Supply and Demand Trading in 2026

We have been trading supply and demand strategies for over ten years, and they have stood the test of time remarkably well. Supply and demand is...

News and fundamentals are a very controversially discussed topic among traders, but even if you are not a fundamental trader, being aware of news releases and important announcements is a must for traders of all types. The main reasons why it pays to keep track of news are:

Every week and month, a variety of news are being released and new economic figures are published. We shortly walk you through the most important news releases for any trader:

The price governments and companies pay for labor. When the prices for goods which companies have to pay rise, it is usually passed on to the consumer and it could lead to a rise in consumer prices (CPI). Thus, the hourly earnings numbers are used to make decisions about interest rates because it reflects inflation. A rise in earnings can also lead to more consumer spending which is also considered bullish.

When the actual numbers beat the forecast, it is generally considered bullish.

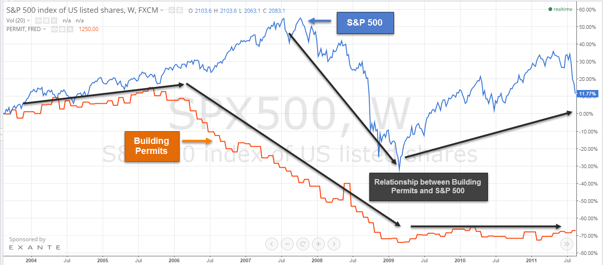

The amount of building permits for the construction of new houses. Building permits is considered a leading economic indicator because a rise in building permits can foreshadow rising demand for construction, material and labor when the actual construction of the homes start.

When the actual numbers beat the forecast, it is generally considered bullish.

The consumer sentiment data shows the confidence (or the lack of confidence) of the consumers. Positive consumer sentiment and high confidence can lead to more spending and, thus, increase economic activity.

When the actual numbers beat the forecast, it is generally considered bullish.

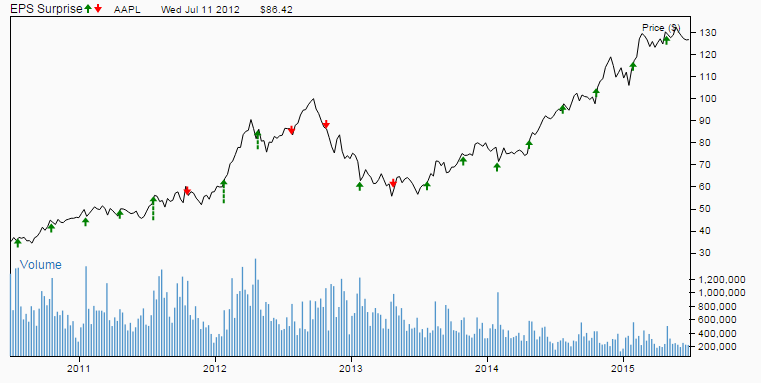

Earnings announcements are important when trading stocks. Earnings provide information about the situation of the company. Although earnings announcements will often be priced into a stock price already, surprises in earnings announcements can lead to significant price moves.

If investors believe that a company is doing well, they expect good earnings and therefore will not react to a good number as much. On the other side, if investors believe that a company is doing well and the earnings don’t show that, price usually react strongly. The same holds true when investors are not convinced that a company is doing well, but the earnings report shows a very positive number.

The chart below shows the stock price of Apple and the green and red arrows indicate earning surprises (positive and negative).

Further reading: How to use earnings per share to analyze a company

The COT condenses trading activity by commercial, non-commercial and other investor groups in the futures market. The COT is released weekly and shows open interest, long and short positions for futures contracts.

Further reading: Follow the smart money with the COT report

The average prices consumers pay for a basket of consumer goods and services. The CPI is an inflation measurement and, thus, important when estimating the likelihood of interest rate decisions. Generally speaking, higher than expected CPI number make an interest rate hike more likely to counter the impacts of inflation, which again could be bullish for the currency.

Rising CPI is considered bullish because it makes an interest rate hike more likely

The number and the price of homes sold in a given period. The numbers include homes that have been built previously and the sales have been closed now. When coming out of a recession, existing home sales tend to rise and it is a good estimation for how well an economy is recovering.

A survey of purchasing managers in the manufacturing industry. The survey includes business activities, employment, production, orders, prices and supplier deliveries. Purchasing managers are highly informed and the outcome of the survey is considered a leading economic indicator about the health of the manufacturing industry and the economy as a whole.

The American equivalent is the ISM Manufacturing Index

Positive data suggest a healthy and growing economy which is bullish

FOMC meetings are closely watched and can lead to a lot of price volatility and market moves. During the FOMC meetings, monetary policies are being discussed. During the FOMC meeting the participants also vote about potential interest rate decisions (raising or lowering interest rates) and also provide a potential outlook of the economy.

The price and the development of government bonds can tell a lot about the risk sentiment in the financial markets. When investors believe that overall risk is low, the prices of government bonds tend to fall because investors are looking for investment alternatives with a larger potential payout such as company stocks. When risk is perceived as high, investors pile out of stocks and invest more in government bonds. Thus, government bonds tend to rise during times of uncertainty and perceived risk.

Further reading: Follow the smart money

The GDP measures the total value of the output (goods and services) of a country during a certain period. The GDP is, therefore, the best measurement to how well a country and an economy is doing. A rising GDP number suggests that the economy is growing while a falling GDP number signals a contraction.

Positive and rising GDP is bullish

The number of residential construction projects that has started during a given period. A rising number of newly started residential housing is an important measure for the health of an economy. When the economy is doing well, more people will build houses which then lead to greater employment in the home-building sector, greater demand for raw materials and it also increases the demand for financial services such as mortgages.

Positive numbers are considered bullish

The German IFO business climate is a survey of manufacturers, builders, wholesalers and retailers. The German IFO business climate survey is closely watched because it serves as a proxy for the whole Eurozone. It is a leading indicator and provides information about the health of the economy.

Positive numbers are considered bullish

Total value of the output produced by manufacturers. Industrial production is often considered a leading economic indicator because it immediately shows the health of an economy and it can react quickly to changing sentiment. Slowing industrial production can lead to less employment, a reduction in the GDP and signal an economic contraction.

Interest rates are one of the main drivers of currency prices and currency valuation. The FOMC meetings already provide a future outlook for interest rate developments and potential interest rate decisions are usually priced in. However interest rate decisions are carefully watched by investors and traders and a surprise can lead to major market moves.

Further reading: Follow the smart money with interest rate analysis

NFP data shows the employment numbers of paid workers in the US, excluding government employees, private household employees and farm employees.

The NFP are released monthly and provide information about the health of the economy. The NFP numbers can also serve as a proxy for how likely government activity is.

The PPI measures the average price producers have received for their goods and services. The PPI is similar to the CPI, but it measures the average prices from a producer perspective. Thus, it is also considered an estimate for inflation.

Retail sales show the behavior of consumer spending. Rising retail sales show confidence of consumers because consumers spend more and potentially save less. It is also a proxy for the health of an economy.

The trade balance compares the number of imports and exports. A negative trade balance shows that more goods were imported than exported (deficit). A positive number shows that more goods were exported than imported (surplus).

When the trade balance is positive it can signal a higher demand for the domestic currency because domestic exporters have to be paid by foreign importers. Furthermore, rising exports can also mean more employment for the domestic economy.

However, a negative trade balance cannot generally be considered “bad”. In times of strong economic growth, more imports can be needed to fuel the growth. Putting the trade balance numbers into the context of the current state of the economy is important to avoid misinterpretations.

The unemployment claims show how many people have filed for unemployment. Unemployment claims is an important number because it also affects consumer spending behavior and shows the state of the economy.

A higher number is considered bearish

A survey of German institutional investors and analysts. A ZEW reading of above 0 indicates optimism about the economy. Because investors and analysts often have a deep understanding of the economy and about what is going on, the ZEW report is closely watched. The German economy serves as a proxy for the Eurozone and it is one of the strongest economies which makes this report so important.

If you are looking to brush up on your macroeconomic understanding, why don’t ask one of the most successful macro hedge fund managers? Ray Dalio explains how to economic machine works in 30 minutes.

The phrase ‘Risk on / Risk off’ refers to investors risk tolerance given the current market conditions and also the current state of the economy (worldwide or regional).

Risk on

When risk is low, which means that the current state is perceived as relatively stable, investors are willing to invest in higher risk investment, such as stocks.

Risk off

When risk is perceived high and the current state is unstable and more volatile, investors take their money and shift it from more risk investment into ‘safer’ investments, such as government bonds or cash.

Risk-on-off in action – Stock market appreciation and the Carry Trade

When a trader understands to read the general mood and risk appetite of the crowd, traders can potentially anticipate market direction. In a risk-on environment, investors feel good about the economy and they believe that the outlook is good as well. Therefore, they will buy stocks which will drive prices higher. Furthermore, during risk-on times, investors buy high yielding currencies (currencies with higher interest rates, typically the AUD) and sell low yielding currencies, which is also referred to as the ‘Carry Trade’ (during risk-on times, the AUD/USD will often rise because investors buy the high yielding AUD).

Furthermore, during risk-on times, investors take their money out from the so-called safe haven currencies to shift their capital to more risky instruments. A risk-on environment can, therefore, lead to a US- Dollar depreciation, since the USD is perceived as a safe haven / less risky instrument.

It happens frequently that traders are left clueless because they cannot make sense out of price behavior after news releases. How often did you wonder why price moved higher after a bad news report or suddenly tanked, even though news were positive?

Expectations trump numbers

When it comes to interpreting reactions to news announcements, it is important to understand that expectations of investors and traders often matter more than the actual numbers. For example, if investors already expect a prosperous and good future for a company, a positive news announcement such as positive earnings number is nothing too surprising anymore, unless it widely exceed expectations. On the other hand, if good news are not expected, but a company releases a positive earnings number, price may very well rise.

Thus, if what investors expect and what then happens differs a lot, price move relatively more then when expectations and reality are in sync. A trader, therefore, should always try to understand what ‘the crowd’ and investors expect to happen in order to make sense out of reactions to news.

News and risk appetite

As we have mentioned earlier, when risk appetite is high, investors seek higher yielding assets. A possible scenario which often confuses traders is when after better than expected USD news, the US-Dollar suddenly starts going down, although it is what is likely to happen if you know the connections:

Better than expected US news can trigger a risk-on environment. The US-Dollar is a safe-haven and low yielding currency. During risk-on times, investors shift from low to high yielding currencies and, therefore, cause the US-Dollar to go down.

As you can see, a depreciation of the US-Dollar despite good news is not uncommon or unexpected. For investors and traders it is important to understand the connections and connect the dots when interpreting price reactions.

We have been trading supply and demand strategies for over ten years, and they have stood the test of time remarkably well. Supply and demand is...

3 min read

Choosing the right trading journal is essential for traders wanting to analyze performance, refine strategies, and improve consistency. In this...

3 min read

“95% of all traders fail” is the most commonly used trading related statistic around the internet. But no research paper exists that proves this...