Supply and Demand Trading in 2026

We have been trading supply and demand strategies for over ten years, and they have stood the test of time remarkably well. Supply and demand is...

4 min read

Rolf

Jul 22, 2018 8:00:00 PM

Trading with the trend is trading with the flow.

When the prevailing trend is up, why would you want to look for short entries when buying might result in much smoother trades?

Many amateur traders, even when facing a very obvious trend can’t stop trying to predict reversals and burn their fingers going counter-trend, whereas they could have made so much more money by simply joining the trend.

But even if you are not a trend-following trader, you can combine the concept of trading with the trend and with momentum with your regular trading approach. Knowing where the price is going and which side of the market is stronger is an important trading skill.

To be able to correctly read price action, trends and trend direction, we will now introduce the most effective ways to analyze a chart.

Before we learn how to identify the trend, we should first be clear what we are looking for.

It may sound too simplistic first, but stick with me for now and you will soon see the power of this analysis approach.

Markets can do one of three things: go up, go down, or move sideways.

Of course, how fast (or how slow) and how long the individual periods last changes all the time, but the price can only do one of those three things.

The picture below shows you the three possible scenarios and how the market keeps alternating between the phases. We will shortly see how all price patterns and chart formations are also made up of those moves.

Most traders only use bars and candles when it comes to observing charts, but they completely forget about a very effective and simple tool that allows them to look through all the clutter and noise: the line graph.

The purpose of bars and candles is to provide detailed information about what is happening on your charts, but is this really necessary when it comes to identifying the overall trend? Probably not.

A trader should zoom out from time to time (at least once a week) and also switch to the line graph to get a better and clearer picture of what is currently happening. And since our only goal here is to identify the trend direction and become aware of the overall situation, the line graph is a perfect starting point.

This is my personal favorite way of analyzing charts and although it sounds very simple, it is usually everything you need to understand any price chart.

Conventional technical analysis says that during an uptrend you have higher highs, because buyers are in the majority and push the price higher, and lows are also higher because buyers keep buying the dips earlier and earlier.

It works the same during a downtrend: lows are lower when the seller surplus moves price lower and highs are lower because sellers sell earlier and buyers are not as interested.

Highs and lows define all market patterns and chart formations. Below we see a Head and Shoulders pattern and this pattern is, of course, also made up of highs and lows. This pattern beautifully shows how transitioning highs and lows describe the shifting power between buyers and sellers.

We just need to follow the highs and lows to understand what the market is telling us.

Try it out and you will be able to describe all market patterns and conventional chart formations using highs and lows.

Moving averages are undoubtedly among the most popular trading tools and they are great to identify the market direction as well. However, there are a few things to be aware of when it comes to analyzing trend direction with moving averages.

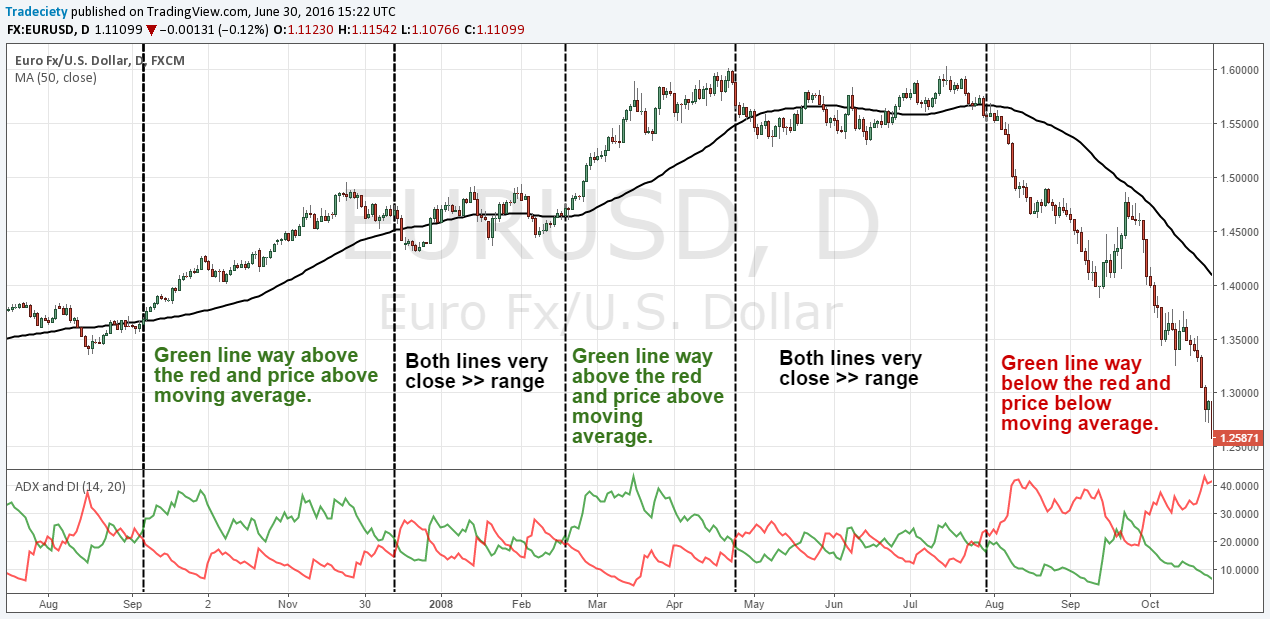

In the screenshot below we used the 50 EMA which is a mid-term moving average. You can see that during an uptrend, price always stayed well above the moving average and once price has crossed the moving average, it entered a range. In a range, price does not pay too much attention to moving averages because they fall in the middle of the range, hence average.

If you want to use moving averages as a filter, you can apply the 50 MA to the daily timeframe and then only look for trades in the direction of the daily MA on the lower timeframes.

Channels and trend lines are another way of identifying the direction of a trend and they can also help you understand range markets much better.

Whereas moving averages and the analysis of highs and lows can also be used during early trend stages, trendlines are better suited for later trend stages because you need at least 2 touch-points (better 3) to draw a trendline.

I mainly use trendlines to identify changes of established trends; when you have a strong trend and suddenly the trendline breaks, it can signal the transition into a new trend. Trendlines during ranges are ideal when it comes to finding breakout scenarios when price enters the trending mode again. Also, trendlines can be combined with moving averages nicely because of the complementary characteristics.

If you want to learn more about trendlines, take a few minutes and watch our video here: learn how to draw trendlines.

The ADX is an indicator that you could use to determine the direction of the trend and for the strength as well. The ADX indicator comes with three lines: the ADX line that tells you the strength of the trend (we deleted this line in our example, since we only want to analyze the direction of the trend), the +DI line which shows the bullish strength (green line) and the -DI line which shows the bearish strength (red line).

As you can see in the screenshot below, the ADX signals an uptrend when the green line is on top of the red line, and it signals a downtrend when the red line is higher than the green line. When price is ranging, the two DI lines are very close together and hover around the middle.

The ADX can be combined with moving averages nicely and you can see that once the DI lines cross, price also crosses the moving average. In the video below we explain how to use the ADX in more detail with the other concepts.

We have been trading supply and demand strategies for over ten years, and they have stood the test of time remarkably well. Supply and demand is...

3 min read

Choosing the right trading journal is essential for traders wanting to analyze performance, refine strategies, and improve consistency. In this...

3 min read

“95% of all traders fail” is the most commonly used trading related statistic around the internet. But no research paper exists that proves this...