3 min read

Scientist Discovered Why Most Traders Lose Money – 24 Surprising Statistics

“95% of all traders fail” is the most commonly used trading related statistic around the internet. But no research paper exists that proves this...

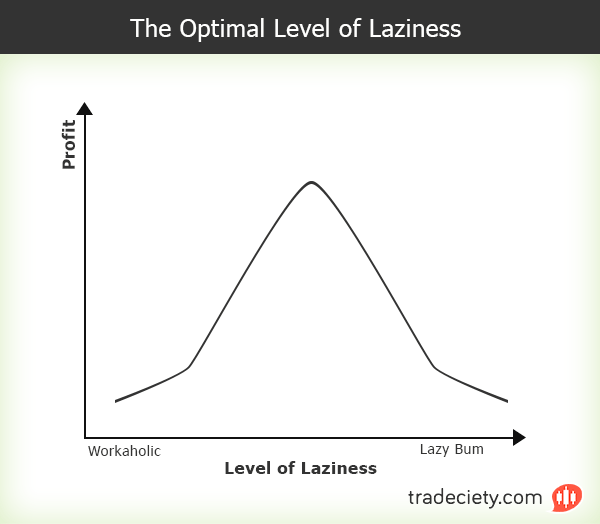

The images of the continuously stressed out trader that yells at his screens and opens and closes trades every minute are obsolete and not helpful for your own path to becoming a professional trader. It is true, the more relaxed and laid back you can approach your trading routine, the better you can handle your trades and the more money you will be able to make. In the following we show you with a handful of concrete examples and tips why and how you should adopt the mentality of a lazy trader.

If you encounter a trading scenario that totally knocks you off your socks, you haven’t done your homework. A trader has to exactly know what could happen at any point in time. This means that you have to be aware of upcoming news events, important talks and speeches and always have an eye on the current political and geopolitical events. But even further, as a trader you have to know what could happen to your charts technically. Where are the key price areas, important moving averages and other famous trading tools and what are the possibilities around those areas. However, this is nothing you do on the fly, but before the markets open. Once you arrive at your trading desk you have to know everything that could happen and just sit back, wait and let the markets do the rest. If you find yourself surprised or not sure why something is happening, you haven’t done your homework.

It does not matter which successful trader you follow; even a Marty Schwartz, a Paul Tudor Jones or a Warren Buffet claim that the most important trait of a trader is his ability to sit down and plan his trades/investments ahead of time. As a trader you sit down on a weekend, go over your instruments you follow and make precise and detailed plans about what you expect and what will trigger a trade for you. Once the markets open, you do nothing but sit back and watch what will happen. Being a trader does not mean that you constantly ‘have to do something’. The better your trading plan, the less you will do during your trading hours, the more relaxed you can approach your trading and the better your results will be.

It is not that we had any unfair knowledge that other people didn’t have, it is just that we did our homework. – Paul Tudor Jones

Of course, this is a very general statement and not true for every trader and trading strategy, but let me make a point. A main reason why traders cannot make money is because they try to outsmart the market by constantly moving around take profit or stop loss orders to ‘react’ to what they believe is happening on their charts. The truth is, traders who constantly feel that they have ‘to do’ something are only victims of their emotional responses. Most traders will see a significant improvement in their overall performance once they start applying the set and forget approach. After they have figured out the entry, take profit and stop loss order prices, they close their chart and let the markets do the rest. Give it a try and you will not only see an increase in your performance, but also in your overall mood and stress level.

The set and forget approach works even better if you do risk an appropriate amount of money per trade. Often traders risk a substantial percentage amount on individual trades which makes it even more likely that you feel the urge to interact with your trades. Only risk what you can afford to lose comfortably. The less significant a loss is for your overall trading account and emotional state, the more relaxed you can approach trading.

You will often hear traders talk about needing 10,000 hours to become a profitable trader. Consequentially, they then translate this concept to the idea that collecting 10,000 hours of screen-time will make them profitable traders. If you ever hear a trader making such assumptions, he has no idea what he is talking about. You have probably watched TV series and movies for (tens of) thousands of hours over the course of your life, but did it make you a professional and successful Hollywood director? Do not waste your time and don’t be glued to your screen all day long, it will not help you become a better trader. Do your homework, create a trading plan, wait patiently until the scenario plays out and then walk away. There is no need to babysit your trades.

The lazy trader is not glued to his screens all day long and has a lot of free time available to pursue other things. Especially for non-professional traders it is important to find a trading routine that leaves enough time to follow their regular day job. By creating a detailed trading plan and implementing the set and forget approach, a trader can easily combine trading and a 9-5 job. Furthermore, without the pressure to make money trading to provide food and shelter for your family, you can approach trading more relaxed which will in turn increase trading performance.

The lazy trader accepts the fact that the outcome of a trade is totally random. Furthermore, you are not able to tell whether a trade is going to be a winner or a loser before price either hits your take profit or stop loss order. And finally, the professional lazy trader knows that the distribution between winning and losing trades not in his hands. But most important, he knows that over the long term the combination of winrate and risk:reward ratio will make him money no matter what. You cannot force winning trades as a trader, no matter how hard you try. Therefore, you can as well just not care, be more relaxed and let the market do its thing. If you have found a trading strategy with a profitable combination of winrate and risk:reward ratio, making money in trading is not a question of ‘if’, but ‘when’.

Why did you get into trading in the first place? Because you wanted to replace your day job with another activity where you are glued to a single chair for 10 hours every day? Or because you wanted personal and financial freedom and more time for the things you really care about? The lazy trader gets the best of both worlds, making money and being your own boss, while actually having time for hobbies and your family.

3 min read

“95% of all traders fail” is the most commonly used trading related statistic around the internet. But no research paper exists that proves this...

3 min read

Trendlines can be great trading tools if used correctly and in this post, I am going to share three powerful trendline strategies with you.

3 min read

Choosing the right trading journal is essential for traders wanting to analyze performance, refine strategies, and improve consistency. In this...