Supply and demand is...

Options give a trader another dimension to speculate on the market. Used properly, they can be a very beneficial tool.

The first thing to know about options is what they are. An option gives the buyer the right to take an action on a particular security at a certain price within a certain time frame. These “rights” are homogenized and trade on exchanges, similar to the way stocks do.

The security that the buyer has the right to take action on is called the underlying. If you buy an option, you are long. If you sell an option, you are short. There are two sides to every option, the buyer and the seller. The seller has an obligation to fulfill the buyer’s right. Each side has entered into an agreement with the other. Therefore, we refer to an option as an option contract. You can buy and sell multiple contracts at once, the same way you can buy and sell multiple shares of a stock. The price that the option contracts are exchanged at is called a premium. The price of the underlying, that the option buyer has the right to buy or sell at is called the strike price. The date that the contract runs out on is called the expiration date. There are two types of options:

A call gives the owner the right to buy a security at a particular price. A put, gives the owner the right to sell a security at a particular price.

You can see the payoff of a long call and put below. The option value will be negative until the underlying is equal to the strike price. It then moves up in value. A call moves up in value as the underlying moves up in price, because you have the right to buy. A put moves up in value as the underlying moves down in price, because you have the right to sell. Both options loss is limited to the premium paid. They both have an unlimited amount of potential profit.

As a rule, one option on a stock represents one hundred shares of the underlying stock. This is true of most options that trade on exchanges. If a stock is trading at $50 a share and a call option with a $50 strike price has a premium of $1. That option will cost you $100. Let’s say the stock rises to $55 a share and the option premium rises to $4, and you sell. You have made a profit of $300. Options are leveraged securities.

Leverage is controlling a large amount of a security (stock, bond, commodity etc..) with a small amount of principal. Your profits are amplified, but remember your losses will be too.

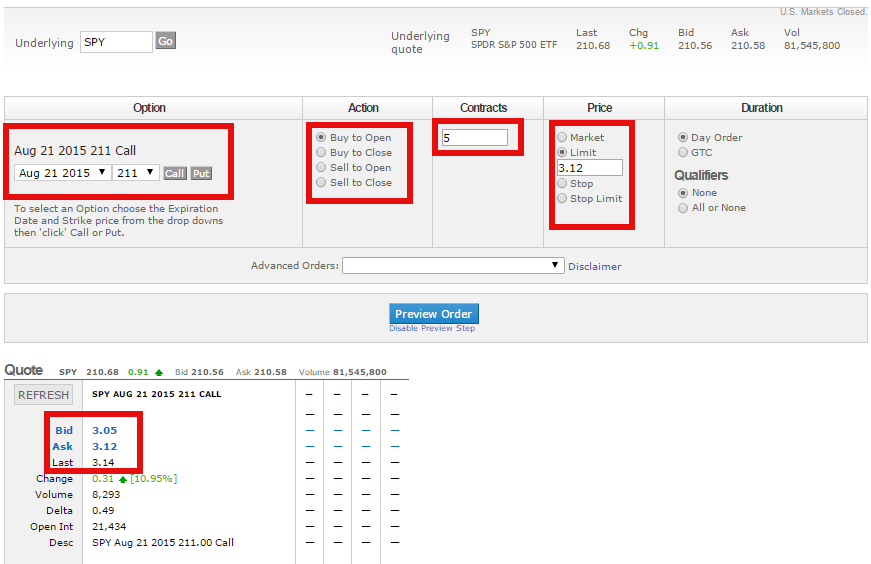

The image below is an example of an options order entry screen.

The underlying is the SPDR S&P 500 ETF. I am going to attempt to buy calls with an expiration date of August 21. The strike price is 211. I will be buying to open, which means I am initiating a position. If I was currently short the option and wanted to close out my position, I would buy to close. Conversely, if I want to initiate a short position, I would sell to open. If I want to close out a long position, I will sell to close. I am going to attempt to buy five contracts.

The types of orders available are the same as for stocks. I will make my limit order for 3.12, since there is an ask, or asking price, of 3.12 right now. This means I will not pay more than a 3.12 premium for each option contract. The ask of 3.12 indicates that the lowest sellers are are at 3.12. Therefore, it is likely, but not guaranteed, that my order will be executed. If I want, I could place my limit order below 3.12. However, the price would need to come down for my order to be executed. A market order will be executed at whatever price the market is at when the broker receives your trade. A stop order and stop limit orders are protective orders, that are placed above the market for buys and below the market for sells. A regular stop order becomes a market order when the option reaches the price you set. A stop limit becomes a limit order when the option reaches the price you set.

You can also make the order a day order or GTC, the same way you can with a stock order. I will make this order a day order, which means it will expire at the end of the day. A GTC is good until cancelled. This means the order stays active until I specifically say to cancel it. A GTC order can be active for multiple days.

All or none, means that the order will be executed all at once or not at all. If I select this, I will buy five contracts at my price or my order will not be executed at all. Since I selected “None”, I could end up having my order partially executed. For example the broker could end up buying only two contracts. Then the broker will attempt to buy the three other contracts at my limit price.

We have been trading supply and demand strategies for over ten years, and they have stood the test of time remarkably well. Supply and demand is...

3 min read

Choosing the right trading journal is essential for traders wanting to analyze performance, refine strategies, and improve consistency. In this...

3 min read

“95% of all traders fail” is the most commonly used trading related statistic around the internet. But no research paper exists that proves this...