Supply and Demand Trading in 2026

We have been trading supply and demand strategies for over ten years, and they have stood the test of time remarkably well. Supply and demand is...

Trading is all about making money and one of the most asked questions is “How can I make more money?”. There are mainly 5 different ways ‘to make more money’ in trading that we will discuss in the following article. We will lay out the possible problems that you might run into and what to be aware of when trying to increase your trading performance.

Trading is all about making money and one of the most asked questions is “How can I make more money?”. There are mainly 5 different ways ‘to make more money’ in trading that we will discuss in the following article. We will lay out the possible problems that you might run into and what to be aware of when trying to increase your trading performance.

Once you have a tested and proven trading strategy, the most obvious thing to do to get more trades and increase your performance is to add more instruments to the ones you are already trading. Whereas this seems like a smart thing to do, it brings a variety of problems that will not only not increase your performance, but will undoubtedly result in a lower trading performance. The reasons why just adding more instruments to your arsenal and keep doing the same things won’t work are the following:

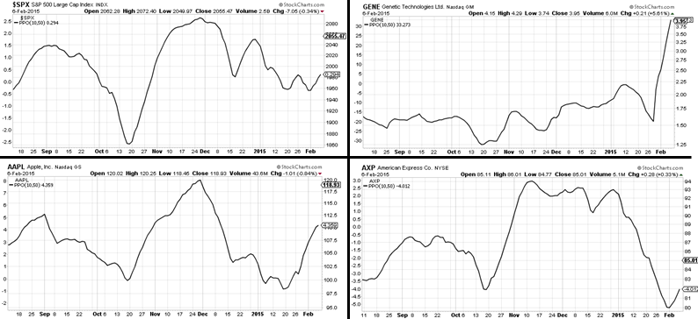

The graphs below show the percentage price change of 4 different instruments, three of them are big US corporations and included in the Dow Jones Index. You can see that although they are included in the same index, the way they move and behave is significantly different. Thus, taking one profitable strategy and blindly applying it to different instruments will not automatically result in an increased performance.

Source: Stockcharts.com

The next thing on the list when thinking about increasing trading frequency and trading performance is just to change to trading lower timeframes. Isn’t it obvious that when you get one signal every few days on the daily timeframe, you should see a potential setup daily on an intra-day timeframe!? Trading lower timeframes seems an easy way to get more trades and, potentially, more winners, but is it true? Here is what you have to keep in mind when moving down timeframes:

Improving your position sizing is a great way to take your trading to the next level. You can not only increase your equity growth, but you can also limit and regulate drawdowns by applying a better position sizing technique.

Pro:

Cons:

The fourth possibility to increase trading performance is by adding a new trading strategy. By adding a new trading method you do not have to worry about correlated instruments increasing your risk, lower timeframes adding psychological pressure and increased position sizes that could ruin a trader, even with a profitable trading strategy. But, and there is always a but, adding a new trading strategy does not only have positive aspects.

All previous points have their pros and cons – some have more cons, some less. But what if there was a way to increase your trading performance without having to worry about potential problems or traps you might run into? Although improving your current trading strategy is easier said than done, there are only few, if any, downsides to increasing your trading performance this way. The following points can serve as a guideline how to follow through:

The following posts show you how tweaking a trading strategy can be done in a simplified way:

What is a trading strategy – How to find the perfect trading strategy for your personality

All previously described methods can help you increase trading performance and it is up to you as a trader to find what is working for you. However, this article has the goal to open your eyes for the pros and cons each approach has and what to be aware of when trying to increase your trading performance.

We have been trading supply and demand strategies for over ten years, and they have stood the test of time remarkably well. Supply and demand is...

3 min read

Choosing the right trading journal is essential for traders wanting to analyze performance, refine strategies, and improve consistency. In this...

3 min read

“95% of all traders fail” is the most commonly used trading related statistic around the internet. But no research paper exists that proves this...