Supply and Demand Trading in 2026

We have been trading supply and demand strategies for over ten years, and they have stood the test of time remarkably well. Supply and demand is...

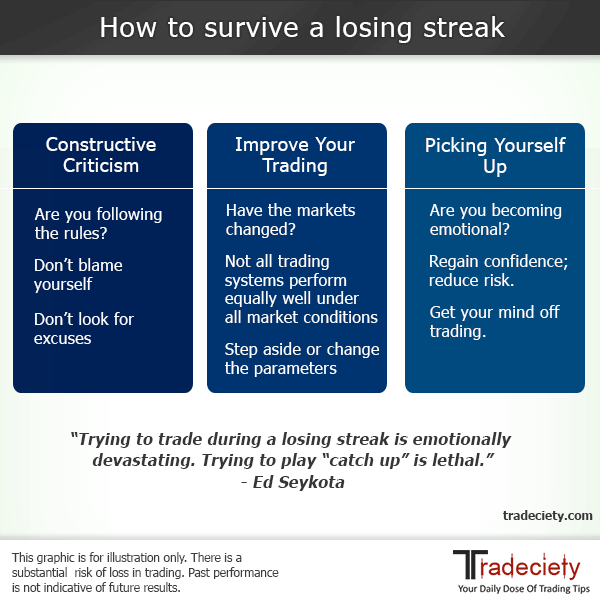

Drawdowns and losing streaks happen all the time and even the best trader will encounter multiple losing streaks and drawdowns during his trading career. Whereas amateur traders get discouraged easily during losing streaks, the professional knows how to use such periods to work even harder on his game and come back stronger.

This article helps you understand how to deal with a losing streak effectively, how to avoid the most commonly made mistakes and how to use losing streaks to improve your trading.

The first stage is what happens in your head. The most important aspect during a losing streak and a drawdown is to not lose your head. You have to stay in control and be objective. You have to make sure that it’s not you who are actually causing the losses. This means that you have to take a look at your recent losing trades and evaluate how you made your trading decisions. Have you been following the system and adhered to the rules, did you broke the rules, entered prematurely, revenge traded or did anything else wrong? After you are clear about that, you can move on.

To stay in control, you should not blame yourself. Losing streaks happen even to the best traders and beating yourself up over a few losses won’t do you any good. Traders who blame themselves lose their focus and ending the streak becomes much harder.

Furthermore, you cannot blame the markets or look for excuses. Only if you take full responsibility you can get back on track. Traders who look for excuses somewhere else won’t put in the work and will miss important clues that will help them improve their trading.

Next you have to look at your actual trading performance, the market and your system to find ways to grow from a losing streak. What do your losses have in common? Do your stops only get barely hit before price turned, or does price blow straight through your stop losses? Did your trades move into profits first and then turned on you, or did price immediately went into a loss? Those are important clues when it comes to adjusting stop loss and take profit placement, or to see if there is anything fundamentally wrong.

Second, have the markets changed and your system does not work well with current market conditions? Do you see a significant change in volatility or momentum? How about the price environment; are you in a range or in a trend environment? Which market conditions can your trading system handle best? Is it time to step aside and wait until the environment changes again? Not all trading systems perform equally well under all market conditions.

If a major changed has occurred and the market conditions are just not right at the moment, you have to wait it out and don’t trade anymore. If you are just seeing a slight change in market behavior, you may be able to overcome some of the problems by adjusting your stop and take profit placement.

Now it’s time to pick yourself up again. How do you currently feel when you are in a drawdown? Are you frustrated and hopeless? Are you desperately trying to come back to break-even? An emotional state that is not the neutral norm should set off your alarm bells. A professional trader has to be in control of emotions at all times and he has to make sure that his decisions are not emotionally influenced. If you are not feeling 100% well, reduce your risk significantly – or maybe even step aside for a week or two.

Regaining confidence is the #1 priority for struggling traders during drawdowns. Only if you can trade with absolute confidence and trust in your system, you can make the best trading decisions.

And finally, get your mind off of trading. In another article we talked about the character traits of high achievers and we came across a technique called “mental flushing” where the person engages in a completely different activity. Go for a run, play with your kids, do some gardening or take your spouse out to the movies. Usually, the world looks very different after getting a new perspective. Staring at your screen and wondering how you could have lost so much won’t help you improve your trading.

Make sure you are not the one causing the losses. Are you being disciplined?

Don’t blame yourself. Stay focused!

Don’t look for excuses. Take responsibility.

What do your losers have in common? Look beyond the result.

Analyze market behavior. Has volatility, trend direction and momentum changed?

Will adjusting your stop or profit placement make a difference?

If you are emotionally upset, go small.

Regain confidence before doing anything. Be an observer.

Take a break. You don’t have to make it back at once.

We have been trading supply and demand strategies for over ten years, and they have stood the test of time remarkably well. Supply and demand is...

3 min read

Choosing the right trading journal is essential for traders wanting to analyze performance, refine strategies, and improve consistency. In this...

3 min read

“95% of all traders fail” is the most commonly used trading related statistic around the internet. But no research paper exists that proves this...