Supply and Demand Trading in 2026

We have been trading supply and demand strategies for over ten years, and they have stood the test of time remarkably well. Supply and demand is...

4 min read

Rolf

Dec 12, 2016 7:00:00 PM

Traders doubt their trading methods, the way they manage trades and their own abilities as traders. They are uncertain about how to approach the markets, how to manage trades, when to exit trades or how to set a stop loss correctly. And all this uncertainty and continuous doubting lead to fear – the fear that they are doing something wrong or the fear that they are missing out.

A trader who does not have full confidence in his system can’t trade at his best because he always thinks that he could (or even should) be doing something differently. This leads to making impulsive decisions, micro-managing trades incorrectly or plainly trading emotionally without a plan. Such an approach leads to inconsistent results and many traders make the same mistakes repeatedly, which then reinforces the beliefs that they are doing something wrong and more doubts, questioning and fear enter their mind.

Traders then often reach out to other traders and look for answers to their questions. You will usually see traders ask things such as “how should I move my stop loss”, “when do you take profit”, “which indicator is the best for entries”, “how much money do I need and how much can I make”, “which timeframe is the best” or “is my indicator setting wrong”. I am sure those questions sound familiar and most traders will have them in their heads, but…

However, you should NEVER EVER ask another trader about such crucial, personal and strategy-specific questions. First, you don’t know his objections and, most importantly, the other trader has no idea how you trade, he does not know your full approach, how you execute your trades and what your struggles are. At best, the answers you get are then totally meaningless and destructive in the worst case.

By asking the questions above, traders hope to gain clarity and remove the doubts they have. However, when the answers you get are not correct and you start making changes to your trading that result in more losses, you will end up worse off. You artificially created hope and certainty by asking random traders and your hopes then got crushed once you saw that your results didn’t improve your performance. Then you are back to square one and many traders end up trading with a Frankenstein-like system where the individual concepts don’t fit and it creates bad trading results because a trader doesn’t know how to operate it.

It is so important that you make your own observations, you have to think for yourself and make targeted adjustments to your trading method through a serious process.

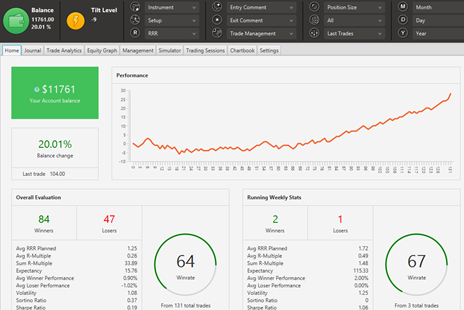

The good news is that you can answer all your questions yourself. A structured trading routine and a good trading journal are built in a way that allow a trader to choose from a variety of variables and metrics to dissect his trading. By answering your questions yourself through your own verified data, you will not only be able to remove the voices in your head for good, but the answers you receive are also going to be the right ones most likely.

Trading is a business and every good business keeps track of where the money goes, it analyzes expenditures, compares the rates of return on specific projects and keeps very detailed records. If a business does not know how much money it spends, where it generates the most profits, where it loses money and what works won’t be in business too long. Traders approach trading from a lazy perspective where all they do is punching in trades without ever looking back at what they did.

Just ask yourself right now: Do you remember your last 5, 10 or 20 trades? Can you recall what works well for you, where you lose the most money and under which circumstances? Most traders have no idea and that’s why they will keep struggling. A trader who doesn’t know his numbers is doomed to fail and there will never be a profitable trader who isn’t serious about analyzing performance.

Below we provided a list with the most commonly asked questions and how trade journaling with the Edgewonk trading journal (which we have developed at Tradeciety) and other tips can help you improve your system and approach the right way. And if you don’t want to spend money on a professional trading journal, that’s fine, but you must keep track of your trading or otherwise improvement is impossible and traders will just keep stumbling around.

Answer: Track the different timeframes that your trade was based on and see which one has the best performance. You can do that easily and just set up a new Custom Statistic and tag the trades.

Answer: You can assign each trade with a different setup and you can easily compare two different systems or, in that case, different ways of entering trades.

Answer: That is a big one and many traders often wonder if they should follow a different stop loss or take profit strategy. We know that and that’s why we have added the Alternative Strategies in our journal. Simply record the potential outcome of other trade management strategies and let Edgewonk show you which works best.

Answer: Every journal should have MAE and Drawdownstatistics which show you how much price went against you and how close price came to your stop loss. Then, stop loss adjustment can be done easily.

Answer: The MFE and the Updraw are the opposite to the MAE and the Drawdown. They show you how much price moves in your favor and you can use them to improve how you exit trades.

Answer: Tag your trades with the comment function and then pay attention to the Tiltmeter. The Tiltmeter analyzes discipline and your mental game. It shows your worst mistakes.

Answer: The Trade Management graph shows you exactly if you mismanage trades once you are in them. Simply compare your actual with your potential performance and get the answers you need.

Answer: Use the Edgewonk simulator and analyze the future projections for your current trading strategy. Go through multiple simulations and get a feeling for potential account growth.

Answer: Again, go to the Simulator and play around with it. You can change the values for Avg. Winner and Avg Loser – keep the Reward/Risk metric constant – and see how different risk levels impact your account development.

You can see, most questions you have asked yourself can be answered through your journaling practice. Journaling does require some work and time, but in the end, you will find the true answers to all the questions and you will finally be able to cope with doubt, uncertainty and fear more effectively. There is no better way to create confidence in your trading and your abilities than through deliberate journaling and making progress through your own work.

If you are never certain about the viability of your edge, you won’t feel too confident about it. To whatever degree you lack confidence, you will experience fear. – Mark Douglas

If you don’t want to go this journey alone, take a look at our trader development program where we guide you through the whole process step by step.

We have been trading supply and demand strategies for over ten years, and they have stood the test of time remarkably well. Supply and demand is...

3 min read

Choosing the right trading journal is essential for traders wanting to analyze performance, refine strategies, and improve consistency. In this...

3 min read

“95% of all traders fail” is the most commonly used trading related statistic around the internet. But no research paper exists that proves this...