Supply and Demand Trading in 2026

We have been trading supply and demand strategies for over ten years, and they have stood the test of time remarkably well. Supply and demand is...

Take profit placement and trade exits usually rank very low on a trader’s priorities list; typically way behind finding better entry signals or effectively setting stops. This is a very big mistake and we will see why many traders could easily improve their trading if they’d spend a bit more time on improving their take profit strategy and understand how to set take profit orders correctly.

Let’s first take a look at the most commonly made mistakes when it comes to exiting trades and profit taking before we look at tools and techniques for target placement. The mistakes below account for the majority of trade exit problems and by avoiding them most traders can probably already see a big improvement in their trading.

#1 Exits as a function of your stop

The cardinal sin of profit placement is picking your trade exit based on the amount of money you want to make and not based on chart context. Always, always, always choose a price level that makes sense in the overall context of your trade and the chart you are trading on. The market does not care about your orders and you need to make sure that price can reach them.

People usually pick the exit point as a function of their entry point and it’s usually some arbitrary Dollar amount.

#2 What do you do if price misses your TP?

It’s very common to see price move towards your target and then turn just a few points ahead of your actual target order. What should you do in such scenarios? My analysis over hundreds of trades shows that it’s more profitable to exit such trades and not hope for another run on your target. Price moves in waves and your order does not mean anything to the markets; thus, if your target was missed, exit the trade and take what you can, but don’t hope to get a second chance.

#3 Denying Losses

Here is a great quote from the book “What I learned losing a million dollars” (click here for my book review):

Always focus on the downside first. The sequence when entering a trade looks like this:

(1) Make sure you are seeing a valid entry signal (don’t enter your trade just yet)

(2) Identify a reasonable stop loss and take profit level (don’t enter your trade just yet)

(3) Is the reward ratio large enough? Yes, then enter the trade. No, then skip the trade – don’t move stop and profit orders around to create an artificial reward:risk ratio. Never ever fiddle with orders to artificially create a certain reward:risk ratio.

#4 Probability of winning

You can’t calculate the probability of having a winner when entering a trade and you can’t predict profits, regardless of your profit placement. Profits are always potential and it’s important to focus on the downside first because that’s the only thing you can really control.

#5 The last moment of objectivity

It’s very important to identify your stop and target levels before you enter a trade. Once you enter a trade, you can’t make decisions objectively anymore and your decision-making process is often driven by emotions and you put everything in relation to your entry price.

Here is another great quote from “What I learned losing a million dollars” that describes the problem nicely:

The last moment of objectivity for the roulette player is the moment before he places his bet and the wheels starts spinning. After that he can’t do anything anymore to lose more money. For the market participant, the last moment of objectivity is the moment before he places his trade. But after that, he can still do a lot to lose more money. That’s why all your decisions and plans have to be made pre-trade.

#6 You can go broke taking profits

This is a good example of where common trading knowledge is wrong. Again. A trader who repeatedly cuts his winners short will slowly drain his trading account. It’s important to be aware of such negative behavior and monitor it closely in your trading journal.

When it comes to actual profit taking, there are 2 methods traders can choose from and we will take a look at the pros and cons of each one.

#1 The open-end take profit taking method

What it is: With the open-end profit taking method, traders don’t use hard take profit orders at pre-defined price levels, but they let their winners run until exit signals are given and then exit trades manually.

Pro: Traders who follow the open-end TP method can, potentially, ride winning trades much longer and they don’t limit the upside potential right from the start.

Con: Amateurs, inexperienced and traders who have problems with discipline and risk should stay away from the open-end method. Amateurs who can’t read price movements will either exit way too early because they can’t differentiate between a retracement and reversal or they let their trades run too long because they become too greedy and then end up giving back profits.

Summary: This approach should only be used by seasoned and experienced traders. It can have disastrous impacts on the performance and trading behavior of amateur traders.

#2 Hard targets

What it is: This is the conventional approach where you place a take profit order at a pre-defined price level which then gets automatically executed once price reaches it.

Pro: It takes out the guesswork and you can measure a reward:risk ratio of your trades. Hard stops allow traders to establish an objective and repeatable approach to exiting their trades.

Con: It creates an anchor and you may miss larger moves.

I usually always recommend using hard targets because of the emotional aspect and the objectivity. At the end of this article I explain how I combine hard profit targets with discretionary thinking.

Whether you are using hard stops or follow the open-end approach, the following tools can help you establish a more robust and reasonable TP approach.

#1 Support/resistance, highs/lows or supply/demand

I usually look for the first major obstacle when entering a trade and then estimate the chances of the level holding or breaking. Major support/resistance levels and previous highs/lows are used by many traders and you can often see reactions around those high impact areas.

The conservative approach is to place your take profit order ahead of those high impact price levels. Here it’s important to focus on the major levels and not get too scared about every potential horizontal line along the way.

#2 Completed Fibs

With the help of Fibonacci extensions, it’s possible to measure the profit potential of a trending market. It’s not always possible to find a good A-B-C pattern for the Fibonacci tool, but when you have identified one, the 138 or 161 Fibonacci extensions can offer reliable profit opportunities.

This works especially well with the top-down approach: if you have identified a Fib extension sequence on the higher time frame, you can go to your lower, execution time frame to time your trades.

#3 ATR

With the help of the ATR you can determine how far price could potentially travel over any given period. The ATR method is especially effective for the daily ATR potential. If you see that price has already exceeded its daily ATR, another trend push is not very likely. The ATR profit taking method can be combined with other TP methods such as support/resistance profit placement where you estimate the likelihood of levels holding or breaking by analyzing the overall daily range potential. Furthermore, the ATR allows you to react to changing market conditions. When the ATR is high, a wider TP should be applied while a more conservative TP is necessary when the ATR is low.

#4 Bollinger Bands

During trending phases, price will often stay close to the outer bands. At the end of a trend, you can then see a spike through the outer band which can foreshadow a trend reversal – especially if the spike occurs with a price rejection.

Trend exhaustion exists when price does not reach the outer bands anymore and it can also foreshadow a potential shift in buyer-seller sentiment. This is especially true when it happens with a momentum divergence.

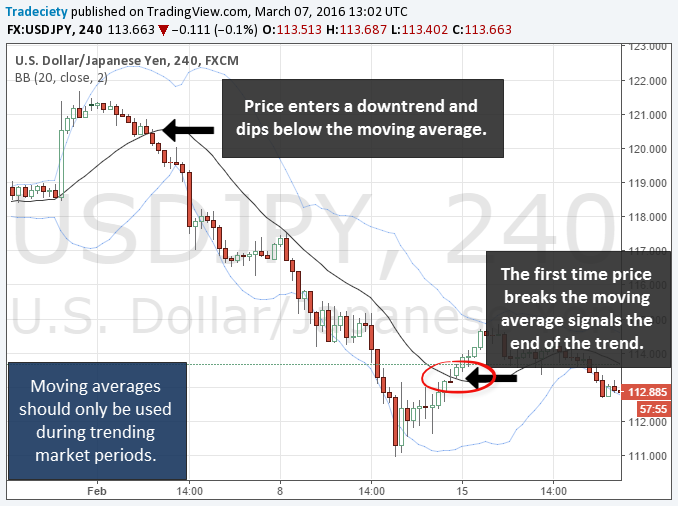

#5 Moving averages

Especially during trending market periods, the moving averages can help you establish a good profit taking approach. During a strong trend price will usually stay above or below the moving average for a long period of time. The signal to exit is given when price crosses the moving average to the opposite side of the ongoing trend. Intraday and short-term moving averages such as the 21 period EMA are ideal when it comes to riding trend waves and exiting trades.

#6 Price action profit taking

Price action can be used as a standalone profit taking method – especially when you are following the open-end approach – where you look for price action signal that foreshadow a change in sentiment. Pinbars, engulfing bars, head and shoulders, rejections at highs and low and other price action formation can be used here.

In my personal trading, I use hard targets at pre-defined price levels, mainly based on support/resistance and supply/demand principles. However, I monitor price and if I can see a shift in price behavior based on the Bollinger Bands or moving average approach outlined above, I will exit my trade manually. Hard targets take out the guesswork for me, but discretionary thinking allows me to stay flexible and manage my trades based on the market context.

We have been trading supply and demand strategies for over ten years, and they have stood the test of time remarkably well. Supply and demand is...

3 min read

Choosing the right trading journal is essential for traders wanting to analyze performance, refine strategies, and improve consistency. In this...

3 min read

“95% of all traders fail” is the most commonly used trading related statistic around the internet. But no research paper exists that proves this...