Supply and Demand Trading in 2026

We have been trading supply and demand strategies for over ten years, and they have stood the test of time remarkably well. Supply and demand is...

Most traders spend the majority of their time trying to find the ultimate trading strategy and they go through dozens of indicators, entry methods and spend hundreds of hours in trading forums looking for the Holy Grail. But, especially for technical traders, the path to finding trading signals and profitable trading opportunities can be quite a different one.

In this article I show you how you can find trading opportunities away from conventional trading wisdom.

Let’s be clear of what the word ‘trading system’ implies. Most traders believe that finding profitable trading opportunities is a matter of combining indicators and trading tools in a way that gives them an edge. However, in the end, being a successful trader means that you are able to identify recurring patterns and price movements and trade them in a way which provides a positive expectancy.

Therefore, a trading ‘system’ can be anything that allows you to identify trading opportunities that recur over time.

“Markets are repetitive. In its purest form this game is simply trading repetitive patterns. More experience you have the easier it becomes.” – Assad Tannous

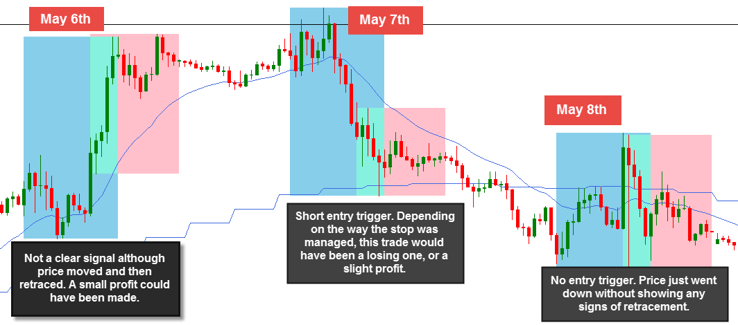

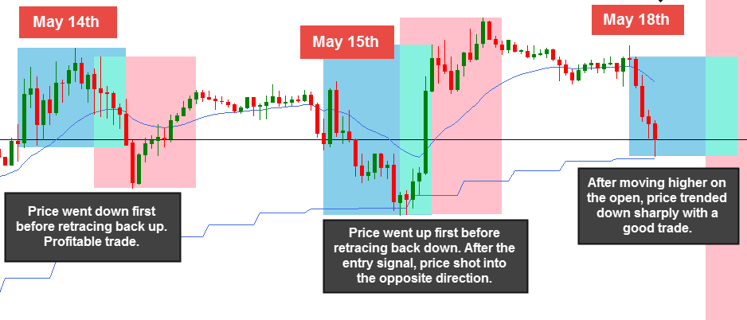

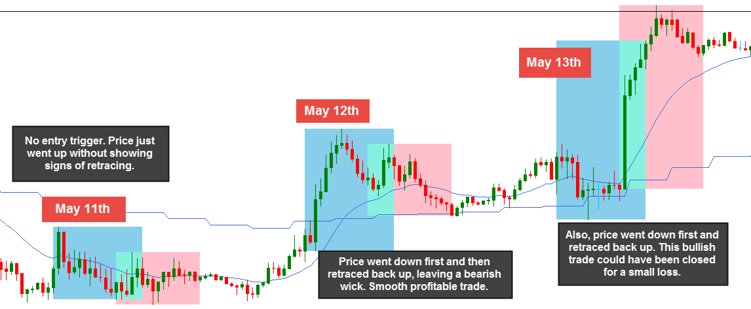

Over the last 3 trading weeks, the EUR/USD opened in a somewhat similar way with the Frankfurt open; although the opening pattern was not present every day, it appeared often enough to point it out and to show you how you can find trading opportunities in an unconventional way.

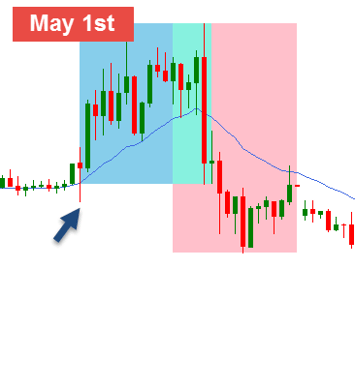

In the following charts, the blue box symbolized the Frankfurt trading session. The trigger for the EUR/USD opening pattern happened in the first 30 minutes of the Frankfurt open.

On the Frankfurt open, the EUR/USD moves in one direction for the first 30 minutes before turning the other way. The initial trigger is easy to spot since the EUR/USD 30 minute chart often prints a price candle with a wick. The open pattern acts some kind of trap, trying to make traders go one way, before turning sharply into the opposite direction.

The screenshot below shows the open trigger on the 30th of April and the 1st of May. As you can see, both times the Frankfurt open started with a price move down, before turning bullish on the following 30 minute candle.

|

|

Over the last 3 weeks, you would have had 7 signals where the pattern resulted in a profitable trade, 2 times when you could have gotten out for a slight profit or loss, 3 times when there was no signal and 2 sure loss. All in all, very promising statistics if a trader finds a way to trade the pattern with adequate stop loss and take profit orders and acchieve the correct risk reward ratio.

We have said before, a trading pattern is not a a clear cut price template that you can apply to any market without thinking. Whether you analyze broader price movements, or single candlestick patterns, you have to understand the underlying dynamics to read the market sentiment.

The kind of pattern that we talked about in this article is recurring price behavior, charaterized by the occurrence of the time of day (specific trading session), the specific instrument and a price behavior pattern. Furthermore, it is important to understand that after finding such a recurring pattern, you don’t just blindly jump into the markets, but you wait for confirmation; it won’t repeat itself every day, but only appear sometimes.

As you can see, it is possible to find recurring patterns and exploit them in a profitable way. A trader would do well if he pays close attention to the instruments he is trading. This is why you can often read that, especially in the beginning, a trader should focus on trading only a few instruments to really understand the way they move. Taking one trading system and one approach and applying it to different instruments, markets, timeframes and times of volatility usually results in mixed results and traders wondering where they went wrong.

We have been trading supply and demand strategies for over ten years, and they have stood the test of time remarkably well. Supply and demand is...

3 min read

Choosing the right trading journal is essential for traders wanting to analyze performance, refine strategies, and improve consistency. In this...

3 min read

“95% of all traders fail” is the most commonly used trading related statistic around the internet. But no research paper exists that proves this...