Supply and Demand Trading in 2026

We have been trading supply and demand strategies for over ten years, and they have stood the test of time remarkably well. Supply and demand is...

3 min read

Rolf

Mar 12, 2018 8:00:00 PM

Everyone can catch great trades when the market is trending nicely and just shoot in one direction.

But markets spend a lot of time ranging and many traders often lose all their money during choppy range markets when they don’t know how to approach and trade them. In this article, I want to share principles and tips on dealing with and trading consolidations the right way.

Most traders forget that besides buying and selling, standing on the side and being neutral is also a viable option. You don’t have to be in a trade at all times just because you call yourself a trader.

When it comes to ranges and consolidations, there are good and then there are bad consolidations. A good consolidation is orderly, the top and the bottom are well defined and the volatility is usually moderate. A bad consolidation is wild, price continuously overshoots the boundaries and you also get frequent false breakouts which trap the amateur traders.

Whenever you can’t fully make sense of a chart and when the technicals are not clear, then it’s best not to get involved.

A tight range is typically the prelude to a new trend. During a long and narrow range, such as the one on the AUD/USD in the screenshot below, there is a lot of position building and trend-preparation going on inside. The price had more touch points at the top but was never able to really break through. A lack of buying power is our clue number one.

The low volatility (ATR) indicates that there wasn’t a big fight between buyers and sellers going on inside the range and a low volatility range environment usually makes for cleaner breakouts; this is clue number two.

During the ranging period, the RSI hovered in the middle which means a lack of momentum and it confirms the consolidation. Just before the breakout occurred, momentum started picking up and the RSI started to go down faster: clue number three.

On the actual breakout, you could only see bearish candles and the size of the candles increased as well. There was little to no opposition from the bullish side during the actual breakout. Such a breakout is likely to succeed because it shows the strong imbalance between sellers and buyers and rising monentum: the final clue.

The next screenshot shows a different type of breakout. After a sell-off, price started to consolidate. This range is very different compared to the previous one and you can see a lot of volatility on the ATR; the candles have long wicks which signal the strong fight between bulls and bears.

Before the breakout to the upside occurred, price moved to the lower side of the range but failed to break it. We can clearly see that the price was more drawn to the lows but failed to push lower: clue number one.

Just before the breakout, the price started to show bullish candles exclusively and momentum on the RSI started to pick up; clue number two.

The break of the moving average was a Doji candle and price closed above the moving average afterward; clue number three. There was a little consolidation after the large bullish candle, but price never moved against the breakout.

The third type of breakout can be found during trends. After a trend leg, price often spends some time ranging and consolidating before continuing the trend. Such periods often offer great re-entry opportunities if a trader knows what to look for.

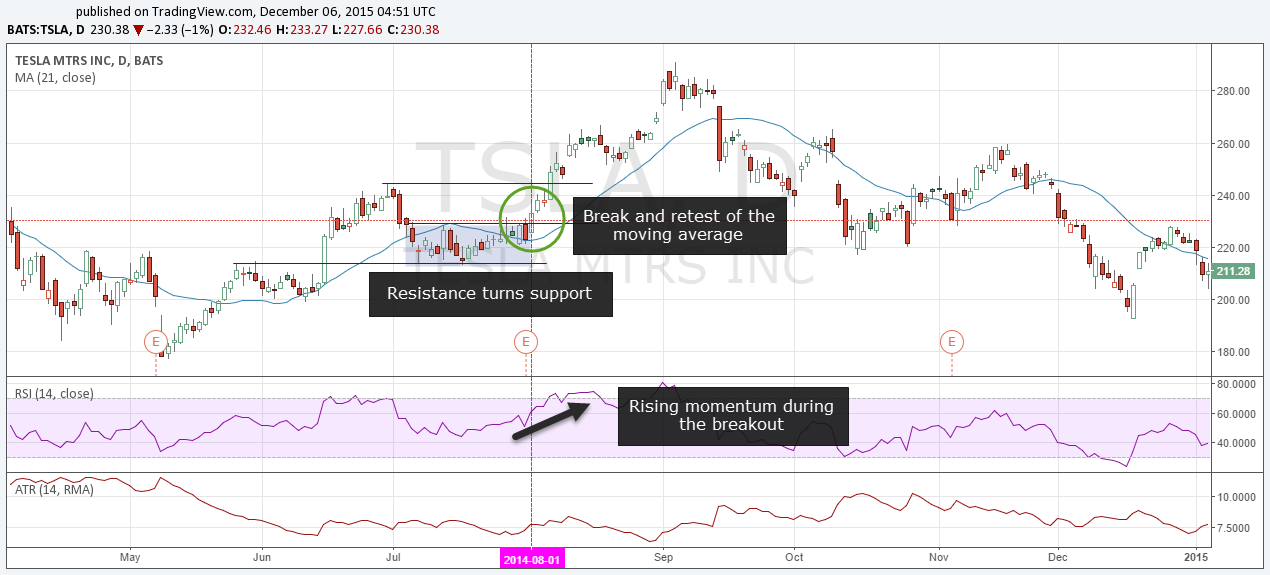

The screenshot below shows an uptrend of Tesla. First, it’s important to see that the consolidation happened after a pullback, but it never made a lower low. It even tested the prior highs as support – clue number one.

Prior to the breakout, the price started to move up very slowly and eventually broke the moving average. At one time, price gapped and opened below the moving average, but buyers pushed it back up immediately – clue number two.

Momentum picked up before the breakout happened and the RSI started rising again – clue number three. Eventually, the previous high broke in a strong fashion and price kept on making higher highs. The consolidation during the pullback could have been a good time to add to an existing position or to establish a new position.

Knowing how to trade breakouts the right way is an important skill in trading because breakouts typically occur at the origin of a new trend or in between trendwaves and can, thus, offer great new entry points. Very often, we can find very precise clues before the actual breakout happens but the most important point is that you always wait for the confirmation breakout where the candle also fully closes outside the range.

Amateurs make the mistake of jumping on unconfirmed breakouts as they happen and then often get trapped when the price reverses on them. We discussed the bull trap previously and in our Forex trading course, you will learn everything about it as well.

Traps around important range barriers are very common and they aim at taking out the impatient traders who always act on their FOMO and are eager to get into trades as soon as possible. Traps are dangerous for breakout traders if you do not wait for a confirmed breakout. But a patient trader can usually easily avoid this problem.

We have been trading supply and demand strategies for over ten years, and they have stood the test of time remarkably well. Supply and demand is...

3 min read

Choosing the right trading journal is essential for traders wanting to analyze performance, refine strategies, and improve consistency. In this...

3 min read

“95% of all traders fail” is the most commonly used trading related statistic around the internet. But no research paper exists that proves this...