Supply and Demand Trading in 2026

We have been trading supply and demand strategies for over ten years, and they have stood the test of time remarkably well. Supply and demand is...

Trading with the trend is said to be the ‘best’ and most effective way to trade but when it comes to defining what trading with the trend is, most people don’t really know what it means. By definition it would mean that you always have to chase price as ‘trading with the trend’ is only possible if you get in late when the trend is already obvious and visible. But without the benefit of hindsight, how can you know that your entry point isn’t going to be the turning point and that the trend is over?

In call myself a reversal trader and people then automatically believe that I only trade counter trend which many believe has a low success rate, not because they know anything but just because they repeat what they have read somewhere on the internet.

In this article, I want to show you how to trade ‘with the trend’ even if you are a reversal trader and how to find high probability trading opportunities using the top-down, Daily-4H analysis approach.

I look for early trend stages and signs that a market is going from one market direction into another one. I start my trend analysis on the Daily chart and all I want to see is a strong turnaround reaction on the Daily chart which will keep me from picking tops and bottoms a.k.a. catching a falling knife.

Of course, I might be wrong at times when the turnaround is only a pullback during a trend and not a complete reversal, but that’s the nature of the game.

On the Daily timeframe, I draw major support and resistance areas and identify key price levels. I don’t trade them blindly and I always wait for a real price reaction at such a level. I then look for a combination of the 3 things below:

Now let’s go over 3 very recent examples and I take the Daily-4H top-down approach to explain how to follow price and the trend the right way.

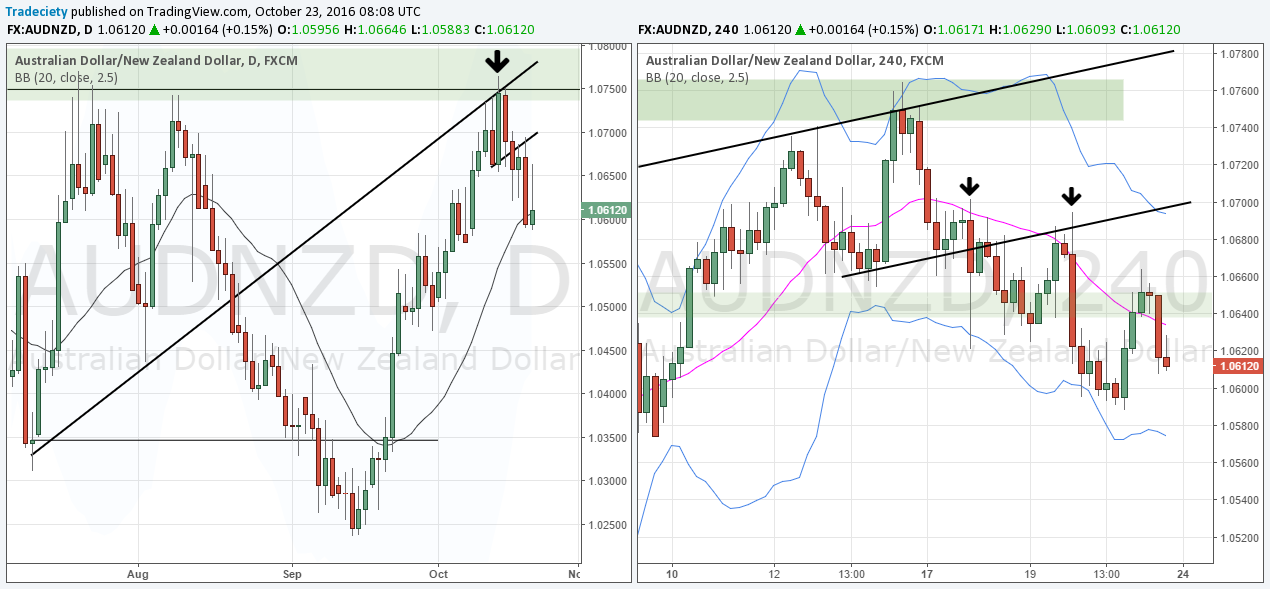

On the left Daily chart you can see how price ripped higher and the rally was very strong. Shorting during such a market is very dangerous and has to be avoided. All I did was wait patiently until price had reached the resistance at 1.075 to see if price can find resistance here again. Most traders will continuously try to short a market that is going higher because they believe that ‘what goes up has to go down eventually’ and although there is some truth to it, if you time your trades incorrectly, you won’t last long as a trader.

So once you see clear signs that price is finding resistance up there – a false breakout, a strong bearish candle and a break of the last low – you can go the lower timeframe and time your short entry there.

On the 4H on the right you see nicely that this has nothing to do with picking tops and bottoms and that getting into a new trend at an early stage WITH confirmation can be also seen as ‘trading with the trend’.

The NZD/JPY is a textbook example and after price rallied on the Daily into previous resistance, a trader just had to wait for the higher timeframe confirmation. In this case, we had multiple failed breakout attempts with long wicks and a nice pinbar. After the pinbar has formed, it was time to go to the lower timeframe and time the trade there. It worked out perfectly and this is a great example how higher timeframe price action and technical analysis can give you confirmation about a new lower timeframe trend. However, you don’t always catch a long lasting, multi-day or multi-week trend but such reversals usually make for a good trading opportunity where the trader can extract 2-3R easily.

And finally, the USD/CAD long example which is similar to the NZD/JPY. The sell-off prior wasn’t as strong, but price dropped into the previous swing lows where it found support. It tested this area multiple times and left 2 pinbars.

Again, after the first pinbar a trader should go to the lower timeframe and wait for signals that momentum is confirming the change in direction which it did on the 4H and then led to a great move. However, it’s worth noting that the pinbar alone isn’t enough to get into a trade automatically and it is just the higher timeframe directional information that we need to then go to the lower timeframe.

All 3 examples show nicely how a trade idea is formed and how the Daily-4H combination can be used to create trade hypothesis and then execute it when the signals are given. ‘Trading with the trend’ can be anything and it’s up to you to form a method that makes sense to you and that allows you to build confluence around the trades that you want to take.

We have been trading supply and demand strategies for over ten years, and they have stood the test of time remarkably well. Supply and demand is...

3 min read

Choosing the right trading journal is essential for traders wanting to analyze performance, refine strategies, and improve consistency. In this...

3 min read

“95% of all traders fail” is the most commonly used trading related statistic around the internet. But no research paper exists that proves this...