Supply and Demand Trading in 2026

We have been trading supply and demand strategies for over ten years, and they have stood the test of time remarkably well. Supply and demand is...

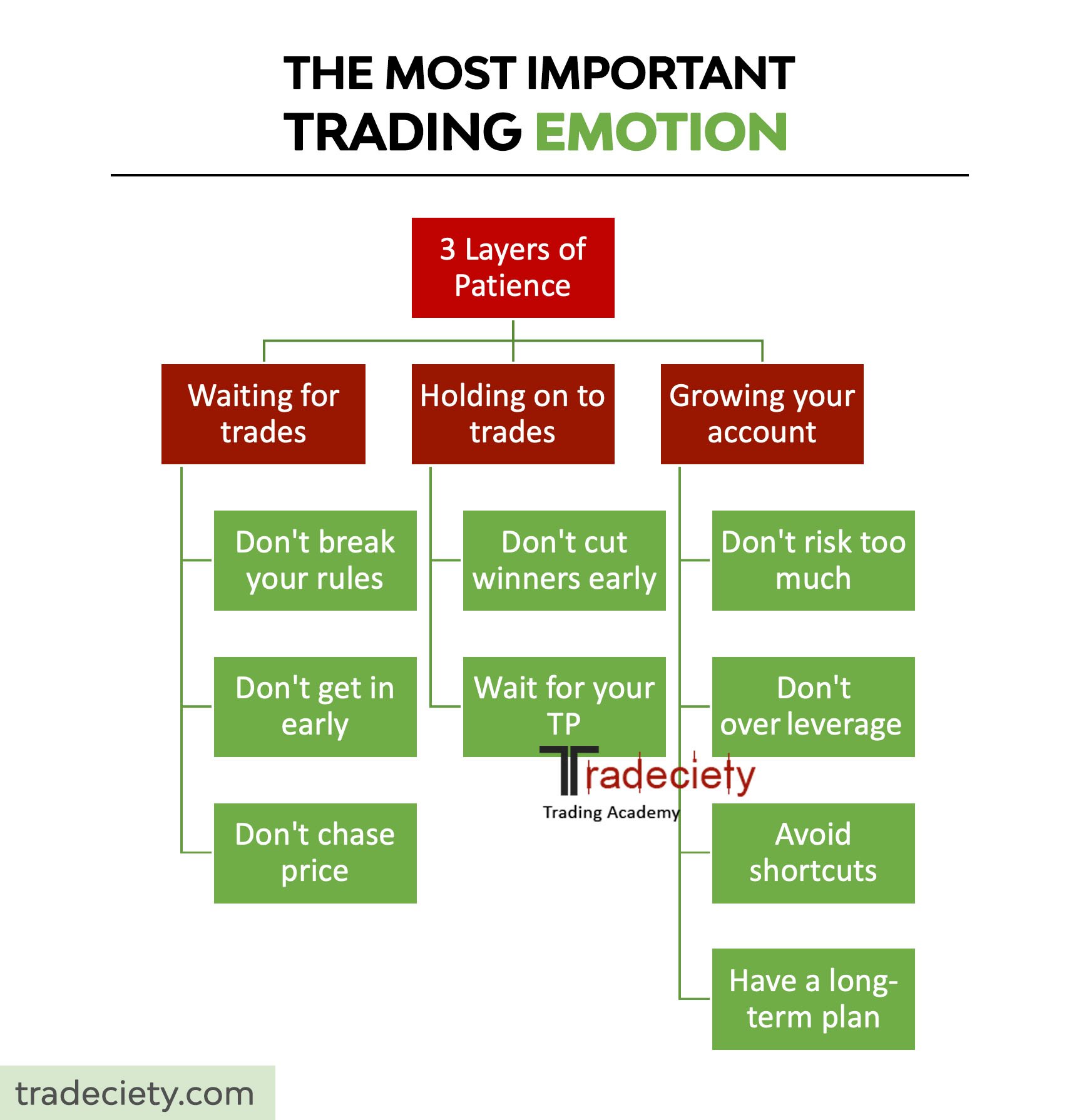

Trading is 90% psychology in my opinion. Although we might have a great system as traders, the way we execute our system is determined by our psychology and by our mental state.

The way we judge our performance and our trading are determined by our emotions.

You can see the best setup but if you are coming from a series of losses, you might hesitate or trade too small because you lack confidence. And if you just experienced a good run, you will often end up taking bad trades because you are over-confident. When you exit a profitable trade too soon or close a loss too late, emotions are the driving factors behind your decisions as well. And, of course, the big problems such as revenge trading, chasing or over-leveraging are all also a product of our emotions and our inability to manage them.

However, I believe that one specific trading emotion stands above all: Patience. Or better a lack of patience. In my latest podcast, I talked about why I believe that patience is the most important trading emotion / skill.

What do you think? Let me know in the comments below and I would love to hear your thoughts about patience and trading emotions in general.

We have been trading supply and demand strategies for over ten years, and they have stood the test of time remarkably well. Supply and demand is...

3 min read

Choosing the right trading journal is essential for traders wanting to analyze performance, refine strategies, and improve consistency. In this...

3 min read

“95% of all traders fail” is the most commonly used trading related statistic around the internet. But no research paper exists that proves this...