Supply and Demand Trading in 2026

We have been trading supply and demand strategies for over ten years, and they have stood the test of time remarkably well. Supply and demand is...

How you talk or think about your trades can signal how you are going to manage your trade and your language can even provide information about whether you are about to commit a wrong trading decision before you actually do it. You might not even be aware of how your thinking influences your trading decisions, but once you read through the following article, you will see why it is so important to analyze your thought process during your trading decisions.

Example #1: I should have used more risk for this winning trade.

Example #2: If I had used a different indicator, I could have avoided the losing trade.

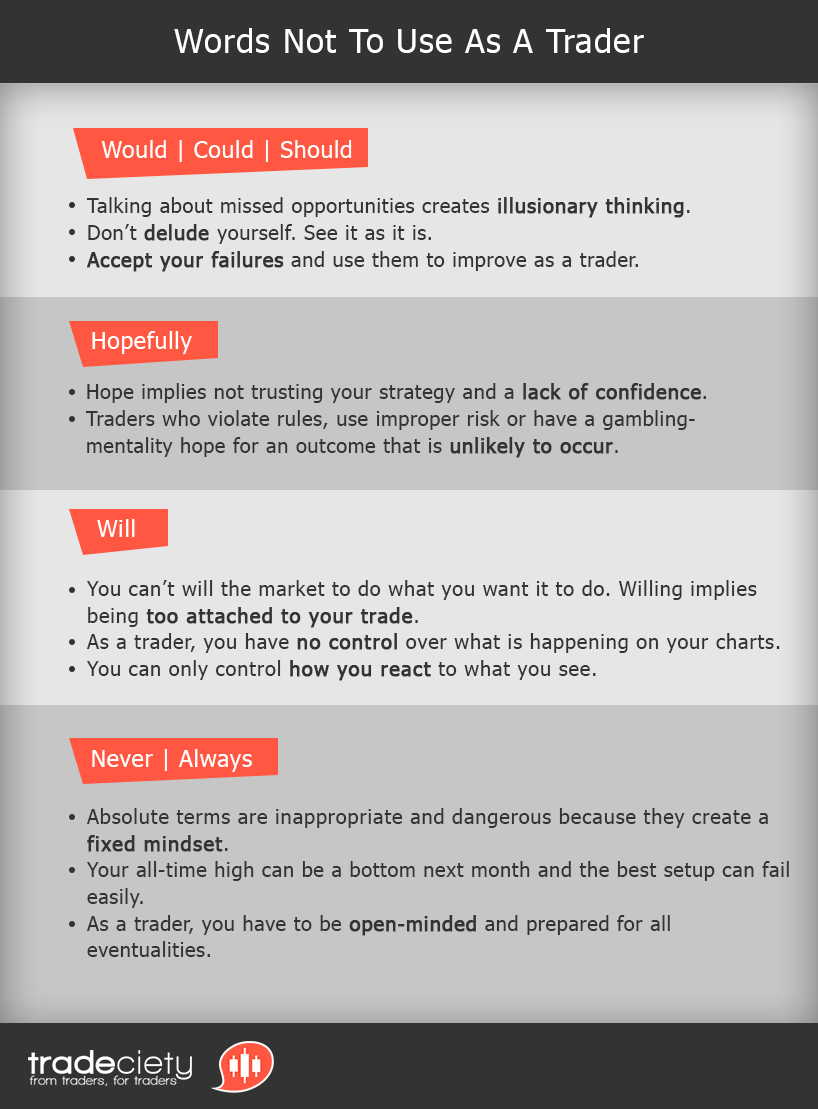

Would have, could have and should have are terms that describe missed opportunities or facts that you can only know with the benefit of hindsight. When traders use such words, they are likely to change their trading strategy on a trade-to-trade basis. If you try another indicator setting and suddenly see that you could have avoided a losing trade, you are more likely to use the new setting next time, although you haven’t fully tested it; however, the fact that you could have avoided a losing trade with a random adjustment might just have been a pure coincidence.

Tip: Don’t use hindsight to change your trading strategy. Stick to your trading method for a while and then evaluate how it performed.

Example #1: I hope price goes much further. It will be a big winner and I can buy some nice things with the money.

Example #2: Hopefully this time it won’t be a loser again. I really need a winner now.

Hope is a word that shows that you have no trust in your trading strategy. Furthermore, if you hope for a certain outcome, it can signal that you have violated your trading rules and that, under normal circumstances, you expect the trade to be a loser. Another reason why traders hope for a winner is when they have used too much risk and a losing trade would mean a significant loss to their account.

Tip: If you find yourself hoping for a certain outcome, you have done something wrong. Close your trade immediately, regain your focus and get back to following your trading plan.get back to following your trading plan.

Example #1: Price will go higher. This trade looks so good; it will be a winner. I know it.

Example #2: This is just a small retracement; it won’t go below $100. It looks so bullish.

When you use the word ‘will’ as a trader, it shows that you are very certain about what is going to happen. Traders who think that they ‘know’ what price will do are less likely to realize a losing trade and are, therefore, more likely to interfere with their trade in a negative way, such as: widening stop loss orders, adding to a losing trade or taking off stop loss orders completely.

Tip: Accept that you will never know what is going to happen. As a trader, it is your responsibility to act within the scope of your trading strategy and follow your rules religiously.

Example #1: Price can never go below this support level. It will hold.

Example #2: Price always goes higher when it does this. I have seen it before, and it always goes higher.

Never and always are words that signal a fixed mindset. Similar to the word ‘will’, traders who think that price always behaves in a certain way, or who believe that price ‘never’ does something, are too attached to their trades and can’t make judgments objectively. As a trader, it is important to be open-minded and accept that anything can happen. If you act within a fixed mindset, you are less likely to accept failure or don’t see warning signals that could signal that you better get out of your trade.

Tip: Anything can happen and you never know what price will do next. Follow your rules and react to what you see on your charts. You can’t outsmart the market.

By analyzing your thoughts and your language you might be able to spot trading mistakes that you are about to make. Your actions are only manifestations of your thoughts. It is therefore very important to be aware of how you form your opinions about your trades.

We have been trading supply and demand strategies for over ten years, and they have stood the test of time remarkably well. Supply and demand is...

3 min read

Choosing the right trading journal is essential for traders wanting to analyze performance, refine strategies, and improve consistency. In this...

3 min read

“95% of all traders fail” is the most commonly used trading related statistic around the internet. But no research paper exists that proves this...